-

Stacks has been growing in adoption for its ability to make Bitcoin as programmable as Ethereum.

-

Stacks current pump is not fundamentals driven and is more consistent with whale activity.

-

Volumes are dropping, but Stack is still holding at key intra-day support.

Stacks (STX) is a crypto project that unlocks the power of Bitcoin way beyond its use cases as a currency and a store of value. Through stacks, the world’s largest cryptocurrency by market cap and the most secure can be used to create smart contracts. This is a big deal because Bitcoin’s security allows it to be used in creating highly sensitive Dapps, especially for DeFi.

The implications of making Bitcoin programmable are pretty high for stacks, too. One of them is that it makes Stacks a highly sought-after cryptocurrency by investors who want to earn staking rewards in Bitcoin. By staking Stacks, investors earn an APY as high as 9.8%, and the rewards are paid in Bitcoin.

However, Stacks usually moves in tandem with the broader market, and its current price is an anomaly, considering that the cryptocurrency market is bearish now.

Price action consistent with whale activity

Stacks has in the last 24-hours shot up by over 28%. This follows a sudden increase in volumes, now up by over 4800%. Such a sudden increase in buying volumes indicates that a whale is buying up Stacks in huge amounts, triggering the current price rally.

Stacks forms a descending triangle pattern

After a massive pump that saw Stacks hit a high of $1.9, Stacks has formed a descending triangle pattern, with strong support at $1.346. This is an indicator that trading volumes are dropping after the initial pump that was consistent with whale activity.

Source: TradingView

If Stack’s buying volumes remain high, and it bounces off the $1.346 support, it could retest the $1.9 resistance in the short term. If stacks bulls can break the $1.9 intra-day high, now resistance, prices above $2.5 could be within focus.

However, if this was just a random pump and Stacks drops below the $1.346 support, prices below $1.07 could come within focus in the short term.

Summary

Stacks has pumped in the last 24-hours in price action consistent with whale activity. However, these volumes are declining, and STX is now trading at key support.

The post Stacks (STX) – Is a whale aggressively loading up? appeared first on Coin Journal.

Source: TradingView

Source: TradingView

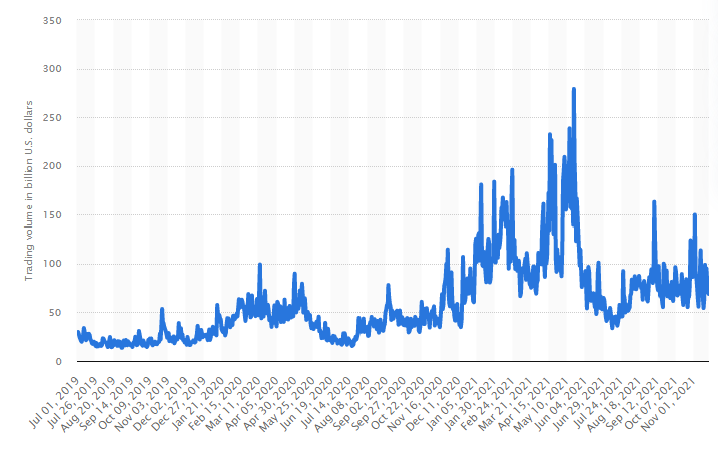

Tether 24H volume 2019-2021, via Statista

Tether 24H volume 2019-2021, via Statista