With thousands and thousands of crypto projects currently in existence, it can be easy to get lost in the crowd. But sometimes, one jumps out.

Mysten Labs’ inaugural product is one of those. The first thing which caught my eye was the team – the start-up was founded by four ex-Facebook engineers.

University of Facebook

Novi is the digital wallet app launched by Facebook last year. When released last October, Facebook stock jumped 4.2%. The vision is ambitious – first, it is expected to challenge in the remittances sector, but with plans to be integrated into Messenger and WhatsApp, where it will go is anyone’s guess.

However, crypto engineers are a funny bunch; they are never afraid to swim against the current. Four engineers who worked together in the Novi division exemplified this, as they jumped ship to found their own crypto start-up – Mysten Labs.

Last October, the start-up raised $36 million in a round of funding led by Andreessen Horowitz. One of the four founders was Evan Cheng, the director of research and development at the Novi financial products unit.

“We’ve been dreaming about doing something together for a long time,” Cheng said to CNBC in an interview last year. “We’re building infrastructure that, based on our previous research, will overcome a lot of limitations.”

Sui

Today, Mysten Labs announced its inaugural product – a Layer 1 blockchain titled Sui, which will tackle some of crypto’s biggest sticking points.

“Sui is the first decentralized blockchain platform for the vibrant asset economy with high throughput, low latency and an asset-oriented programming model powered by Move”, the press release said. “It is a high performance, horizontally scalable blockchain with no theoretical limits utilizing extremely low computation resources per transaction. It is designed from the ground-up to facilitate instant settlement, delivering the high throughput, low latency, and low cost needed to power applications for billions of users”.

Without doubt, Sui is going right into the belly of the beast. The claim of “no theoretical limits” is very notable, given the column space that computational resources and lack of scalability takes up in crypto. The source of many of crypto’s biggest headaches, these problems have been tough ones to solve for the nascent industry. The release further claims that Sui will have “horizontal scalability to maintain low gas fees and high transaction processing capacities beyond legacy payment rails such as VISA and SWIFT”.

Ethereum

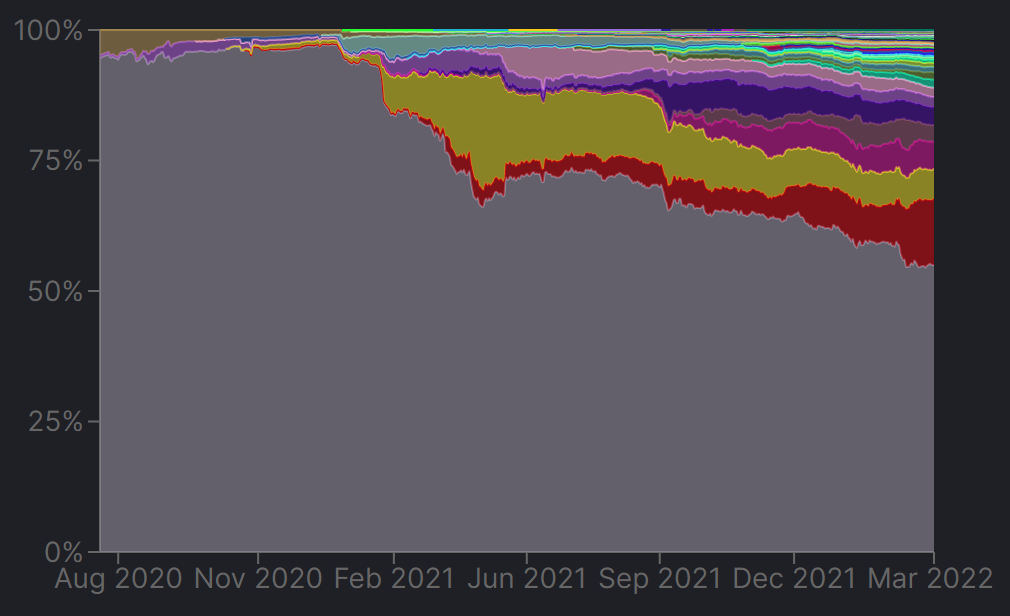

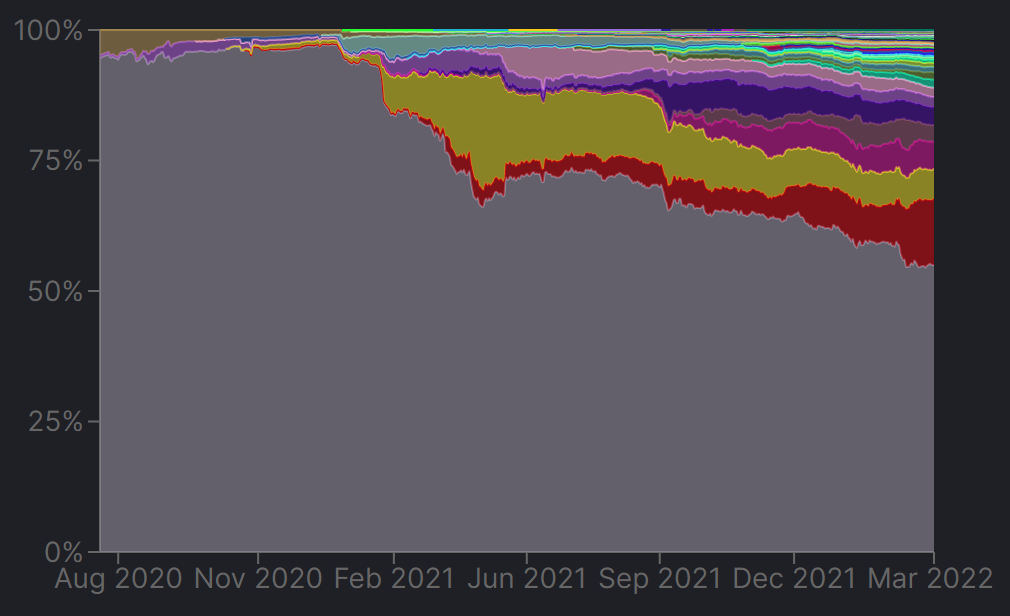

Ethereum, of course, has its fair share of problems. The release quotes the fall in dominance regarding TVL – which as you can see from the below graph from Defi Llama, has fallen drastically. The Sui team further critique Ethereum’s problems with scalability, high gas fees and also the decline of the NFT market. To be honest, it’s hard to argue with these points, as Ethereum’s dominance has definitely wavered. However, with ETH 2.0 seemingly inching closer, the hope is that it will improve. For now though, competition is healthy, and Sui are taking aim at the throne. Ethereum’s fall in TVL dominance, per Defi Llama

Ethereum’s fall in TVL dominance, per Defi Llama

Use Cases

The scope of Sui is certainly not narrow. The release touches several of crypto’s biggest areas as use cases.

- The implementation of low-latency, central-limit order books on-chain with reduced slippage and no impermanent loss – delivering optimized mechanics to traders

- Facilitating batched airdrops to millions of people in a single, low cost transaction

- The development of richer in-game interactions, including equipment crafting, character leveling and battle records stored on-chain

- Creator-owned decentralized social media networks custom-built to deliver privacy, ownership and interoperability

- The ability to seamlessly deliver content across decentralized networks

- Decentralised storage and on-chain oracles

“We have only scratched the surface of what is possible in Web 3.0,” continued Cheng. “Lacking infrastructure has hamstrung development across the space – from DeFi to gaming and NFTs. With Sui, we will empower builders and collectors to unlock a world that was not previously accessible.”

Thoughts

This will be a fascinating project to follow. The team is absolutely correct with regards to Ethereum’s problems, and the opportunity is there for a project to make noise – that’s not up for debate. But as mentioned above, what separates Sui from the crowd is the team behind it.

Stout investment in Mysten Labs is enticing, while the work experience gained on Novi is no doubt valuable – being behind the scenes as Facebook transitioned more and more into a metaverse-focused company no doubt provides a unique viewpoint.

The press release also includes glowing reviews from the creators of Pranzerdogs, a Solana NFT gaming project, as well as SoWork, builders of the Workplace Metaverse.

Beyond a superficial read, it’s tough to speculate further on Sui at this point in time, especially given the volatile nature of the industry. But it’s rare that a crypto project at this early stage triggers as much intrigue as Sui. I’m excited to follow their journey.

The post Ex-Facebook developers launch Layer 1 blockchain appeared first on Coin Journal.

Data Source: Tradingview

Data Source: Tradingview

Source: TradingView

Source: TradingView

Ethereum’s fall in TVL dominance, per Defi Llama

Ethereum’s fall in TVL dominance, per Defi Llama