Cryptocurrencies had a relatively successful March even after the Federal Reserve embraced a more hawkish tone and the crisis in Ukraine escalated. The yield curve also inverted, signaling that a recession could be on the way. Here are some of the top cryptocurrencies to buy in April.

1. Ripple (XRP)

XRP has had a successful past few weeks as its price jumped from the year-to-date low of $0.5482 to a multi-month high of $0.90. The main catalyst for the coin was the ongoing case between the Securities and Exchange Commission (SEC) and Ripple Labs. The two sides had some minor wins in March and there is uncertainty about the outcome of the case.

Analysts expect that the court will deliver its verdict in April. Regardless of what happens, there is a likelihood that XRP will do well. In most situations, such cases tend to end with a settlement or a punishment. Meanwhile, looking at the chart below, XRP remains steady above the 25-day and 50-day moving averages and is attempting to move above the resistance at $0.9153. If this happens, it will be a signal that bulls have prevailed.

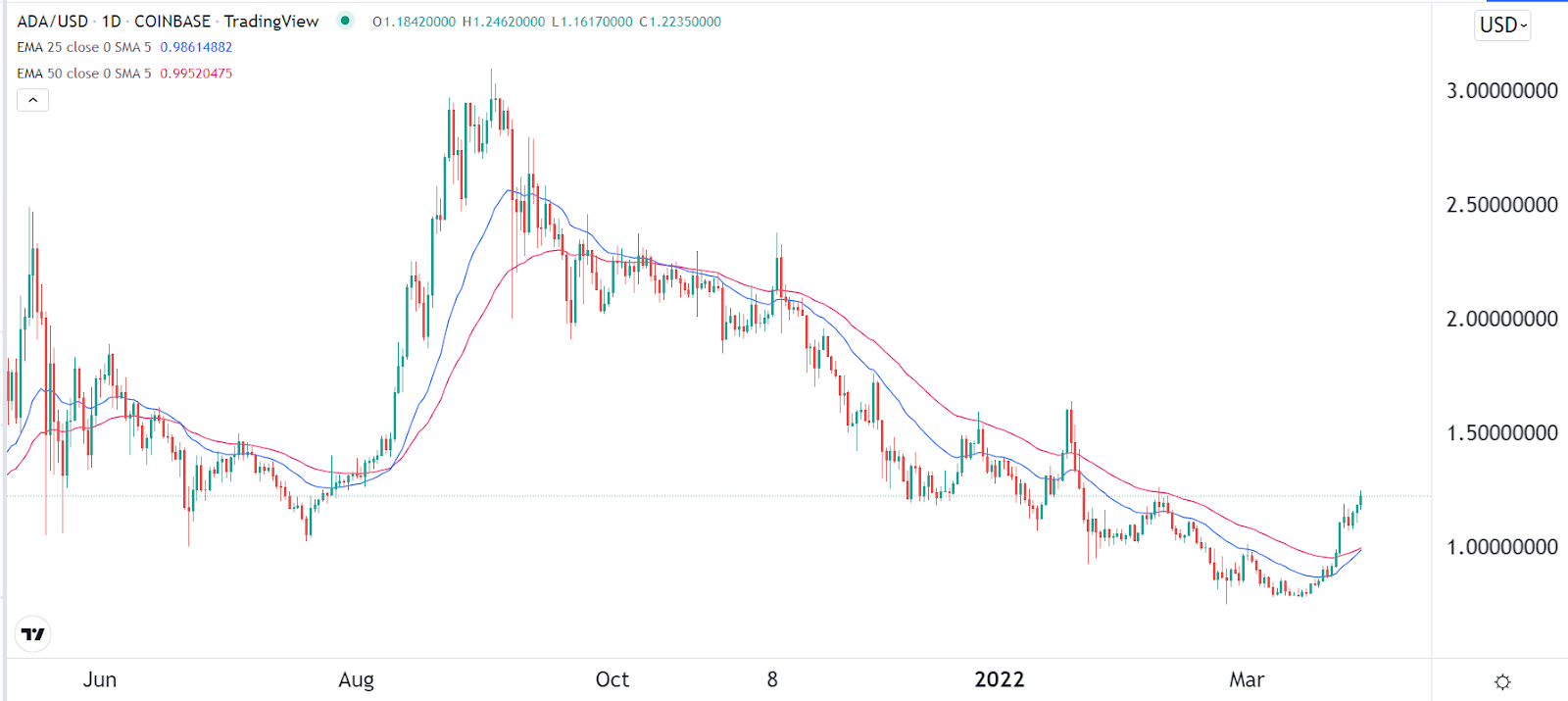

2. Cardano (ADA)

Cardano has been an embattled cryptocurrency as investors worried about its ecosystem. The main concern was that many developers were not embracing the network to build decentralized applications.

This changed in March as the number of active platforms in its ecosystem rose. The most successful one was MinSwap, a decentralized exchange. According to DeFi Llama, its total value locked (TVL) jumped to over $200 million. The TVL of Cardano’s ecosystem also rose to $338 million.

Therefore, the strength of its ecosystem and the fact that many investors felt that Cardano was undervalued helped it to do well in March. This trend will likely continue in April now that the 25-day and 50-day moving averages have made a bullish crossover.

3. Ethereum (ETH)

Ethereum also had a successful March as the developers pushed the new version of the network to a testnet in the kiln network. Also, the platform received praise from central banks in South Africa and Australia.

Therefore, Ethereum price will be in the spotlight in April this year as investors wait for the merge when the two versions will be combined. This merge will usher in a new era where Ethereum will be much faster and its cost significantly cheaper.

Technicals are also supportive of ETH. In the daily chart, the coin managed to move above the upper side of the triangle pattern while the 25-day and 50-day EMAs made a crossover. It also crossed the psychological level of $3,000.

4. Avalanche (AVAX)

Avalanche, like other altcoins, also had a successful March as its price rose to the highest level since February 16th. The performance was driven by the overall expansion of its network. For example, the total value locked (TVL) in its DeFi ecosystem rose to over $10 billion, making it the fourth-biggest platform in the world.

Avalanche’s network growth is mostly because of the quality of the network and the multi-million dollar rush program. In March, the developers unveiled another $250 million program targeting the metaverse industry. This being the largest such fund, there is a likelihood that more developers will embrace it.

The AVAX token is approaching the important resistance at $99.01, which was the highest level in February. A move above this price will see the coin rising above the next psychological level of $100.

5. Cronos (CRO)

Cronos, formerly known as Crypto.com Coin, is one of the fastest-growing cryptocurrencies in the world. While the CRO token has been around for a while, the network’s mainnet went live in February and has become incredibly successful.

According to DeFi Llama, the network has a total value locked (TVL) of over $3.6 billion, making it the 9th biggest platform in the industry. Some of the most active DeFi apps in its ecosystem are VVS Finance, MM Finance, and Tectonic among others. Therefore, there is a likelihood that the network will continue expanding in April.

Technically, it has moved above the Ichimoku cloud while the 25-day and 50-day EMAs have made a bullish crossover, which is a bullish factor.

6. VeChain (VET)

VeChain was once one of the most popular cryptocurrencies in the world. This changed after China started its crackdown of digital currencies. There was also a lack of clarity about what VeChain does and its ecosystem.

VET rebounded in March as investors rushed to the so-called fallen angels. It also rose after the developers launched the VEUSD stablecoin and other tools. Because of its former popularity and the fact that technicals are supportive, there is a likelihood that it will keep rising. It has already found a strong support at $0.042, moved above the moving averages, and the 23.6% Fibonacci retracement level.

7. Monero (XMR)

Monero is a leading privacy-focused cryptocurrency valued at over $3.987 billion. The coin also performed well in March as investors priced-in more demand because of cybercrime. While no major hack happened in March, the Biden administration has warned that Russia was planning major attacks.

Therefore, there is a likelihood that such an attack will happen in April and that hackers will demand Monero, which is a safer alternative to Bitcoin. Also, the fact that XMR is undervalued is a good catalyst.

From a technical perspective, it is above the 38.2% Fibonacci retracement level while moving averages are also supportive.

8. Velas (VLX)

Velas is a layer 1 project that seeks to become a better alternative to Ethereum. It is a relatively small platform but analysts believe it will gain traction in the coming months. The VLX token had a relatively positive month in March as the new Formula 1 season started. This was a notable thing since Velas is one of the biggest Ferrari sponsors and the team is currently leading. Therefore, VLX could gain more traction as the season continues.

Velas seems undervalued while its price has also crossed the 25-day and 50-day moving averages, which is a bullish catalyst.

9. Near Protocol (NEAR)

Near Protocol is a blockchain project that is gaining a strong market share in the smart contract industry. According to DeFi Llama, the network has a TVL of over $203 million, which is an all-time high. Some of the projects in its network are Ref Finance and Meta Pool among others.

Near is a good cryptocurrency to invest in in April because of the growth of its ecosystem and the fact that the developers are transitioning it to a fully sharded network. More progress is expected in April. It has also moved above the moving averages and is approaching a key resistance at $13.97. A move above that level will lead to more upside.

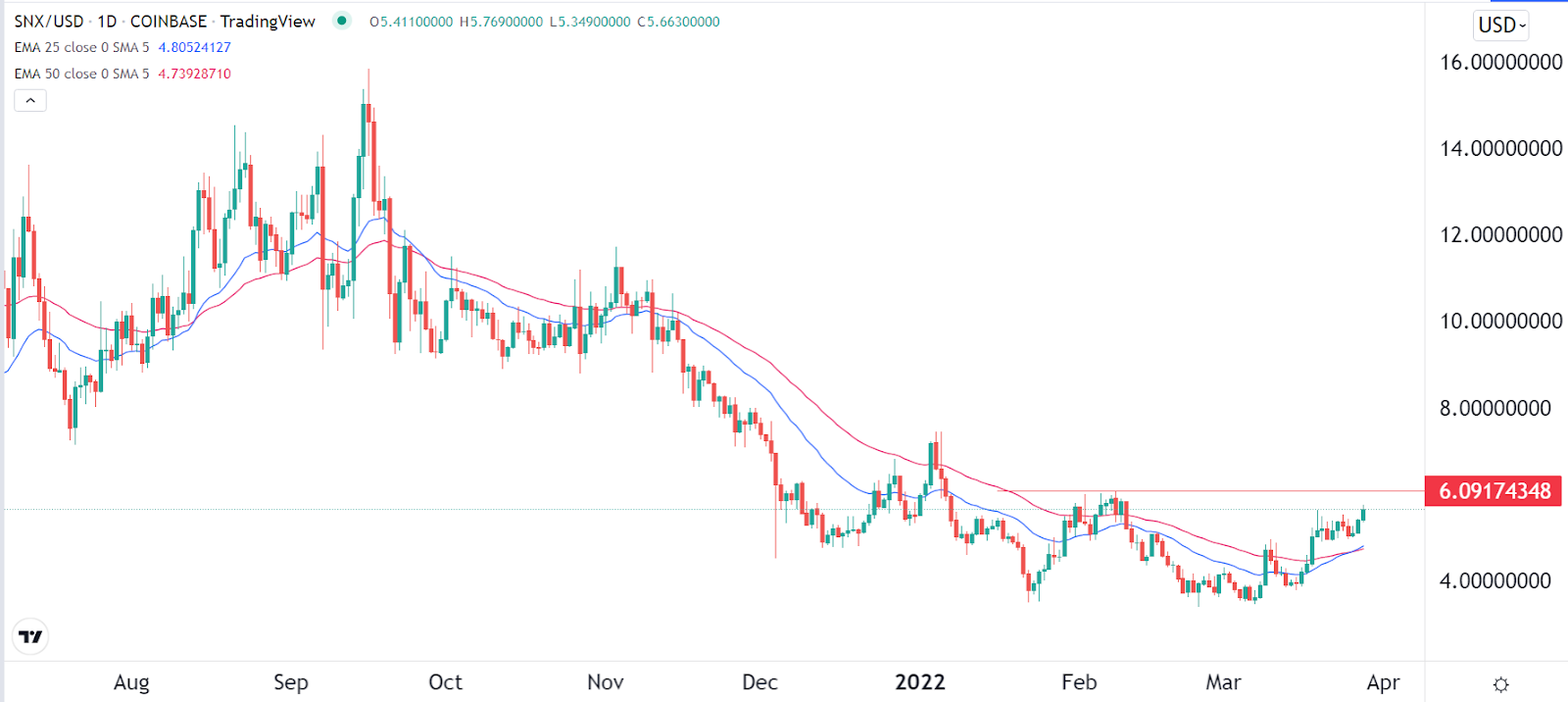

10. Synthetix Network (SNX)

Synthetix Network is an Australian blockchain network in the DeFi industry. It helps anyone to build their synthetic assets known as synths. The coin’s price did well as investors bought formerly hot coins. It has moved above the 25-day and 50-day MAs and is nearing the key resistance level at $6.08. It has also formed an inverted head and shoulders pattern. Therefore, there is a likelihood that it will keep doing well in April.

The post 10 Best Cryptocurrencies to Buy in April appeared first on Coin Journal.