- Neon EVM is a low-friction solution that enables Ethereum dApps to settle transactions on Solana.

- The EVM helps breach the gap between Ethereum and Solana.

- Since the Neon EVM beta is closed it will only accept transactions for those on the guest list.

Neon Labs, an Ethereum virtual machine on Solana that enables dApp developers to use Ethereum tooling to scale and get access to liquidity, has announced that it has launched a closed Neon EVM beta version, Neon EVMβ, on Solana’s mainnet. The launch is a significant milestone for the Neon EVM roadmap.

The Neon EVMβ is a fully-functioning Neon EVM that supports fee-free transactions.

All Neon EVM transactions are settled to Solana’s L1 and require payment in SOL, the native token of Solana, just like any other Solana transaction. However, in the just-launched beta version, the NEON token is not requested by the Proxy Operator responsible for accepting the transaction request and ensuring that it is finalized.

What is Neon EVM?

Neon EVM is a low-friction solution that enables Ethereum dApps to settle transactions on Solana, eliminating the gap between these two leading blockchains. It allows Ethereum developers to enjoy the best of Solana’s network, from low fees to high transaction speeds, and parallel transaction execution capabilities.

The Neon EVM solves Solana’s incompatibility with EVM which made EVM multichain dApp developers avoid the chain, which is otherwise known for being one of the fastest and organically-growing chains. It aims at making Solana a viable option for multichain builders.

Why a closed beta Neon EVM?

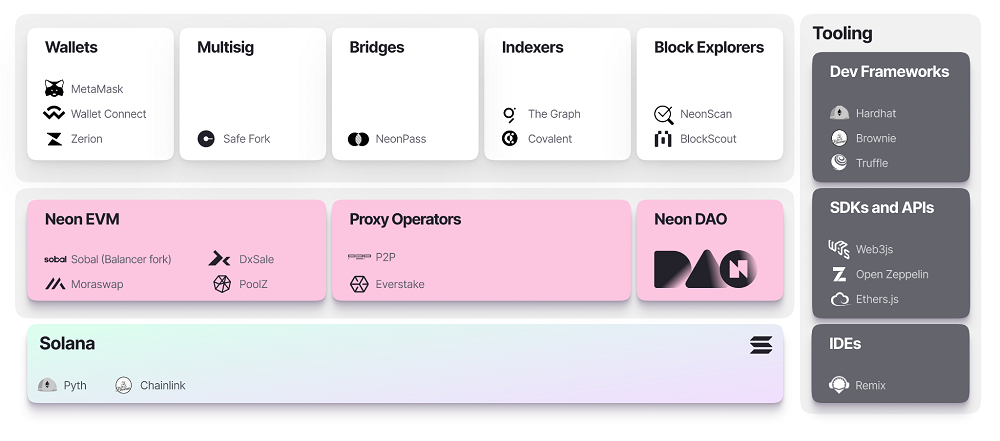

The Neon EVM ecosystem includes many more players than just the Neon EVM and the Proxy Operators that accept and settle transaction requests. It includes DAO, oracles, indexers, wallets, multisigs, bridges, explorers, and more.

Neon EVMβ provides an opportunity for all parties to deploy and test to ensure the seamless integration of their services before the official Solana Mainnet launch.

Launching in closed beta allows the Neon EVM team to onboard and test the services of ecosystem players in controlled phases. It will only allow those who are on the guest list to test transactions.

The first phase onboards the infrastructure components, and the second phase accepts dApps and will test the connection of wallets.

Operating in closed beta also controls the budget by keeping the activity limited to an invite-only list. Remember, while the Proxy Operator is not charging a fee, the Solana network still does. It simply is not possible to provide an open beta and predict the cost in SOL for such an initiative.

The post Closed beta version of Neon EVM launches on Solana’s Mainnet appeared first on CoinJournal.