-

Bloomberg analyst believes Bitcoin’s rising value is bad for commodities, citing copper as an example.

-

JPMorgan and Morgan Stanley also gave bearish outlooks for gold and copper in December.

-

Other strategists have given bullish forecasts though, including billionaire Paul Tudor Jones who noted this week that commodities were “greatly undervalued.”

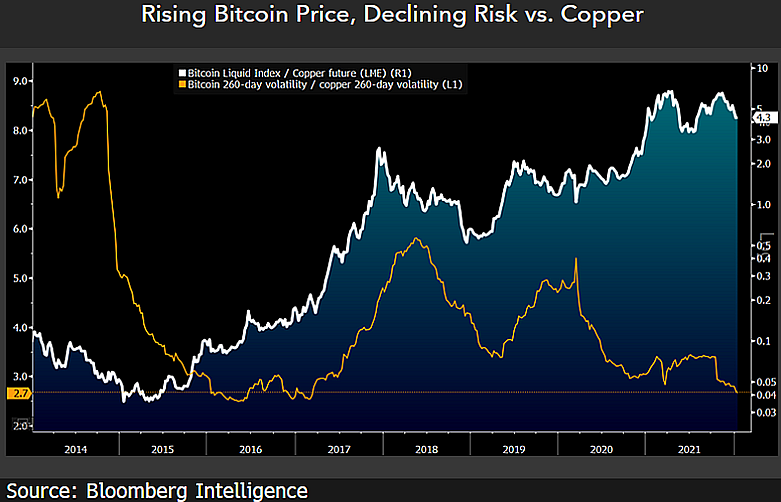

Mike McGlone, a senior commodity strategist at Bloomberg Intelligence, has suggested that commodities are unlikely to witness a price supercycle if Bitcoin’s growth and maturity is anything to go by.

The strategist has previously predicted that Bitcoin’s price could rally to $100,000 this year, and he’s not convinced of a similar run for commodities.

According to McGlone, the market resilience of Bitcoin and the outlook for metals like copper suggest the potential for a mega uptick for commodities is low. He indicated this in a comment shared on Twitter on Thursday, 13 January.

He noted that Bitcoin has the “edge” over copper, referring to the comparison between digital gold versus “the Old-Guard Doctor.”

Looking at a chart comparing Bitcoin’s rising price and declining risk versus copper futures, and the 260-day volatility for both assets, McGlone noted:

Chart showing Bitcoin vs. copper price and volatility comparison. Source: Mike McGlone on Twitter

Chart showing Bitcoin vs. copper price and volatility comparison. Source: Mike McGlone on Twitter

“Copper may be a good example of the low potential for a commodity supercycle, notably vs. an advancing Bitcoin. We see Bitcoins’ upper hand gaining endurance, and maturity, vs. copper.”

Other analysts’ views on gold, copper, and other commodities

In December, analysts at JP Morgan and Morgan Stanley forecast a bearish outlook for gold, silver and copper for 2022.

JP Morgan said that it expected US real yields to edge higher in 2022, with gold prices likely to decline to around $1,520 per ounce. Morgan Stanley, on the other hand, predicted copper would see more volatility, but likely stay “vulnerable to macro moves.”

Early this year, Fat Prophets commodity analyst David Lennox told “Street Signs Asia” that he expected gold to rally to $2,100 per ounce by end of the year. He alluded to rising US inflation and weaknesses for the US dollar, as well as geopolitical factors, as potential catalysts for a breakout in gold prices.

According to him, gold’s safe-haven status remains its biggest pull factor in the face of turbulence across markets and on the geopolitical scene.

Commodities are undervalued

On Monday, legendary trader and hedge fund billionaire Paul Tudor Jones noted that contrary to some observations, commodities were “greatly undervalued” and that they would outperform financial markets long term.

In an interview with CNBC, the Just Capital co-founder said assets that performed well during the pandemic will be in for a “tough sledding”. He added:

“Things that performed the best since March 2020 are probably going to perform the worst as we go through this tightening cycle.“

Gold was priced around $1,815 an ounce on Thursday, down about 0.6% having touched highs of $1,827 during the previous session. Silver and copper were also hovering in the red with 0.8% and 1.2% drawdowns respectively.

Meanwhile, Bitcoin was down 1.2% to $43,150 levels after declining from intraday highs of $43,800.

The post Bitcoin’s endurance suggests unlikelihood of ‘supercycle’ for commodities, says strategist appeared first on Coin Journal.