Events in Russia have dominated market sentiment. Prices pushed higher on optimism over the official recognition of crypto in the country, before dropping back down on concerns about the Ukraine conflict.

Elsewhere, more volatility was catalyzed by hot US inflation figures coming in at 7.5%, and the seizure of $3.6 billion in hacked Bitcoin by the US Justice Department.

BlackRock, which manages over $10 trillion in assets for pension schemes, endowments and sovereign wealth funds, is reported to be preparing a crypto trading service for its clients.

Big four accounting firm KPMG Canada announced the purchase of Bitcoin and Ethereum for its own corporate treasury, saying that “institutional adoption of crypto assets and blockchain technology will continue to grow and become a regular part of the asset mix.”

Tennessee has followed Arizona by drafting its own Bitcoin bill that would allow the state and other municipalities to invest in crypto assets.

Top cryptos

Bitcoin has retreated amidst fears of war and uncertainty around inflation. The flagship crypto rallied to a peak of almost $46K early last week, after local media reported that Russian authorities would create new legislation recognizing crypto assets as a form of currency.

The move is a major change of direction for the Russian Central Bank, which previously proposed a blanket ban on crypto.

In response to the news, some market analysts are now speculating that Russia could have even bigger future plans — such as accepting Bitcoin as payment for natural gas.

The top 10 cryptos were all in the green over the past 24 hours with Ethereum adding almost 4%, while Cardano and Solana gained 2%.

Avalanche is the biggest gainer in the top 20, up 8% today. The self-styled Ethereum killer is still rising after being listed on eToro recently.

Another altcoin that managed to defy market turmoil was Shiba Inu, finishing the 7-day period with 3% gains after the announcement of a mysterious new metaverse project.

Top movers

The top mover in the top 100 is without a doubt Rally (RLY), a social token-oriented protocol that allows creators to launch their own token and build a digital economy around their work.

Streamers, artists, musicians, gamers, athletes or general content creators can tap into their communities and offer benefits to recruit, retain and monetize their following seamlessly. Rally flew into the top 100 today and is currently at #87. It has added 65% to its value in 24 h.

Neo is a rapidly growing ecosystem that has the goal of becoming the foundation for the next generation of the internet, a new economy where digitized payments, identities and assets come together. It gained 11% today. Qtum is also up 11%.

Algorand, the 26th biggest crypto by market cap, is about to break $1. It has gained 7% in the last 24 h. It’s also a good day for metaverse tokens. Decentraland and Axie Infinity each added 8% to their value today.

Bitfinex’ token UNUS SED LEO continues to reverse gains. It’s down 7% today.

Trending

The biggest gainer of the day is Catcoin, a community-driven meme token created for the cat community by someone or a group of people with the tongue-in-cheek name Miaoshi Nekomoto.

Catcoin develops applications to provide the community with various tools and simplify the crypto world for new investors. It has gained 838% in the last 24 h.

Another trending coin is ALICE, the native token of My Neighbor Alice, a farm-themed play-to-earn game on Chromia.

The game bills itself as a place where “players can buy and own virtual islands and collect and build exciting items while also making new friends.” It has added 11% to its value today.

The post Market highlights February 16: Bitcoin battles global uncertainty at $44K appeared first on Coin Journal.

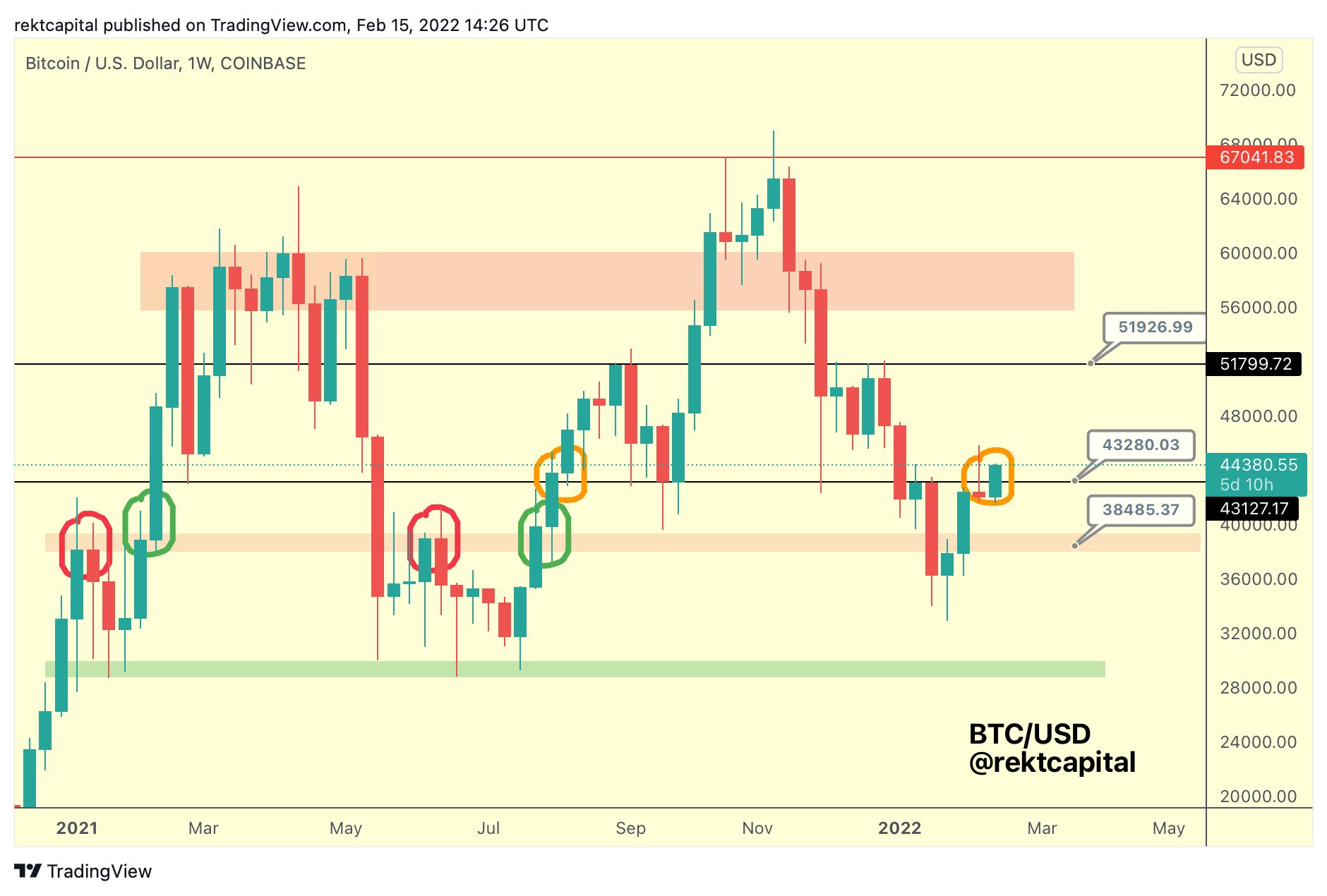

Weekly chart showing Bitcoin price breakout into the key bullish range of $43-$52k. Source:

Weekly chart showing Bitcoin price breakout into the key bullish range of $43-$52k. Source: