The notable thing about Bitcoin’s gains today is that they come despite the continuing uncertainty around the Russia-Ukraine conflict.

Bitcoin (BTC) rose to highs of $41,680 on Monday amid renewed buying pressure across the crypto markets.

The upside move is replicated in altcoins, with Ethereum (ETH) up 7% and trading above $2,800 while Solana (SOL) and Terra (LUNA) are both more than 14% in the green.

The total crypto market valuation is up 7.4% to $1.93 trillion, with Bitcoin’s market cap up to $793 billion.

Russia-Ukraine crisis shines the spotlight on BTC

Currently, BTC is briefly uncorrelated to Wall Street and trades more like gold than as a risk-on asset as seen over the past several months.

The macroeconomic factors that have hindered BTC remain, with uncertainty surrounding the war in Ukraine and the Fed’s rate hike plans likely to continue dictating investor sentiment short to medium-term.

However, Natalie Brunell, the host of Coin Stories Bitcoin Podcast, says the Ukraine conflict has highlighted what Bitcoin is about for the global community. According to her:

“The global monetary system is fracturing and #Bitcoin has surfaced as a pristine savings and freedom technology that is borderless, permissionless, censorship-resistant and unconfiscatable. The Russia-Ukraine Crisis puts a spotlight on this,” she told Fox Business.

Bitcoin price outlook

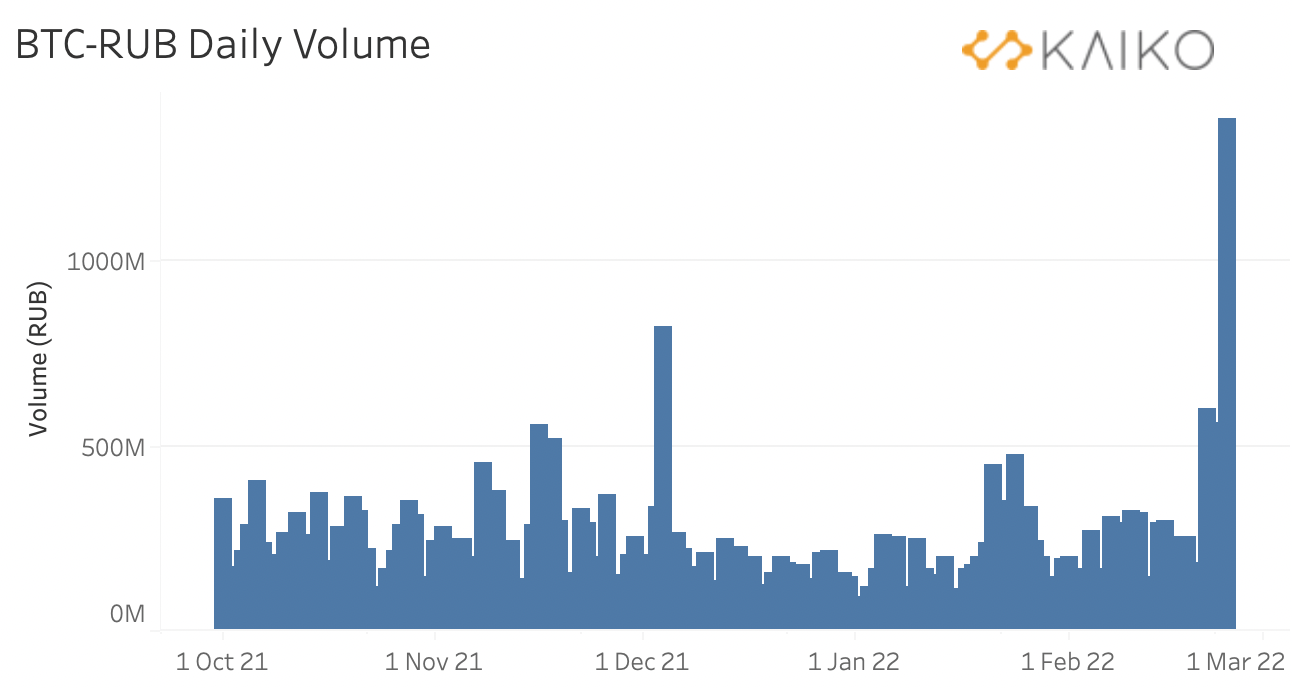

Brunell’s comments come as bitcoin donations to Ukraine continue to soar and ruble-denominated crypto trading volumes surge amidst the Russian currency’s weakness.

On whether BTC can sustain the current upside or hold onto gains, Dylan LeClair, a senior analyst at a digital asset investing fund at UXTO Management thinks it’s a likely scenario.

Per the analyst, BTC’s latest uptick is hinged on a growing number of ‘diamond hands’. He points to data that shows more than 80% of Bitcoin’s circulating supply has moved year-to-date.

“Only 15.5% of the #bitcoin circulating supply has moved in 2022 despite rising levels of macroeconomic uncertainty. HODLers are completely unfazed. Quite astonishing when you think about it,” LeClair tweeted on Monday.

$42,000 and $46,000 are key barriers

Crypto trader and investor Scott Melker wants to see BTC break above $42 and sustain momentum above it to have the chance of fresh legs for further gains.

Right back to the 42K area, the level that Bitcoin has found its way back to repeatedly for over a year. pic.twitter.com/NoDTZZ5ufn

— The Wolf Of All Streets (@scottmelker) February 28, 2022

And according to pseudonymous analyst Altcoin Sherpa, if BTC rallies to the mid-February peak of $46k, investors might want to look at a potential “market structure shift.”

Unlike last week, when Bitcoin (BTC) fell alongside stocks, this week’s upside is happening as the S&P 500 and broader equity move towards another negative close.

Bitcoin is nearly 10% up at $4,665, while the S&P 500 edged to -0.3% close for February.

The post BTC close to $42K as bulls take on bears despite ‘macroeconomic uncertainty’ appeared first on Coin Journal.

Ruble-denominated BTC volume. Source: Kaiko

Ruble-denominated BTC volume. Source: Kaiko