- FLOKI’s price has rallied by over 100% in the past week.

- It has hit a daily high of $0.00002973 today rallying on the news of the passed proposal.

- The passed proposal will see Floki Inu burn about 4.97 trillion FLOKI tokens.

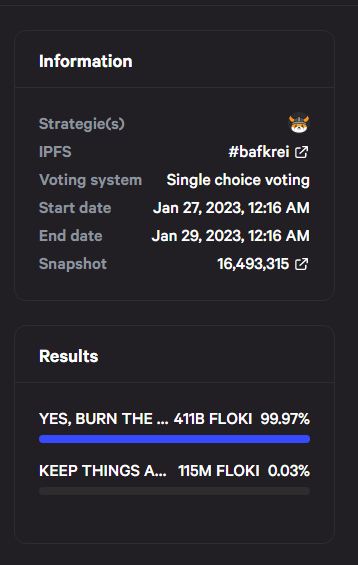

The Floki Inu DAO has finally passed the “Remove the FLOKI transaction tax and burn the bridge tokens” proposal. As reported in our earlier news, the proposal was opened for voting on January 27 causing significant price movements immediately after it was announced.

The voting proses was concluded on January 29 with 99.97% of the participants voting in favour of the proposal.

Screenshot of how Floki Inu DAO voted. Source: snapshot.org

Screenshot of how Floki Inu DAO voted. Source: snapshot.org

The price of FLOKI token has surged slightly because of the news, with the token gaining about 8% at press time to trade at $0.00002415.

What next after approving the proposal?

According to the information provided by Floki Inu, the proposal determined the future of two things for the Floki Inu community which are:

- The original Floki cross-chain bridge.

- The 3% tax on the FLOKI token.

The proposal sought to have the original cross-chain bridge disabled and the tokens in the bridge burned since the bridge posed some vulnerability threats. Floki Inu narrowly dodged a bullet last year when the cross-chain bridge was briefly exploited forcing the team to quickly disable the bridge to limit the exploit’s impact.

Now that the DAO has voted to pass the proposal, the team will go ahead and disable the main cross-bridge and embark on burning the FLOKI tokens that were in the bridge. The 3% buy and sell FLOKI transaction tax will also be drastically reduced to a 0.3% tax which is the default tax/fee on most decentralized exchanges like Uniswap (UNI/USD).

On timelines, the FLOKI transaction tax will be lowered to 0.3% effective 8 PM UTC on February 3, 2023, while the 4.97 trillion tokens will be permanently burnt at 8 PM UTC on February 9, 2023. As of the price of FLOKI today, the planned token burn is worth about $100 million.

The post Floki Inu DAO approves proposal to burn over $100M worth of FLOKI tokens appeared first on CoinJournal.