- TrueUSD will use Chainlink Proof of Reserve (PoR) in minting the TUSD stablecoin.

- It is the first stablecoin to use Chainlink PoR in controlling the minting process.

- The PoR will check the balance between the total supply of TUSD and US dollars held in reserve.

TrueUSD has today announced that it will be using Chainlink (LINK) Proof of Reserve (PoR) to secure the minting of its fully collateralized USD-backed stablecoin TUSD. The news comes after TrueUSD launched TCNH, a TRON-Based stablecoin pegged to offshore Chinese Yuan in December 2022.

This makes TrueUSD the first stablecoin to programmatically control minting using real-time on-chain verification of off-chain reserves. This is a paradigm shift in decentralization, transparency, and independent verification.

How the programmed minting process will work

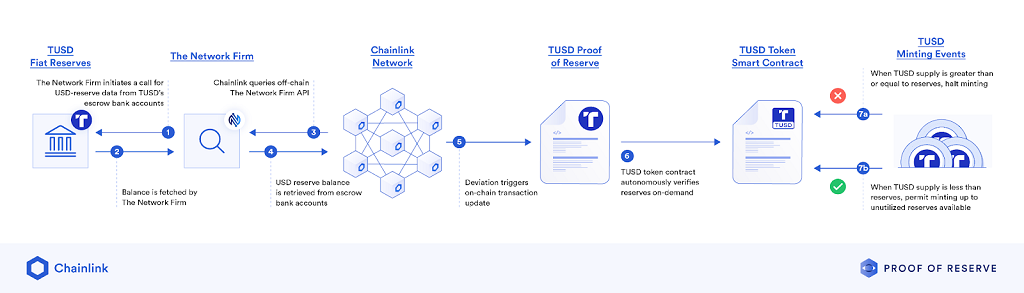

The TUSD reserve data is aggregated by The Network Firm LLP (TNF), which is an independent industry-specialized accounting firm in the US. TNF will aggregate all reserve data of US dollars held at financial institutions in real-time and serve that information on-chain through Chainlink’s oracle network. This is what is referred to as proof of reserve.

TUSD smart contract will then use this Proof of Reserve data feed to automatically check whether the total supply of TUSD would exceed the total amount of US dollars held in reserve before a new stablecoin is minted.

The automatic workflow is transparent in the smart contract code and supported by open independent data feeds thus affirming TUSD’s commitment to ensuring the stability of the ecosystem and the redeemability of the underlying dollars for clients.

TUSD users can feel confident that they have an accurate and transparent source of information about the reserves backing the TUSD stablecoin.

Commenting on the development, the co-founder of Chainlink Sergey Nazarov said:

“We are proud to support TUSD in its efforts to bring new layers of transparency, risk management, and security to its stablecoin minting process. With Chainlink Proof of Reserve, TUSD is able to provide greater levels of assurance and confidence to its users, and help bring greater stability to stablecoins and the broader crypto industry.”

The post TrueUSD the first USD-backed stablecoin to use Chainlink ‘Proof of Reserve’ to mint appeared first on CoinJournal.