- Poodlana’s niche appeal to East Asian luxury consumers sets it apart in crypto.

- Upcoming Asian economic announcements could boost trading volume and interest.

- Plans for staking and partnerships with fashion brands further enhances Poodlana’s appeal.

Poodlana (POODL), a meme-inspired cryptocurrency launched on the Solana blockchain, has gained attention for its unique positioning in the crypto market.

With its poodle-themed concept and strong ties to both the high fashion industry and East Asia’s luxury consumer market, Poodlana presents a combination of cultural relevance and financial potential. Despite experiencing a significant decline after its presale, there are several reasons why Poodlana price is expected to rebound in the near future.

Poodlana’s unique appeal

Poodlana (POODL) stands out in the crowded meme coin market due to its distinct appeal to East Asian investors. The altcoin was designed with a strong emphasis on the region’s fascination with high fashion and toy poodles, both of which are dominant trends in countries like China, Japan, and South Korea.

By combining these themes, Poodlana has successfully differentiated itself from other dog-themed cryptocurrencies such as Dogecoin (DOGE) and Shiba Inu (SHIB), making it a targeted investment opportunity for fashion-savvy and trend-conscious investors.

Moreover, Poodlana’s connection to the Solana blockchain gives it an advantage in terms of transaction speed and cost-efficiency compared to meme coins on Ethereum, where high gas fees have been an issue.

Solana’s reputation for scalability and speed aligns well with the ambitions of Poodlana, particularly as it plans to introduce staking and other community-focused features.

POODL presale success and post-launch decline

Poodlana’s presale was a major success, raising a whopping $7.1m in a record 30 days. During the presale, Poodlana price rose from an initial $0.02 to a Raydium listing price of $0.06.

The presale helped establish a strong foundation for the coin, with early adopters showing confidence in its potential.

However, like many cryptocurrencies, Poodlana (POODL) experienced a significant price drop after it launched on the open market. Since its listing on major exchanges such as MEXC and Raydium, the coin has faced a sharp decline.

This post-presale decline is not uncommon in the world of cryptocurrencies, especially for meme coins. Early investors often sell off their holdings for a quick profit, causing a temporary dip in the price.

Additionally, concerns over token concentration in a few wallets, as flagged by Rugcheck, have also made some investors cautious. Large holders can potentially manipulate the market by selling significant amounts of the coin, creating volatility and price swings.

Why Poodlana’s price is expected to rise

Poodlana (POODL) has recently faced a considerable price decline, dropping over 70% over the past 30 days. At press time, POODL traded at $0.003788, following a considerable drop from its listing price of $0.06.

This downturn, while concerning, is not uncommon for newly launched cryptocurrencies, especially meme coins that often experience volatility post-launch.

Despite the downturn, several factors suggest that Poodlana may be on the verge of a price rebound.

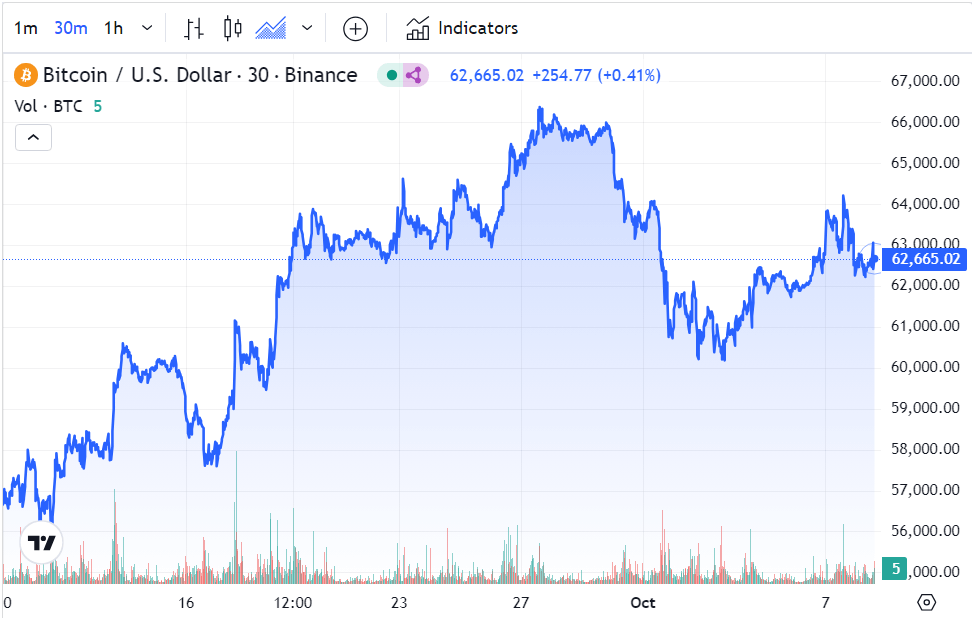

- Geopolitical and macroeconomic factors: Geopolitical tensions and macroeconomic conditions are currently driving investors away from traditional fiat currencies. As conflicts intensify and government deficits rise, investors are turning to cryptocurrencies like Bitcoin as a safe haven. Historically, Bitcoin’s rise often pulls other cryptocurrencies along with it, and Poodlana could benefit from this trend. JPMorgan analysts have even predicted that Bitcoin could see significant gains, and if so, meme coins like Poodlana may follow suit.

- Upcoming Asian economic announcements: This coming Saturday, important economic plans for the Asian market are set to be revealed. Given that 80% of meme coin trading happens during Asian hours, any positive economic news from the region could lead to increased trading volume and renewed interest in Poodlana. The coin’s strong appeal to East Asian investors, particularly those with a passion for luxury fashion and toy poodles, could result in a boost in demand.

- Staking platform and roadmap: Poodlana’s development team has ambitious plans that extend beyond being just another meme coin. The upcoming launch of its staking platform will provide holders with a passive income opportunity, potentially driving more long-term interest in the coin. Additionally, Poodlana’s partnerships with fashion brands and influencers are expected to elevate its profile, making it more attractive to a wider audience. These efforts could result in renewed demand and upward price movement.

- Tailwinds from the fashion industry: As a coin that markets itself as glamour-inspired, Poodlana is also poised to benefit from growth in the global fashion industry. Its plans to partner with high-fashion brands and lifestyle platforms could help establish it as a luxury-oriented cryptocurrency, appealing to a niche market of fashion-conscious consumers.

Conclusion

While Poodlana has experienced a post-presale slump, several factors suggest that the coin may be poised for a comeback. Its strong appeal to East Asian investors, combined with favorable macroeconomic trends, planned technical innovations, and its unique positioning in the fashion industry, make it a coin worth watching.

As geopolitical tensions drive investors toward cryptocurrencies and upcoming economic announcements in Asia create potential tailwinds, Poodlana could see a rise in price in the near future.

Those who are willing to ride out the current volatility may find that Poodlana has significant long-term growth potential. To find out more about the meme coin, you can visit its official website here.

The post Poodlana price prediction: will it rise despite the post-presale decline? appeared first on CoinJournal.