- PEPE price has declined alongside that of Bitcoin ahead of the week’s major events – the US election and Fed’s interest rates decision.

- Vantard has raised over $300 in seed round as investors eye the meme supercycle.

Pepe (PEPE) price has dropped significantly, but could this be a buy opportunity given potential market pump? What about the token creating the most buzz in the meme coins space today – Vantard (VTARD)?

Here’s the price prediction for PEPE and VTARD, and why the latter could outpace the frog-themed meme coin.

Vantard meme index fund

Vantard (VTARD) is a meme coin token that offers access to an index fund. For investors who have heard of Vanguard, then this is a project that seeks to replicate successes of its top funds in the crypto market.

The choice tokens for this index fund are the blue chip meme coins currently dominating the altcoin ecosystem. As a token, VTARD is the ticket to a portfolio that collates all the mega moves of top memes like dogwifhat, Popcat and hot new trends like GOAT and MOODENG.

All this does is allow investors buy a token that represents all the top movers.

The fund will rebalance periodically to add the hottest meme coins. Investors are bullish on VTARD, which stormed to $500k in its pre-seed sale and has surpassed $300k as the seed sale accelerates.

Pepe price prediction

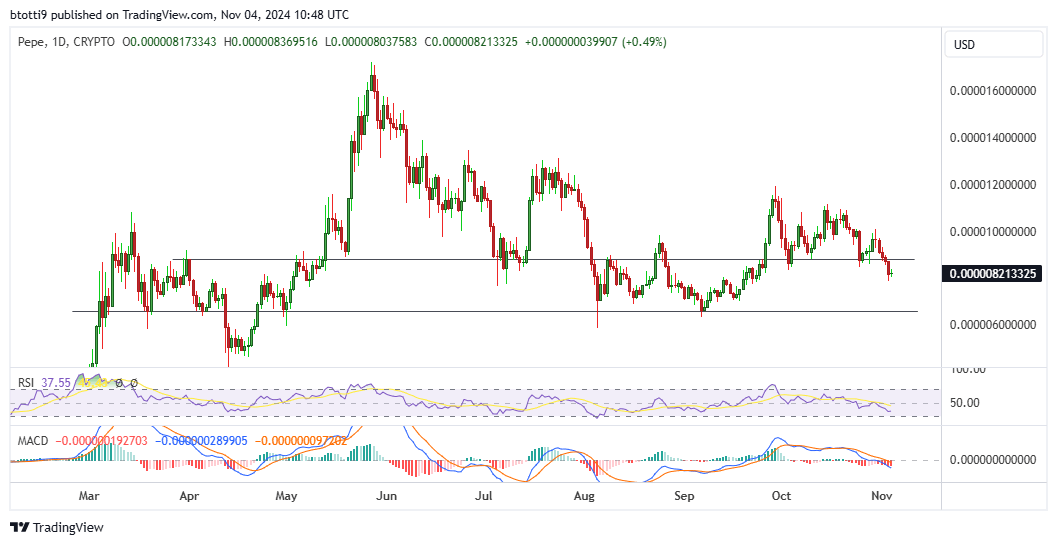

Pepe price has declined 8% this past week and more than 21% over the past two weeks, with bulls struggling to hold key support levels.

As such, PEPE currently signals a bearish outlook as price hovers at levels last seen in mid-September. PEPE has plummeted below the key $0.0000087 area, and the downtrend has sellers eyeing the $0.0000065 level.

Both the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) indicators on the daily chart suggest bears have the upper hand. However, despite the bearish outlook, the overall market setup could help bulls flip momentum.

Should meme coins return to an upward trajectory as its looks very likely they will with a Donald Trump win, PEPE could target a strong recovery to $0.000010. The YTD highs above $0.000017 will be a key target.

If not, likely with a Kamala Harris win, the short term price outlook could be a dip below $0.0000065. The demand reload level in this case will be the area around $0.0000048, a support level seen in April. Notably, bulls bounced off this area above before rallying to the year-to-date highs in May.

Vantard price prediction

VTARD currently sits at $0.00012 but could skyrocket as top meme coins in the portfolio begin to explode.

As noted above, the meme coin market is bullish as the US goes into Election Day on Tuesday, November 5, 2024. The crypto space is buzzing for a Trump win, with the forecast that a win for Harris could see prices fall short term.

In all these, crypto analysts have pointed out to the meme coin narrative as the one to watch.

Vantard’s unique proposition means the seed round is potentially a great entry level. As the project claims, this could be the first 1000x meme index fund, with performance riding the next meme supercycle.

To learn more about Vantard, visit the official website.

The post Crypto price prediction: Is Vantard (VTARD) set to outperform Pepe (PEPE)? appeared first on CoinJournal.