- Bitcoin’s new price follows after it hit $98,000 yesterday

- Analyst Skew said there is “positive market signal” and that there is “a lot of aggregate spot supply around $100k”

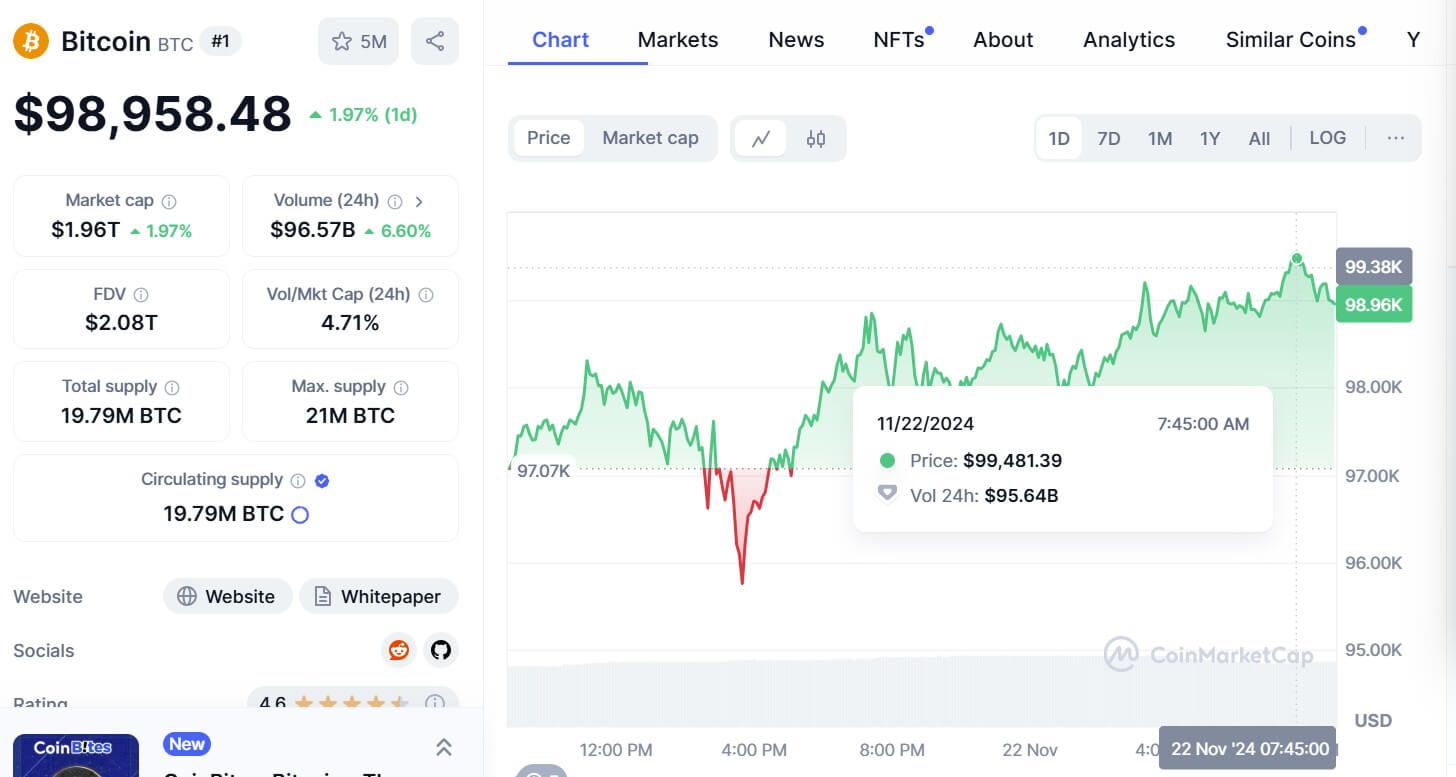

Bitcoin came within touching distance of $100,000 on November 22 as the asset continues its bull run since the beginning of November.

Data from CoinMarketCap shows Bitcoin hit a high of $99,500. The record comes after Bitcoin topped $98,000 yesterday, pushed along by the launch of ETF options earlier this week.

The rally follows after Bitcoin dipped to $95,000 yesterday afternoon before rallying into the green.

Taking to X, analyst Skew said: “Price did see a brief LTF dip before higher thereafter. Still seeing limit bids moving higher with underlying spot buyers ~ positive market signal,” adding:

“A lot of aggregate spot supply around $100k. Price currently is chewing away at this supply, before this has preceded a pretty violent breakout.”

$BTC Binance Spot

Update since previous post

Price did see a brief LTF dip before higher thereafterStill seeing limit bids moving higher with underlying spot buyers

~ Positive market signalA lot of aggregate spot supply around $100K

Price currently is chewing away at this… https://t.co/TruZVGXwTM pic.twitter.com/nGtekY6Y0F

— Skew Δ (@52kskew) November 22, 2024

Joe Constori, head of growth at Theya and institutional lead at the Bitcoin Layer, said on X that Bitcoin at $100,000 is going to happen.

“Its properties have always destined it to be a multi-trillion dollar base layer monetary asset. It just took the price 15 years to catch up.”

Market analyst Ali mentioned that “the TD Sequential presents a sell signal on the #Bitcoin $BTC 4-hour chart, anticipating a brief correction to $97,085,” adding:

“A candlestick close above $100,470 will invalidate the bearish formation and potentially push #BTC to $102,656 or $104,343.”

The TD Sequential presents a sell signal on the #Bitcoin $BTC 4-hour chart, anticipating a brief correction to $97,085!

A candlestick close above $100,470 will invalidate the bearish formation and potentially push #BTC to $102,656 or $104,343. pic.twitter.com/WiKQTGYNmJ

— Ali (@ali_charts) November 22, 2024

Pro-crypto

The continued surge follows since Donald Trump won his re-election into the White House on November 5.

Trump, now considered pro-crypto, made several promises regarding the crypto market during his election campaign, one of which is to make the US the “crypto capital of the world.”

Earlier this week, it was reported that Trump’s transition team was considering its first-ever White House crypto office.

If established, this position would serve as a liaison between the digital assets sector, Congress, and key regulatory agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

At the time of publishing, Bitcoin is trading at $98,600.

The post Bitcoin gets within touching distance of $100K as rally continues appeared first on CoinJournal.