- The PENGU token currently trades at $0.03548, up 609% since its launch.

- The token is currently ranked at position 59 by market cap on CoinMarketCap.

- It has overtaken WIF and GRT in terms of market cap ranking.

In a remarkable display of market enthusiasm, the newly launched Pudgy Penguins (PENGU) token on the Solana blockchain has witnessed its market capitalization skyrocket by 521% since its debut.

Launched with a total supply of 88,888,888,888 tokens and a circulating supply of 62.416 billion tokens, PENGU has quickly become a focal point for the crypto community, especially those involved with the Pudgy Penguins NFT project, which comprises an 8,888-piece NFT collection launched in 2021 on the Ethereum blockchain.

This impressive performance has positioned $PENGU as one of the standout tokens in the Solana ecosystem and propelled the token to position 59 by market cap overtaking more established coins like Dogwifhat (WIF) and The Graph (GRT).

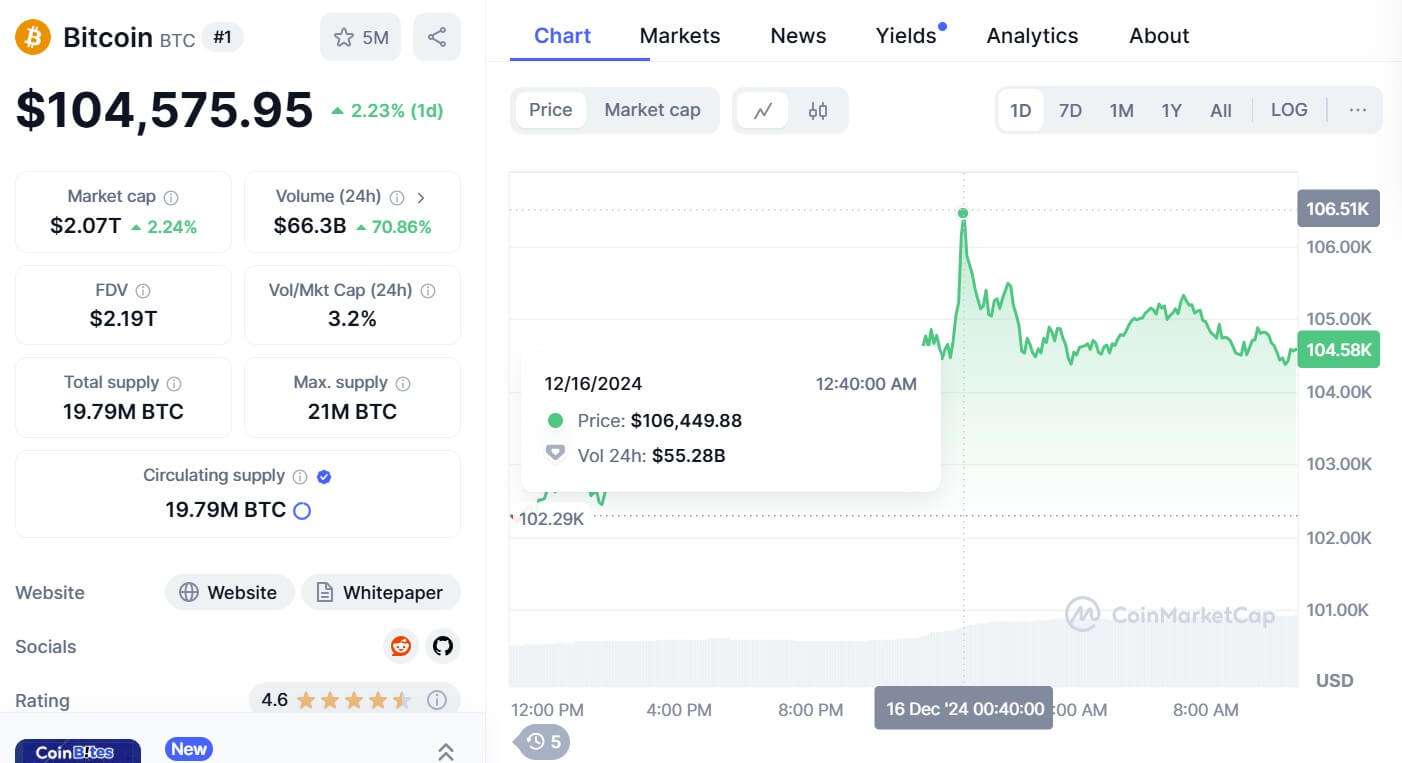

The token’s market cap hit an impressive $2.5 billion within the first day, underlining its potential to influence market trends. Despite the volatile nature of cryptocurrency, $PENGU has managed to maintain a substantial holder base, with reports suggesting a 40% increase from the lowest points post-launch.

With a market cap of $2,227,684,354, PENGU could easily overtake Injective, Ondo, Celestia, Bonk, Immutable, and others if its price soared to $0.05.

This growth has been supported by listings on major exchanges like Binance and OKX, which have facilitated spot trading, and partnerships with services like MoonPay, enhancing $PENGU’s accessibility and liquidity.

Notably PENGU’s surge can be attributed to a strategic airdrop distribution, targeting not only Pudgy Penguins holders but also engaging Ethereum and Solana’s early adopters, known as OGs.

This approach has evidently paid off, as $PENGU has not only seen a significant price increase but has also boasted one of the highest transaction volumes on the Solana blockchain, with daily transactions reaching an unprecedented 66.9 million shortly after launch.

The post PENGU overtakes WIF and GRT as market cap surges 521% appeared first on CoinJournal.