- Michael Saylor, founder of MicroStrategy, has shared the company’s Bitcoin tracker on X.

- The market expects an annoncement that the company has acquired another chunk of BTC.

- Bitcoin price hovered near $94,800 at the time of Saylor’s post on Dec. 29

MicroStrategy founder Michael Saylor has posted the company’s Bitcoin (BTC) tracker chart on X again.

In recent months, every such post has been followed by an announcement that the world’s largest corporate holder of the flagship digital asset had acquired another haul.

Industry experts and observers have been quick to point out that MicroStrategy is about to announce another major BTC purchase.

NEW: Michael Saylor posted his BTC purchase tracker again, which means MicroStrategy will announce another HUGE #Bitcoin purchase tomorrow.

SAYLOR IS THE GOAT 🐐 pic.twitter.com/48RTgEE1ud

— Nikolaus Hoffman (@NikolausHoff) December 29, 2024

Noticeably, MicroStrategy has acquired additional BTC for billions of dollars in recent months, with these following such hints. The company announced it bought 27,200 BTC worth $2.03 billion on Nov. 10; another 51,780 BTC worth $4.5 billion on Nov. 17 and $5.32 billion for 55,500 BTC on Nov. 24. The company’s buying spree also saw it add 15,350 bitcoins in mid-December.

MicroStrategy so far holds 444,262 BTC

Most recently, MicroStrategy acquired 5,262 BTC for $561 million, with the acquisition announced on Dec. 23 indicating the company bought at the average purchase price of $106,662 per bitcoin. This brought the total BTC holdings as of Dec. 22, 2024 to 444,262 BTC, which MicroStrategy has cumulatively acquired for roughly $27.7 billion since 2020.

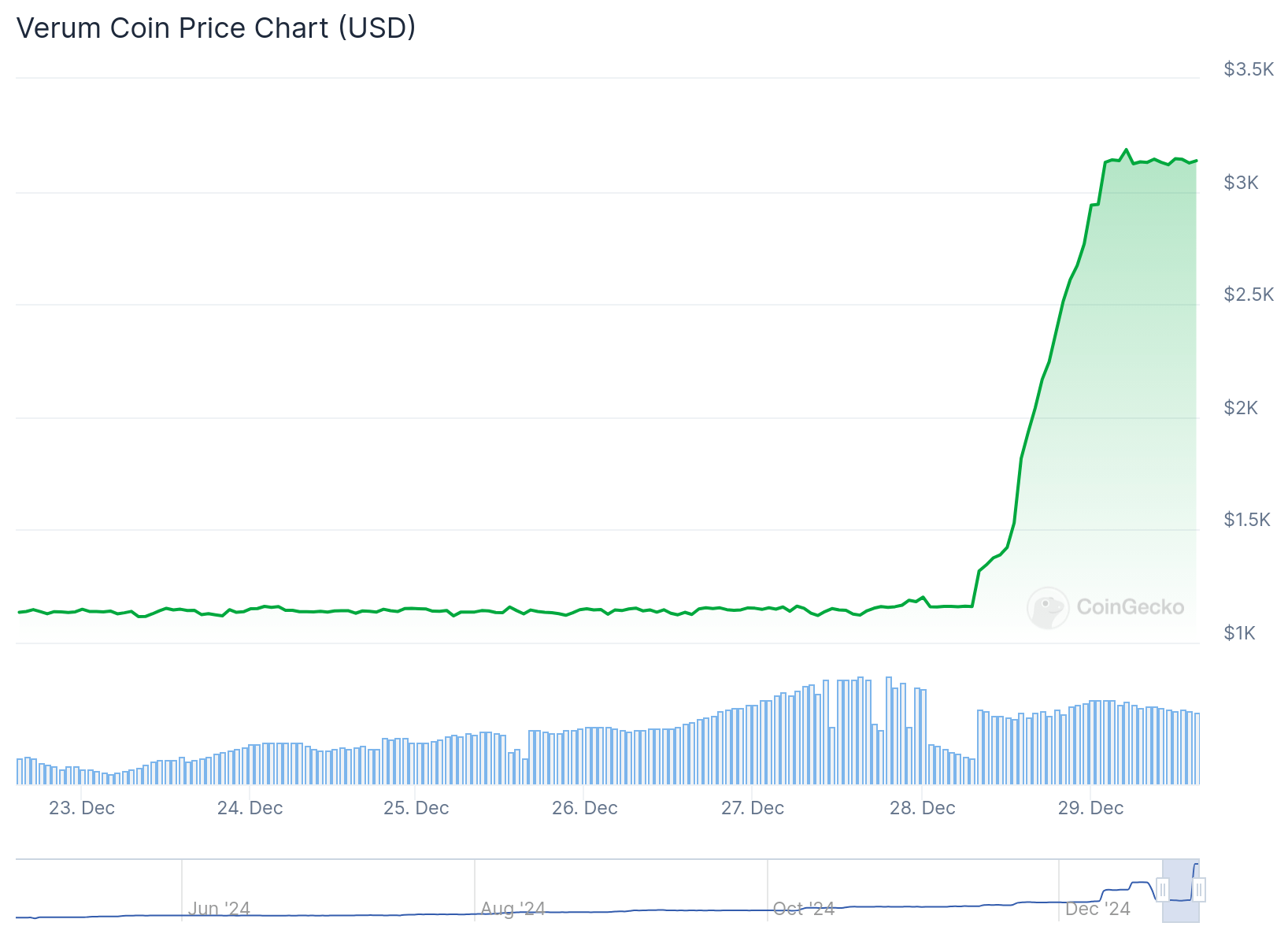

The average purchase price of this entire haul, its dollar cost averaging, stood at $62,257 per bitcoin at the time of writing. Per Saylor portfolio tracker, the company’s holdings stand at $42.16 billion with Bitcoin price hovering near $94,780. Overall profit is over $14.5 billion.

Here’s Saylor’s latest post on X:

Disconcerting blue lines on https://t.co/Bx3917zMqi. pic.twitter.com/xPl4GTKU3E

— Michael Saylor⚡️ (@saylor) December 29, 2024

Bitcoin traded above $94k on Dec. 29, holding above the level after bears rejected bulls’ advances near the $100k level. Earlier this month, bulls recovered from lows of $92k – having suffered the massive slump from above the all-time high of $108k.

While BTC price has not skyrocketed amid recent MicroStrategy buys, the market is extremely bullish amid the combination of the buy pressure, spot ETFs demand and other positive catalysts. Analysts say it could rally to $150k-$200k in 2025.

The post Saylor posts MicroStrategy’s BTC tracker: Another Buy? appeared first on CoinJournal.