- Musk It token has jumped 544% after Errol’s $200M plan.

- Errol Musk plans to fund the Musk Institute project with funds raised using the memecoin.

- Musk It’s future is uncertain seeing that it lacks a clear roadmap.

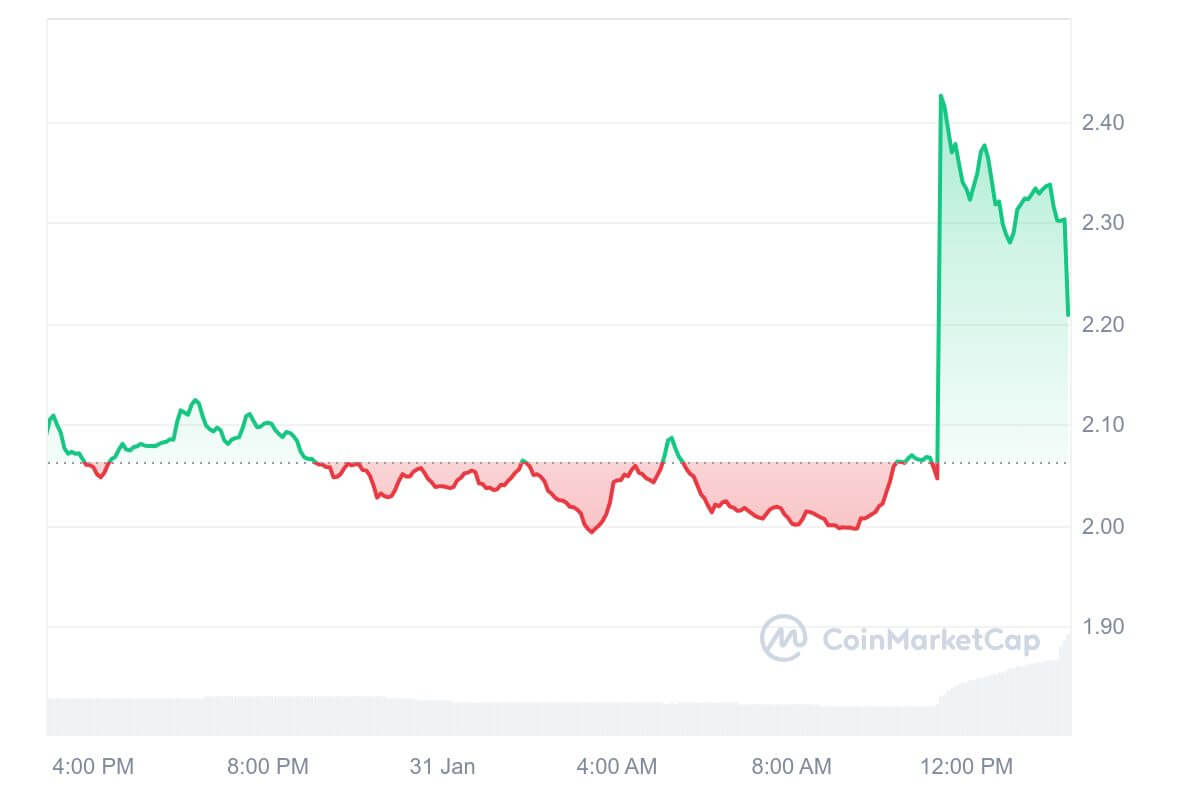

The Musk It (MUSKIT) token has seen an astronomical rise, soaring by 544% within the last 24 hours to hit an all-time high of $0.07278.

This surge comes hot on the heels of an announcement by Errol Musk, the father of tech mogul Elon Musk, who revealed his ambition to raise $200 million through this memecoin for a new venture called the Musk Institute.

The Musk It token price rebound

The Musk It token, which was initially launched in December 2024 by a Middle Eastern cryptocurrency company, had previously struggled to capture the market’s attention, shedding over 50% of its value since its inception.

However, the recent news of Errol Musk’s fundraising plan has dramatically reversed its fortunes, pushing the token’s price to $0.07278 from a low of $0.0107 in a day.

This price movement has been accompanied by a trading volume of $87,495,901, signalling significant investor interest.

The Musk Institute, as envisioned by Errol Musk, aims to be a for-profit think tank focused on engineering projects, particularly those that could go “beyond rockets.”

Errol Musk’s ambitious goal with the Musk It memecoin has evidently struck a chord with investors, despite the token’s lack of intrinsic utility, a common trait among memecoins.

The surge in MUSKIT’s price and trading volume indicates that the market is not just responding to the Musk name but also to the potential for what the raised funds could achieve.

There is a caveat to the sudden MUSKIT’s price surge

However, this dramatic rise in Musk It’s valuation comes with a caveat. The token’s success appears to be closely tied to the Musk family name, yet there’s a clear distinction: Elon Musk has no involvement in this project.

This lack of endorsement from Elon, whose influence in the crypto world is significant, especially with his history of impacting Dogecoin’s price, casts a shadow over the token’s long-term sustainability.

Anndy Lian, an intergovernmental blockchain expert, has expressed scepticism about Musk It reaching the same heights as other celebrity-backed memecoins without Elon’s direct stamp of approval.

The memecoin market, notorious for its volatility, often sees such dramatic swings based on hype rather than fundamental value.

The excitement around Musk It mirrors the recent interest in other high-profile memecoins like those associated with the Trump family, which have also seen significant, albeit fluctuating, gains.

This trend suggests that investors are on a constant lookout for the next big hit in crypto, hoping to capitalize on the speculative nature of these tokens.

While the immediate future for Musk It looks promising with its newfound momentum, the long-term outlook remains uncertain. The market cap has now reached $63,922,516, but without detailed tokenomics or a clear roadmap, the project’s transparency is under scrutiny.

While Errol Musk has distanced the project from being a “pump-and-dump” scheme, the market’s history is rife with such examples where initial excitement quickly dissipates.

The post Musk It price explodes 544%, Errol Musk aims to raise $200M with it appeared first on CoinJournal.