Poodlana, the fast-growing Solana meme coin, is set to list on Raydium, on Friday after running one of the most successful token sales of the year.

Poodlana token listing is nearing

With four hours to go, the developers have raised over $7.9 million from investors, a figure that could top $8 million.

Poodlana, unlike other cryptocurrencies that spend months before listing in exchanges, will start trading almost immediately after the sale ends. Precisely, it will start trading on Raydium, just one hour after that.

Raydium has grown into the most popular Solana DEX. Data by DeFi Llama shows that the network has over $910 million assets in the ecosystem. At the same time, it has handled over $2.7 billion worth of transactions in the last 7 day and is continuing to gain market share.

Raydium is not the only exchange that is expected to list Poodlana. MEXC, one of the biggest crypto exchanges in the world, has pledged to list the token on August 19th while the developers have hinted that a major tier 1 exchange – most likely Binance or OKX – will list it on August 23rd.

Listing the Poodlana token is just the beginning of what is expected to be a long journey to make the POODL token one of the biggest meme coins in the world. After its launch, the developers will continue marketing the token in a bid to make it the most popular asset in crypto.

The next phase will involve building the ecosystem, such as introducing staking, where users can earn returns. They will also launch more airdrops and bonuses to reward long-term holders.

The ecosystem growth is important in the meme coin industry, which is often short-term. Just this year, many meme coins like MOTHER, DADDY, and WATER surged, attracted buyers, and have now imploded.

Poodlana’s appeal

Poodlana hopes to change the short-term nature of meme coins. As part of its appeal, the developers have named it after Poodle, a highly popular Japanese dog that often sells for more money than other brands like Shiba Inu and Floki.

At the same time, it is a luxury brand that sees itself as Hermes, the most popular brand among the elite. While most luxury brand stocks like Kering and Burberry have slumped, Hermes stock has risen to the highest point on record.

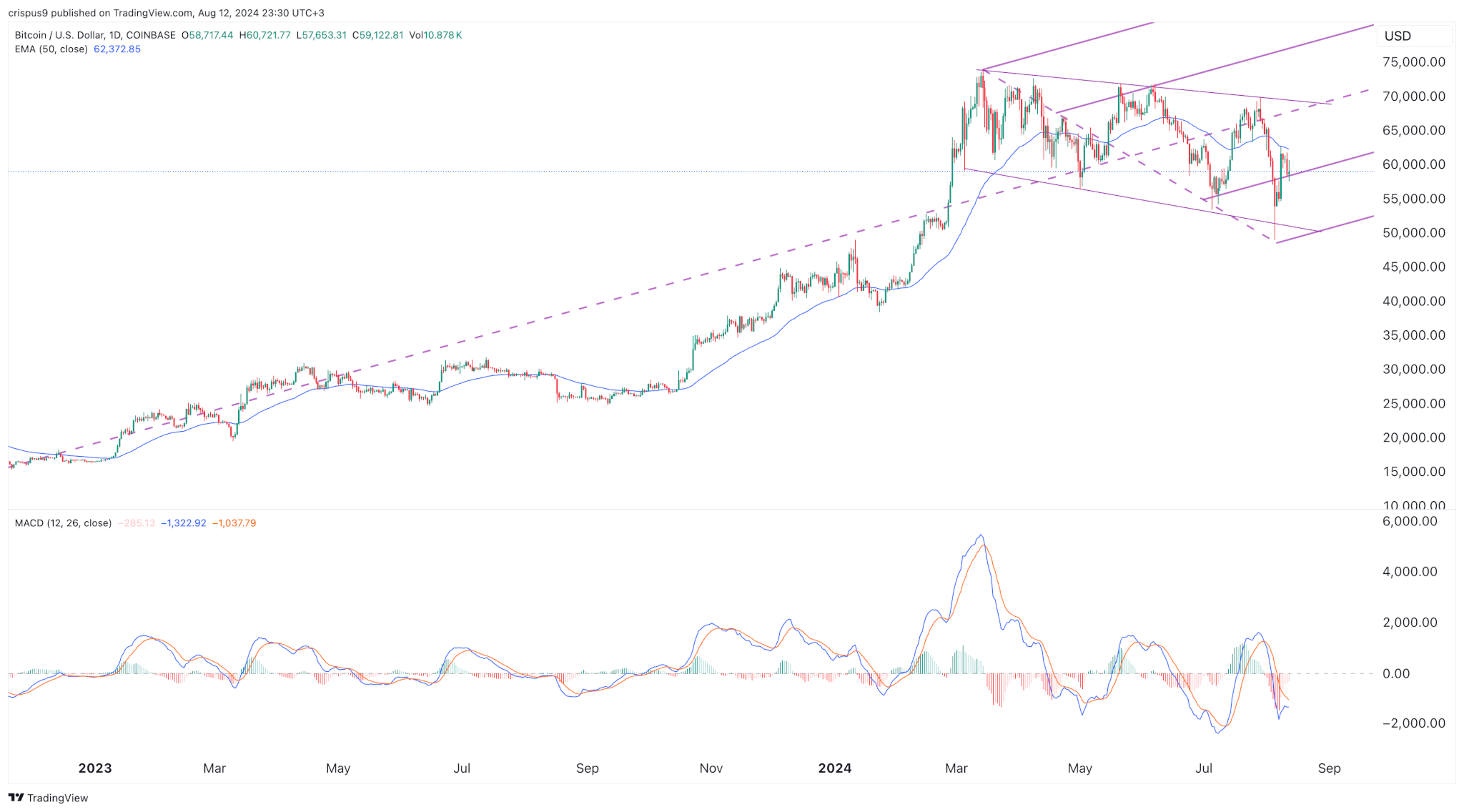

There are other reasons to be bullish on Poodlana now that cryptocurrencies are retreating and the sentiment has waned. In a statement, Miles Deutscher, a popular crypto analyst, hinted that this boring phase could be a form of accumulation and that cryptocurrencies could bounce back soon.

We’re entering the apathy/time capitulation phase again.

In the last 2 weeks:

• Crypto YT views are down ~-30%

• Coinbase app ranking is down from #159 to #502

• Trading volume is down -21% (Binance)Strap in. Things are getting boooooooring.

— Miles Deutscher (@milesdeutscher) August 14, 2024

The main catalyst for these coins will be the upcoming Federal Reserve interest rate cuts, the end of the summer season, and the end of the American election. You can buy the POODL token here.

The post Poodlana token sale nears $8M ahead of Raydium listing appeared first on CoinJournal.