Since September last year, EOS (EOS) has been on a massive downtrend. The coin has sparked a bit, but the general outlook ever since has been downward. There was however some hope that the rally in recent days could trigger a sustained climb. It did not happen, and here are some highlights:

-

At press time, EOS (EOS) had fallen by nearly 8% over the last 24 hours, trading at around $2.38

-

The coin has however rallied by nearly 40% over the last two weeks.

-

Despite this surge, crucial indicators show that EOS (EOS) still remains in the bear market.

Data Source: Tradingview.com

Data Source: Tradingview.com

EOS (EOS) – when will the downtrend break?

We will need to see some sustained gains over a longer period of time for EOS (EOS) to report a decisive breakout on the up. The $3 dollar mark appears to be a crucial resistance zone. We did see EOS (EOS) climb past that late last year but failed to hold any gains.

In fact, some analyst argues that surging above $3 will be decisive for EOS (EOS) in its effort to transition into a bull run. Besides, the RSI readings are neutral, suggesting that there is enough potential for the token to surge.

At the time of writing, EOS (EOS) was trading at $2.62. There is still some way to go before $3, but going by recent rallies, it is possible.

Why you should buy EOS (EOS)?

There are hundreds of crypto assets that must be in your portfolio, and EOS (EOS) is one of them. The platform bills itself as the ultimate DAPP development suite.

It simply gives developers the tools to create and deploy innovative decentralised apps. At the moment, EOS (EOS) has a market cap of around $2.3 billion. This makes it a decent option for unlocking long-term value.

The post EOS (EOS) fails to break downtrend despite reporting significant rally over the last week or so appeared first on Coin Journal.

Data Source: Tradingview

Data Source: Tradingview

Data Source: Tradingview

Data Source: Tradingview

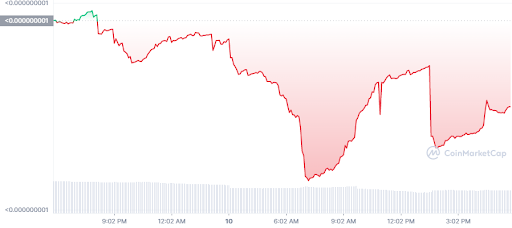

Data Source: Coinmarket.com

Data Source: Coinmarket.com