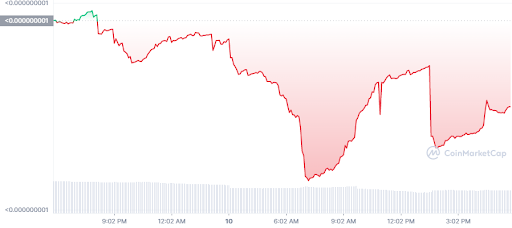

Loopring (LRC) had emerged as one of the top-performing coins in 2021. In fact, the altcoin went on to hit its all-time high of $3.86 in November last year. But after that, it’s been free fall for LRC. However, the coin appears to be nearing a decisive bullish breakout in the coming days. Here are some highlights:

-

After hitting all-time highs of $3.86 in late 2021, Loopring (LRC) has fallen over 75% from those levels.

-

At the time of writing, the token was trading at $1.06, up about 5% over the last 24 hours.

-

Loopring (LRC) is however consolidating and a decisive bullish breakout could see gains of nearly 50% from its current price.

Data Source: Tradingview

Data Source: Tradingview

Loopring (LRC) – Can it return to $3

A run towards $3 for Loopring (LRC) is possible. However, it will not happen soon. But LRC can surge by 50% in the coming days. The key for the token would be to break the $1.2 overhead resistance.

LRC has tested that threshold over the last few days and has been rejected on all occasions. But we are starting to see some decent upward momentum.

It is likely that the coin will break $1.2 and after that rally towards $1.8 in the near term. This will bring gains of nearly 50% for investors. Besides, RSI indicators also show the momentum in the bull’s favour.

Why you must buy Loopring (LRC)

Loopring (LRC) is an Ethereum scaling solution designed to provide the infrastructure needed to build decentralised exchanges. It is one of the most promising crypto projects in the market today.

With a market cap of around $1.4 billion, there is still so much to come from LRC. It is therefore a decent long-term investment especially now that it has fallen significantly from its ATH.

The post Loopring (LRC) could see a decisive breakout with gains of nearly 50% feasible appeared first on Coin Journal.

Data Source: Coinmarket.com

Data Source: Coinmarket.com