Last Thursday, following the news Russia invaded Ukraine, I wrote this piece assessing the hedge capabilities of Bitcoin amid the crisis. With gold holding up its end of the bargain well as it breached a 17 month high, Bitcoin let the team down and fell 7%.

Gold bugs mocked the crypto enthusiasts, as Bitcoin seemingly blew its perfect opportunity, rendering the long-supported argument that Bitcoin is a sovereign hedge as wishful thinking. Bitcoin was trading at circa $37,400, while Gold was at circa $1,920.

Bitcoin Revives

But there’s never a dull moment in crypto, and things have changed dramatically since. Bitcoin is up 17% from those lows, trading at circa $44,000. Gold, meanwhile, is trading at similar levels as previous ($1,920).

It’s interesting to revisit my analysis from Thursday in light of the recent movements of gold and Bitcoin, and the onslaught of economic sanctions which have been levelled against Russia. Last week, following the announcement of the Russian invasion, I concluded that the 7% fall in Bitcoin proved that the cryptocurrency had not yet achieved the status of a store of value asset. Instead, I argued that the red candle proved investors had dumped it for safe haven assets such as cash and gold amid the market volatility. In crises, correlations go to 1, and there’s a flight to quality. People shed crypto exposure as the world went bananas – just like what happened in March 2020, when the COVID pandemic came knocking on our doors.

So, does that conclusion need to be revisited?

Well, yes and no. There’s still no getting around the fact that in the immediate aftermath of the invasion, Bitcoin plummeted while the “hedge” asset that it is striving to replace – gold – held firm, climbing to a 17 month high. But such has been the scale of the rebound of crypto, we need to dig deeper and re-examine.

Economic Sanctions & The Modern Fiat System

The key development since last week’s analysis has been the onslaught of sanctions against Russia. Airspaces are closed to Russian aircraft, Russian banks are getting frozen out of the SWIFT network and Moscow’s ability to use its warchest of $630 billion in foreign reserves has been restricted. This latter point regarding the foreign reserves is particularly compelling when assessing Bitcoin’s price movements. The US, UK, EU and Canada agreed to “prevent the Russian central bank from deploying its international reserves in ways that undermine the impact of our sanctions”.

Remember, in the modern financial system, fiat money is actually something you are owed, rather than something tangible which you actually have. So while the cash you hold in your bank account is considered something you “have”, in reality it is owed to you by your bank, which you collect once you withdraw from an ATM or transfer to another account (at which point the recipient of the transfer will then be “owed” the bank’s liability).

What we are seeing in the markets now is that these assets, given Russia don’t quite “have” them, can be cut off. Putin has found out the hard way that those $630 billion in foreign reserves aren’t quite as liquid as he thought.

Alternatives

Of course, there are alternatives to fiat. Were Russia’s $630 billion in reserves held in gold bullions, there could be no such restrictions. Gold locked away in a Russian vault is nobody else’s liability, Russia simply “have” it, in every sense of the word. As Canadian citizens may have realised recently following the freezing of bank accounts for protesters, fiat cannot always guarantee that access.

Of course, in the last decade we have seen the emergence of another asset which offers this quality – Bitcoin. Holding your private keys is every bit as good as stashing a gold bullion under your bed (and significantly easier). However, as Bloomberg’s Joe Weisenthal pointed out in his newsletter this morning, it’s not fathomable for Russia to hold significant reserves in Bitcoin, given the size of the market. While gold’s market cap hovers around $12 trillion, Bitcoin’s market cap is merely $826 billion (with a propensity at times to dip much lower). So it’s not feasible for governments to hold large amounts of Bitcoin at the current market cap (Russia’s $630 billion in foreign reserves would amount to three quarters of the Bitcoin supply).

Other Implications

So until Bitcoin matures and expands to more lofty levels, it can’t offer what gold can right now. Indeed, many analysts frequently point to gold’s market cap in extrapolating the potential for Bitcoin’s growth, and it certainly presents a compelling benchmark. But for now, all investors aren’t as large as the Russian state and Bitcoin can still have value. The Russian ruble’s movements in the last few days show this distinctly. Shedding 20% of its value against the US dollar, Russian citizens have seen their net worth crater in real terms.

Via XE.com

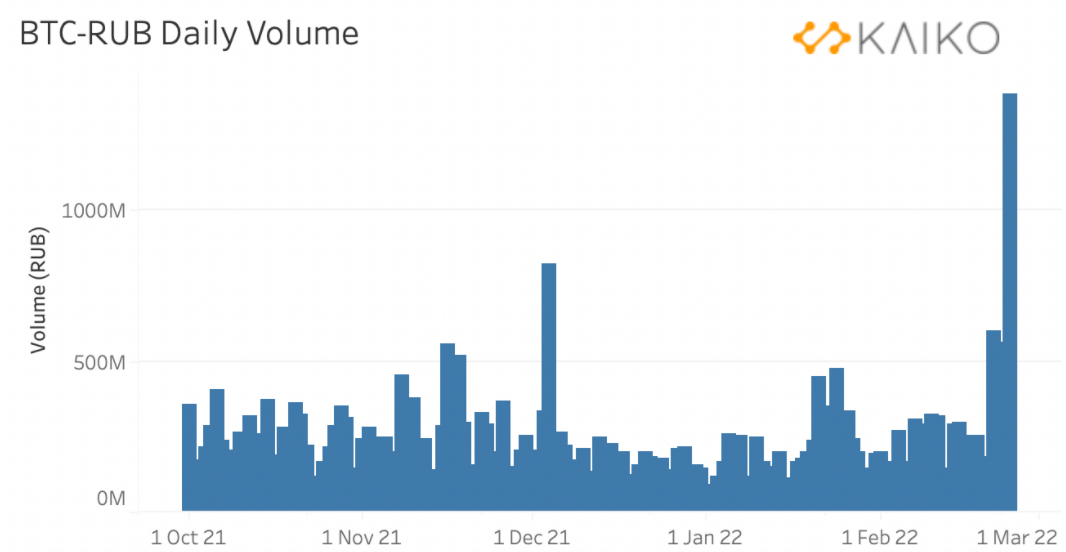

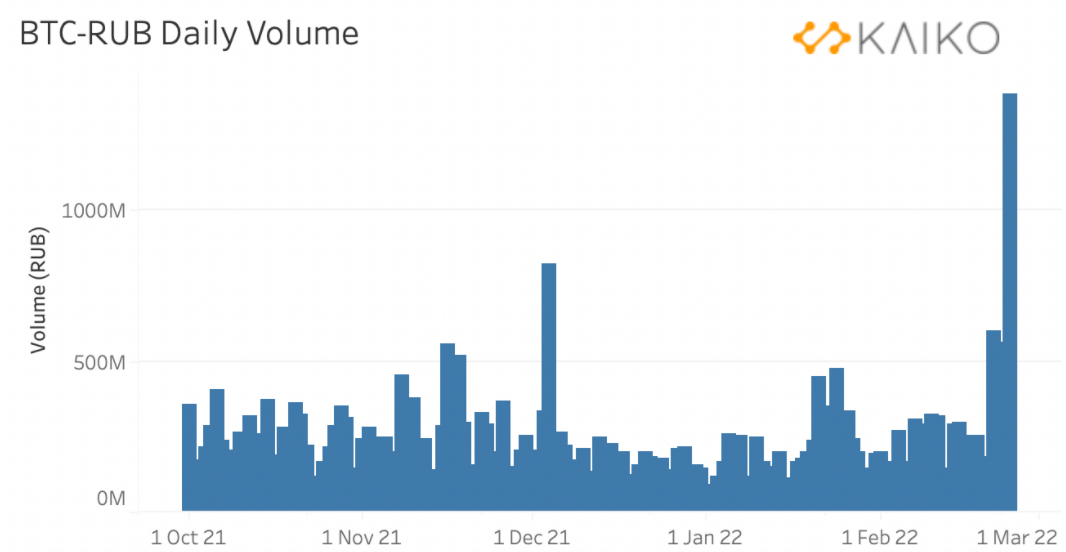

Of course, if they had Bitcoin, they could have escaped this fiat debasement. So how about we check out the volume on the BTC-Ruble exchanges? Ah yes, yesterday we hit a 9 month high, as Russians fled to exchanges as they feared further sanctions and ruble weakness.

Via Kaiko

Via Kaiko

It’s not the first case of (hyper)inflation we have seen (ask Venezuela or Zimbabwe) nor the first case of citizens fearing for their savings (hello Greece and Cyprus) and it highlights just how powerful Bitcoin could be as an asset class, should it continue to grow and ever stabilise. So the way I look at the past week of enthralling price action is this: Bitcoin isn’t a reputable store of value right now, but we are seeing all the right signs that it’s getting there, and it’s given us a glimpse of the power it could hold.

Watershed Moment

What’s happening at the moment is a watershed moment in history, in that previously autonomous central banks are no longer in control of the assets they normally utilise to conduct financial operations. And at this moment, Bitcoin is still a toddler learning to walk with regards to its development and required infrastructure (as well as the market cap mentioned above), so it would be difficult for a nation such as Russia to circumvent sanctions via cryptocurrency. The challenge would be exacerbated too by the transparent nature of the blockchain – a key argument used by crypto enthusiasts in fighting against the thought that crypto could be a tool for sovereign malevolence down the line.

But it may not be too far off. Indeed, we already have a prominent example of a state jumping into magical internet money to circumvent sanctions, if not on the scale of what would be necessary for Russia in fighting against half the world’s restrictions: Iran.

Iran’s crypto tactics

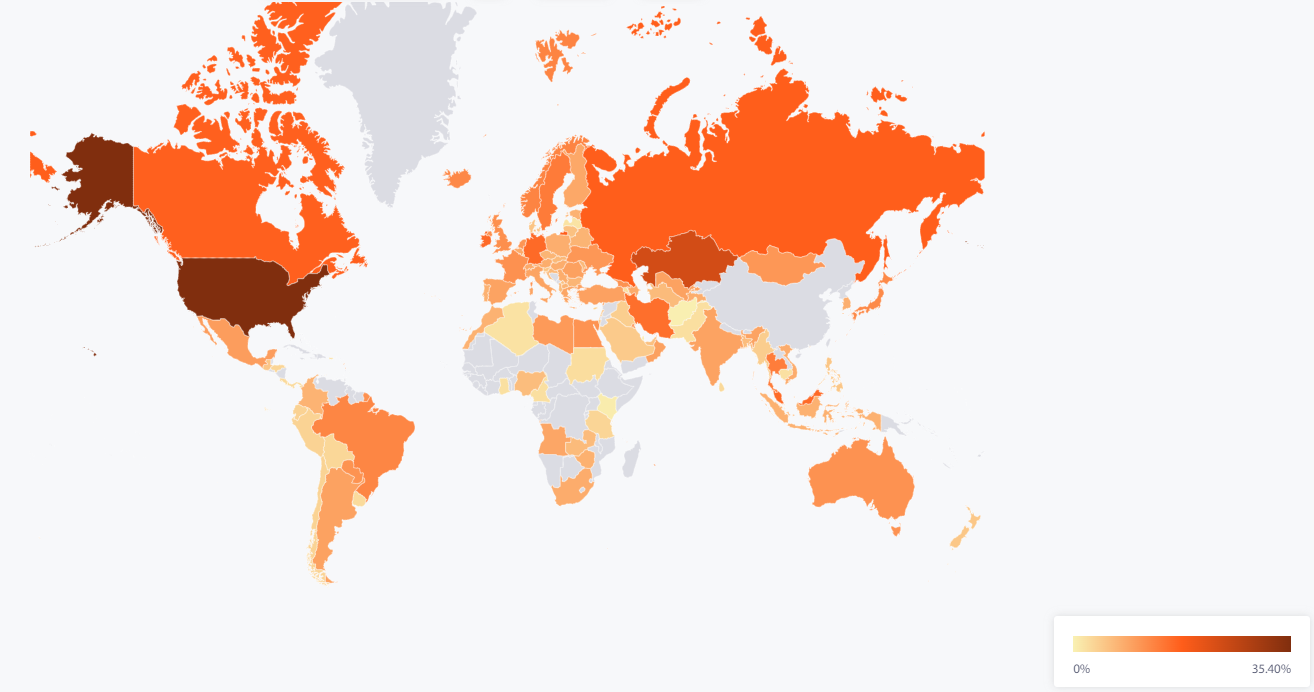

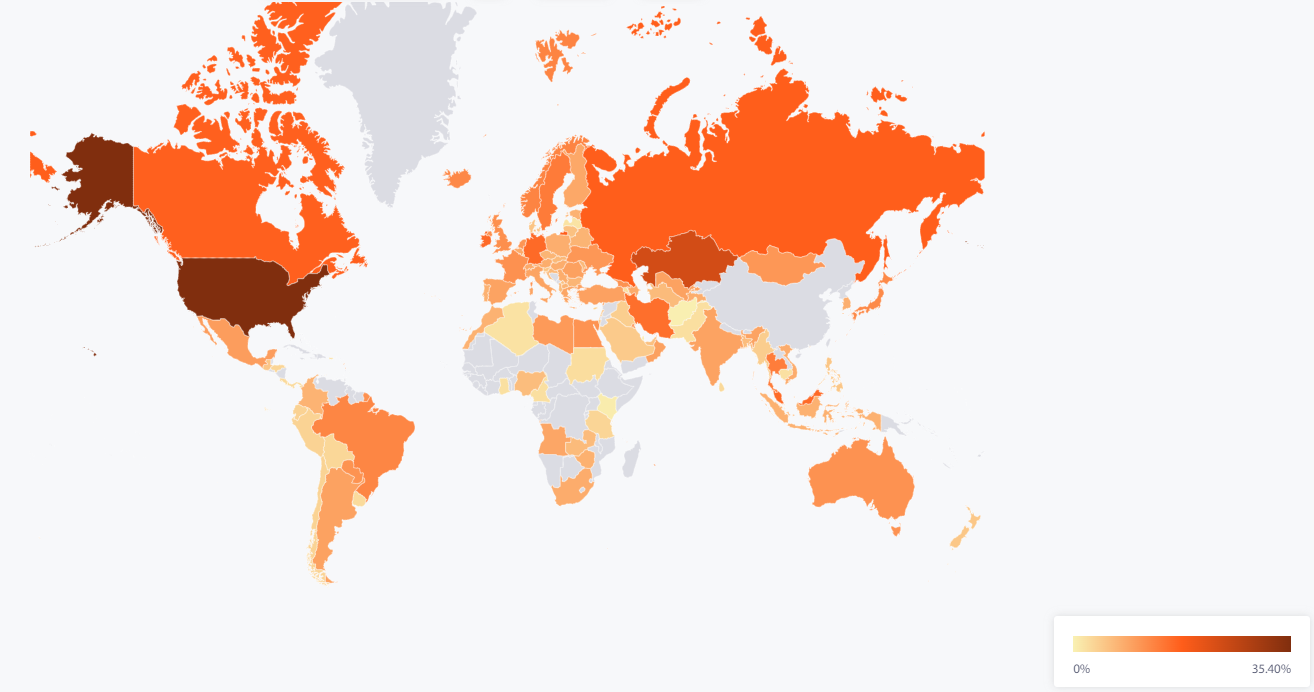

The middle eastern country faces strict sanctions from the US. Iran’s solution, however, is to convert what energy it does not need (Iran has an abundance of fossil fuels) into cash via buying bitcoins from bitcoin miners (who use fossil-fuels in their mining). These bitcoins can then be used to purchase whatever they please, including imports. And the US can do nothing about it. Russia, for its part, is the third largest cryptocurrency miner in the world (average monthly hashrate share of 11% as of Jul-21, according to University of Cambridge). To stir the pot a little more, Putin appeared to soften his stance on cryptocurrency when the Russian central bank proposed a ban on the industry: “Of course , we also have certain competitive advantages, especially in the so-called mining, I mean the surplus of electricity and well-trained personnel available in the country”. Hmm.

Cambridge Bitcoin Electricity Index, with Russia the third largest crypto miner in the world.

In wrapping up, it’s easy to see the route towards a store of value for Bitcoin, even if this week has showed that, while it’s getting there, it hasn’t quite achieved the safe-haven status yet. But Satoshi let the genie out of the bottle when he invented the blockchain in 2009, and geo-political tensions in this increasingly fragmented and chaotic world (not to mention a certain coronavirus and all the vaccine mandates and other consequences born out of the pandemic) have thrown up all sorts of implications and potential use cases for Bitcoin.

Crypto can be good! Ukraine’s crypto wallets have, as of time of writing, received $31.7 million in donations, according to blockchain analytics firm Elliptic. They are also now accepting donations in Polkadot, with more to be added soon

We can debate whether the consequences are good or bad (and like most things on the scale of Bitcoin, there are a selection of both), but one thing which is becoming increasingly clear is the fundamental value and myriad use cases that an alternative to fiat offers.

Yes, there are advantages and disadvantages, but in terms of the price, if you zoom out enough, Bitcoin has only trended one way historically – up. And with the way the world is heading, I certainly don’t see many reasons that the future will be any different.

The post Revisiting Bitcoin’s hedge properties following recent surge amid Russian sanctions appeared first on Coin Journal.

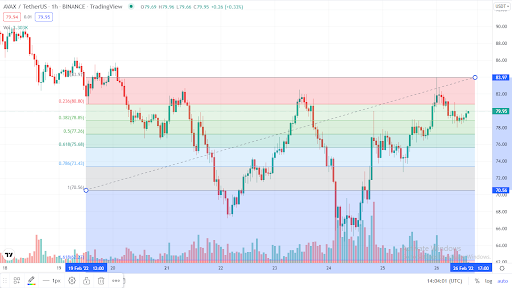

Source: TradingView

Source: TradingView

Poking fun at myself a little here

Poking fun at myself a little here

Via CoinMarketCap

Via CoinMarketCap UST market cap via CoinMarketCap

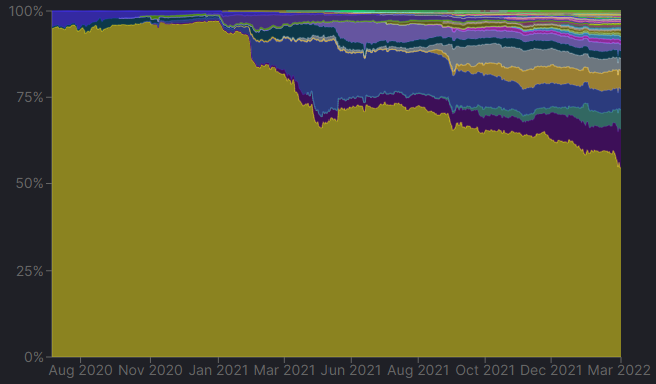

UST market cap via CoinMarketCap TVL on Luna (purple on graph) has been growing steadily, now representing 11.2% of total DeFi TVL

TVL on Luna (purple on graph) has been growing steadily, now representing 11.2% of total DeFi TVL

Via Kaiko

Via Kaiko

Source: TradingView

Source: TradingView