The cryptocurrency market has continued its poor start to the week, losing more than 6% of its value in the last 24 hours.

The crypto market has been performing poorly since the start of the week. The market has lost nearly 7% of its value in the last 24 hours, and the total market cap now stands above the $1.3 trillion mark.

The market has lost over $100 billion over the past few hours, with LUNA’s poor performance affecting the broader crypto market.

Bitcoin is down by more than 4% over the past 24 hours and is struggling to maintain its price above the $30k level. Ether has dropped to the $2,300 region after losing more than 3.5% of its value in the last few hours.

FLOW, the native token of the Flow ecosystem, is down by more than 5% over the past few hours. The poor performance comes despite the Flow team announcing the launch of its $725 million ecosystem fund.

In a blog post on Monday, Flow said the Ecosystem Fund would support existing and future developers in building applications on the Flow blockchain. The developers will gain investments, FLOW token grants and in-kind support from the team.

Key levels to watch

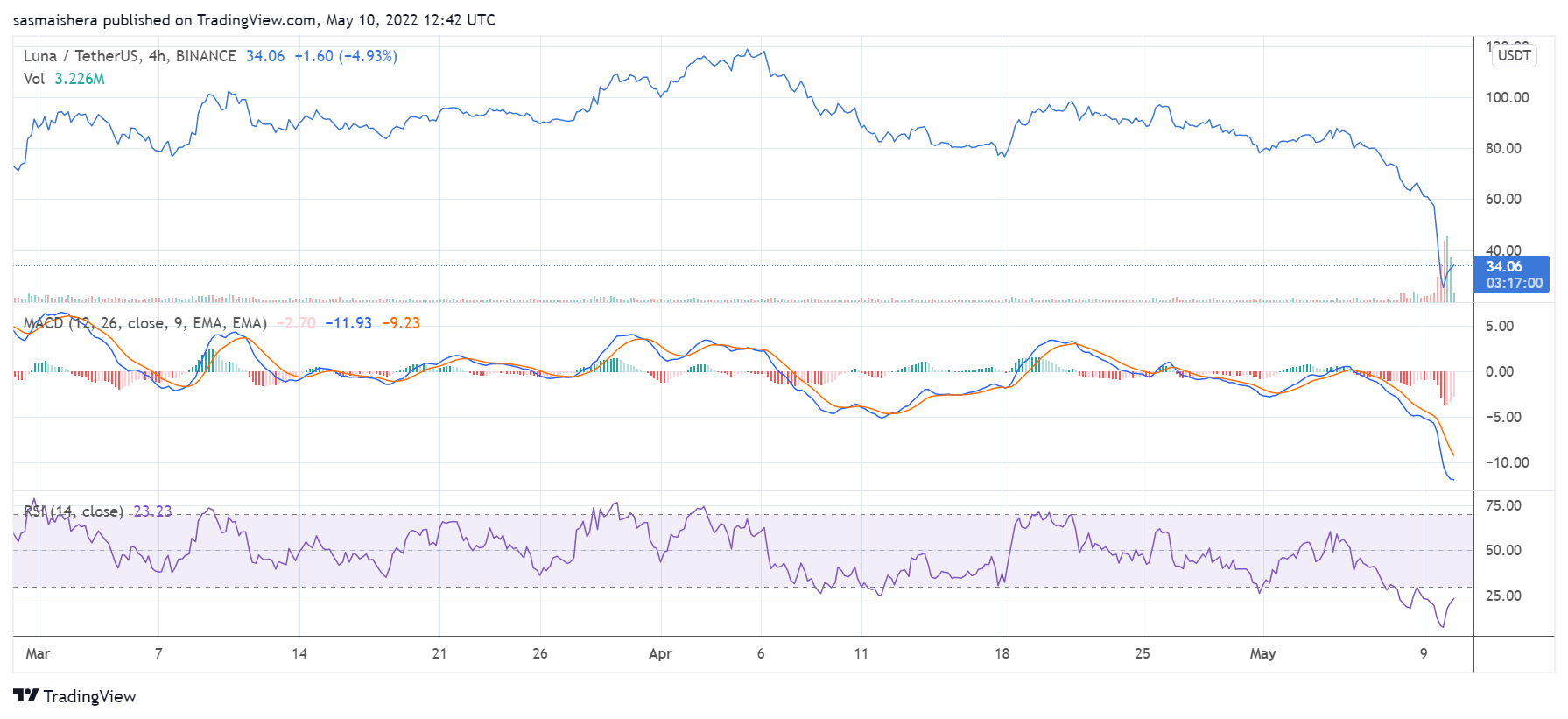

The FLOW/USD 4-hour chart is bearish over the past few hours as the market continues to underperform. Despite the positive news, FLOW could record further losses in the coming hours.

The MACD line is beyond the neutral zone as the bearish sentiment in the market thickens. The 14-day relative strength index of 33 shows that FLOW is currently oversold.

At press time, FLOW is trading at $3.49 per coin. If the bearish trend continues, FLOW could drop below the first major support level at $3.10 before the end of the day.

In the event of extended negative performance, FLOW could trade below $3 for the first time this year.

The post FLOW is down by 5% despite announcing a $725M ecosystem fund appeared first on Coin Journal.

Data Source: Tradingview

Data Source: Tradingview

Data Source: Tradingview

Data Source: Tradingview