Rollercoaster is a term frequently used in cryptocurrency. It’s certainly the first bit of vocabulary that comes to mind when looking at the Waves chart. The coin gained 240% in March 2022, yet has given back all those gains and more, and now trades 70% below where it opened on New Year’s Day.

It’s currently ranked 81st on CoinMarketCap. Back in 2017, it was in the top 20, before competitors such as Solana, Matic and Polkadot surged onto the scene.

So what’s going on here?

First, what is Waves?

A multi-purpose blockchain capable of supporting various decentralised applications and smart contracts, Waves’ summary reads as an alternative to Ethereum, really. Most popularly, it grants users the ability to create and trade custom crypto tokens at ease. No extensive smart contracts are needed, rather the currencies can be run via scripts off user accounts built on the Waves blockchain.

Why the crazy price action?

The chart below, plotting the market cap of WAVES since the start of the year, requires only a glance to realise how unusual the price action here has been.

The March boom was caused by a few variables. Anticipation over the Waves 2.0 upgrade. The announcement of a $150 million fund to boost applications and protocols running on its blockchain. Additionally, the below tweet re-affirming Waves’ founder Sasha Ivanov as Ukrainian seemed to also provide some impetus.

But why the staggering fall since, down 93% from the peak? The most concerning was analysis circulating on Twitter that the team were involved in manipulating the price of its native token through its own DeFi lending protocol Vires.finance. It is important to note that Ivanov dismissed these as false, instead laying the blame on Alameda for manipulating price while simultaneously launching a hostile media campaign to induce panic selling in the markets.

USDN De-Pegging

Either way, the debate quelled enthusiasm for the token, which was reflected in the price. That all got worse when, and stop me if this sounds familiar, a stablecoin started de-pegging. USDN is the coin in question, and works similarly to Waves as UST did to Luna.

Measures by Ivanov to fight back against a de-pegging event were controversial – reducing liquidation thresholds, limiting borrowing and instilling max APRs. Amid the furore, the Waves token has continued to fall, however, while the liquidity in the Vires.finance protocol has done the same.

Now, the team has released a proposal to revamp the approach and recover faith in USDN following the de-pegging, down to as low as 75 cents last month, and still trading below 97 cents at the time of writing.

Revamp

USDN is currently backed by roughly 40 million WAVES which are leased to two generating nodes. Half of the generated WAVES leasing profit is sent as rewards to USDN stakers and the other 50% gets sent to the smart contract to increase the USDN reserves.

The team is striving to decentralise and solidify the peg control mechanism, and therefore seeking crypto investors and community members “who are willing to run their own nodes for the needs of Neutrino to improve the reliability of the system and make their own interest”.

- The addition of participants will be gradual and on a one-by-one basis.

- Maximum participants cannot exceed 80.

- To begin, each participating node will get 1 million WAVES in leasing, with this amount changing in the future with the possibility of additional participants.

- Participants will be combined in groups of 10 addresses to simplify the management of the leased amounts.

Phase two of the program will provide the community the chance to govern the decentralisation through voting.

Conclusion

Whether this will re-instil confidence among the community following the de-pegging remains to be seen. The meltdown of the UST stablecoin obviously sent shockwaves through the entire space, but with USDN possessing so many parallels, the pain was more pronounced here than elsewhere. On the bright side, the Waves team recognised there was action required and is now acting accordingly. If they can learn from Terra’s errors and make the necessary adjustments, there could be a rebound. If not, all bets are off.

It will be an interesting one to follow.

The post What’s happening with Waves’ rollercoaster 2022 price action? appeared first on CoinJournal.

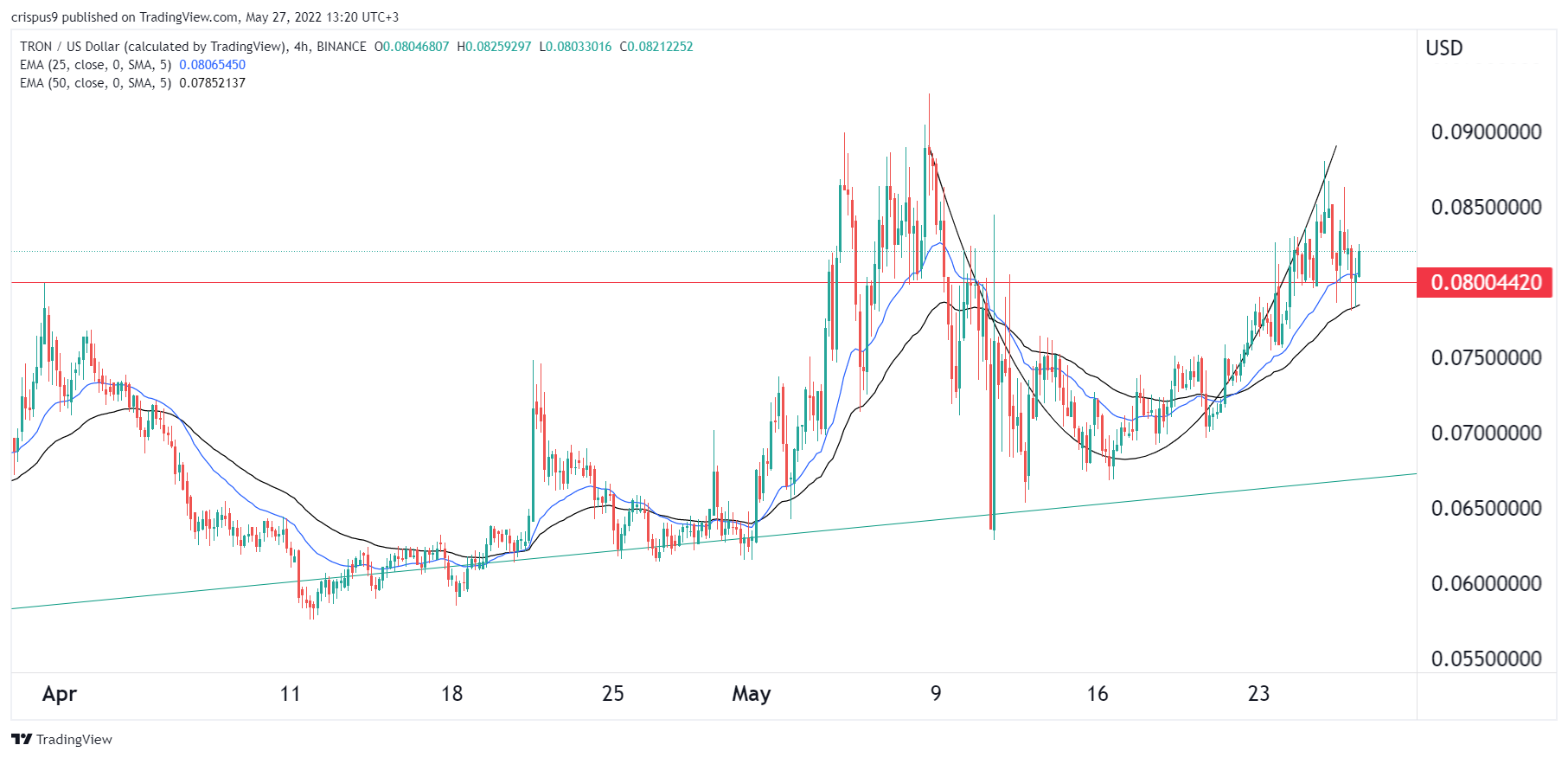

Data Source: TradingView

Data Source: TradingView

Data Source: TradingView

Data Source: TradingView

Data Source: TradingView

Data Source: TradingView