- German Government transferred 250 Bitcoin worth approx. $15.4M to Kraken and Bitstamp on June 26.

- The government has transferred a total of $150M in BTC to various addresses.

- The German Government BTC transfers and Mt. Gox repayments pile pressure on Bitcoin price.

The German Federal Criminal Police Office (BKA) has made additional Bitcoin transfers to different addresses, including Kraken and Bitstamp.

These moves have sparked considerable market speculation and concerns about their potential impact on Bitcoin’s price.

Recent Bitcoin transfers by the German Government

On June 26, a wallet reportedly controlled by the BKA transferred 750 BTC, valued at $46.35 million, to different adresses, marking another instance of the German government engaging in Bitcoin transactions.

These transfers are part of a larger series of activities following the seizure of 50,000 BTC from the film piracy site Movie2k in January.

According to Lookonchain, the German authorities sent 250 BTC, worth $15.41 million, to both Bitstamp and Kraken. Additionally, they transferred 500 BTC, valued at $30.9 million, to an unidentified address labeled “139Po,” which is potentially another exchange.

Today’s transfers come just a day after German authorities moved 400 BTC, valued at $24.3 million, to Coinbase and Kraken on June 25.

This activity is part of a broader trend observed over the past week, with the German government transferring approximately $150 million worth of seized Bitcoin to known exchange addresses, in addition to $147 million sent to the “139Po” address.

Despite these substantial transfers, the government still holds a significant amount of 45,609 BTC, valued at approximately $2.8 billion.

Earlier in June, the German authorities received 310 BTC, worth $20.1 million, from Kraken and smaller amounts totaling 90 BTC, worth $5.5 million, from Robinhood, Bitstamp, and Coinbase.

Potential impact on the crypto market

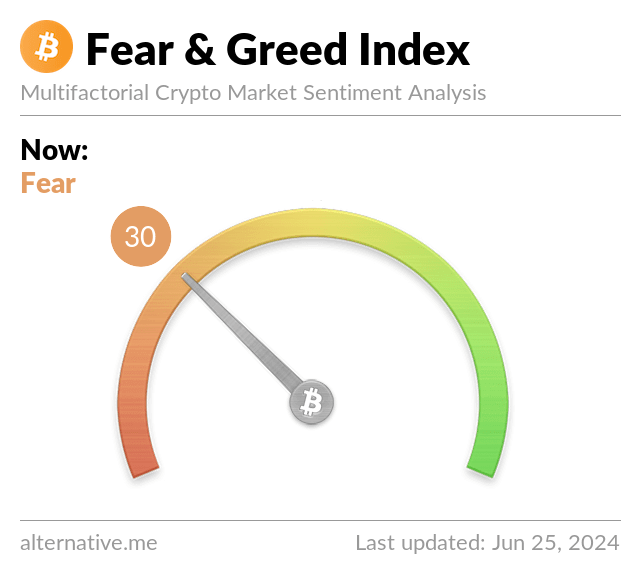

The large movements of bitcoins by the German government have had a noticeable effect on the market.

Notably, Bitcoin’s price has dropped about 6% during this period, reflecting market reactions to these substantial transfers.

Analysts are concerned that the government’s liquidation of its seized Bitcoin might push Bitcoin’s price below the critical $60,000 threshold. Recent market trends support this view, as Bitcoin has experienced an 11% decrease on the monthly chart and over 6% on the weekly chart, with its price standing at $61,065 per coin at the time of writing.

Market analyst Willy Woo suggests that Bitcoin might go through a correction phase lasting up to four weeks before resuming its price rally. He emphasizes the potential for a “cooling down” period in Bitcoin’s price action. Additionally, there might be further selling pressure in July as Mt. Gox plans to distribute repayments in Bitcoin and Bitcoin Cash to its creditors.

With over $9.4 billion worth of Bitcoin owed to approximately 127,000 Mt. Gox creditors, who have been waiting for over a decade, this repayment could substantially impact Bitcoin’s price.

The crypto community is closely monitoring these developments, particularly the sell-off pressure that might be triggered by the German government’s Bitcoin transfers and the upcoming Mt. Gox repayments.

Both events could significantly influence the Bitcoin market dynamics in the coming months.

The post German’s BKA transfers more Bitcoin to exchanges including Kraken and Bitstamp appeared first on CoinJournal.