- Inflationary pressure and geopolitical uncertainty could see Bitcoin become a global reserve currency, states Cuban

- The billionaire believes Trump’s lower tax rates and tariffs could push up Bitcoin’s price

- Elon Musk plans to commit $45m a month to back Trump’s presidential run

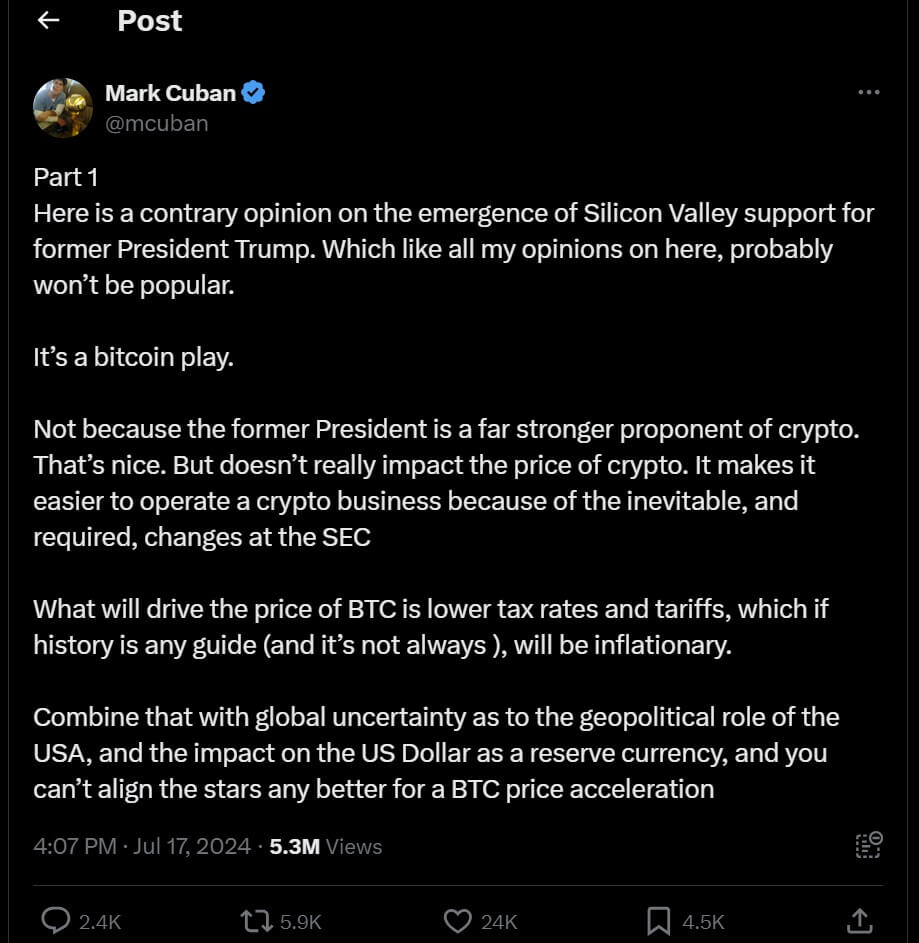

US billionaire Mark Cuban believes that through a combination of inflationary pressure and geopolitical uncertainty, Bitcoin could become a global reserve currency.

Taking to X, the billionaire indicated that Silicon Valley’s support for former President Donald Trump was a “bitcoin play” to boost its price. Cuban, who has backed Joe Biden for re-election, stated that lower tax rates and tariffs under Trump could push up Bitcoin’s price.

“Combine that with global uncertainty as to the geopolitical role of the USA, and the impact on the US dollar as a reserve currency, and you can’t align the stars any better for a BTC price acceleration,” Cuban wrote.

He added that this will make it easier to “operate a crypto business because of the inevitable, and required, changes at the” US Securities and Exchange Commission (SEC).

How High?

Questioning how high Bitcoin can go, Cuban didn’t give a figure, but wrote “way higher than you think,” adding that this is due to its global status, its 21 million Bitcoin limit, and the fact that the currency has unlimited fractionalisation.

In Cuban’s view, Bitcoin could become a safe haven as countries turn to it as they seek to protect their savings if geopolitical uncertainty continues and the dollar declines as a reserve currency.

While he only indicated that this was a possibility and isn’t saying it will happen, he added that it’s already happened in countries facing hyperinflation.

Following Trump’s injury during an assassination attempt at a campaign rally in Pennsylvania, Musk officially endorsed the former GOP President by saying he plans to commit $45m a month to a new super political action committee backing Trump’s presidential run.

In March, billionaire Elon Musk indicated he wasn’t voting for the Democratic Party in November. The tech mogul who owns Tesla and SpaceX, in addition to X, wrote “I voted 100% Dem until a few years ago. Now, I think we need a red wave or America is toast.”

The post Mark Cuban: Inflationary Pressure Could See Bitcoin Become Global Reserve appeared first on CoinJournal.