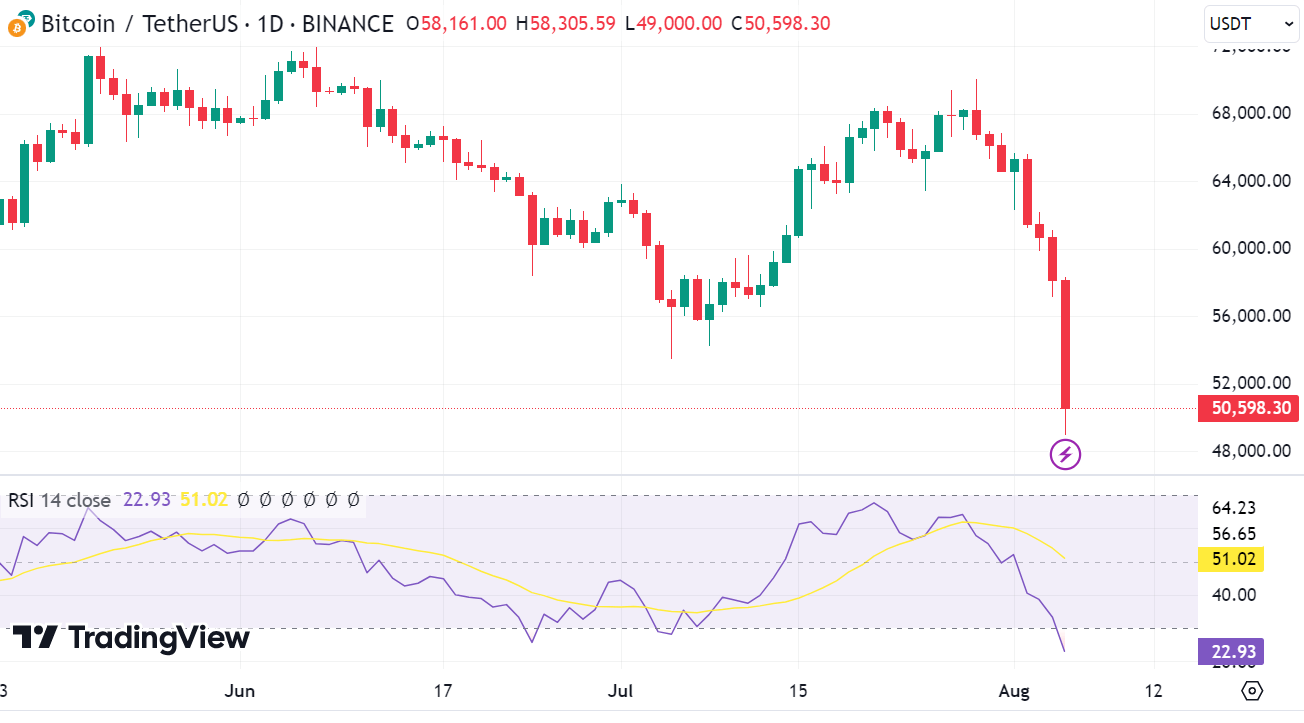

- Bitcoin trades above $55k after a sharp sell-off that saw it break below $50k.

- Brett (BRETT) meme coin is leading top gainers among the top 100 coins by market cap.

- Poodlana has surpassed $5 million in presale with 10 days to go before it lists on DEX.

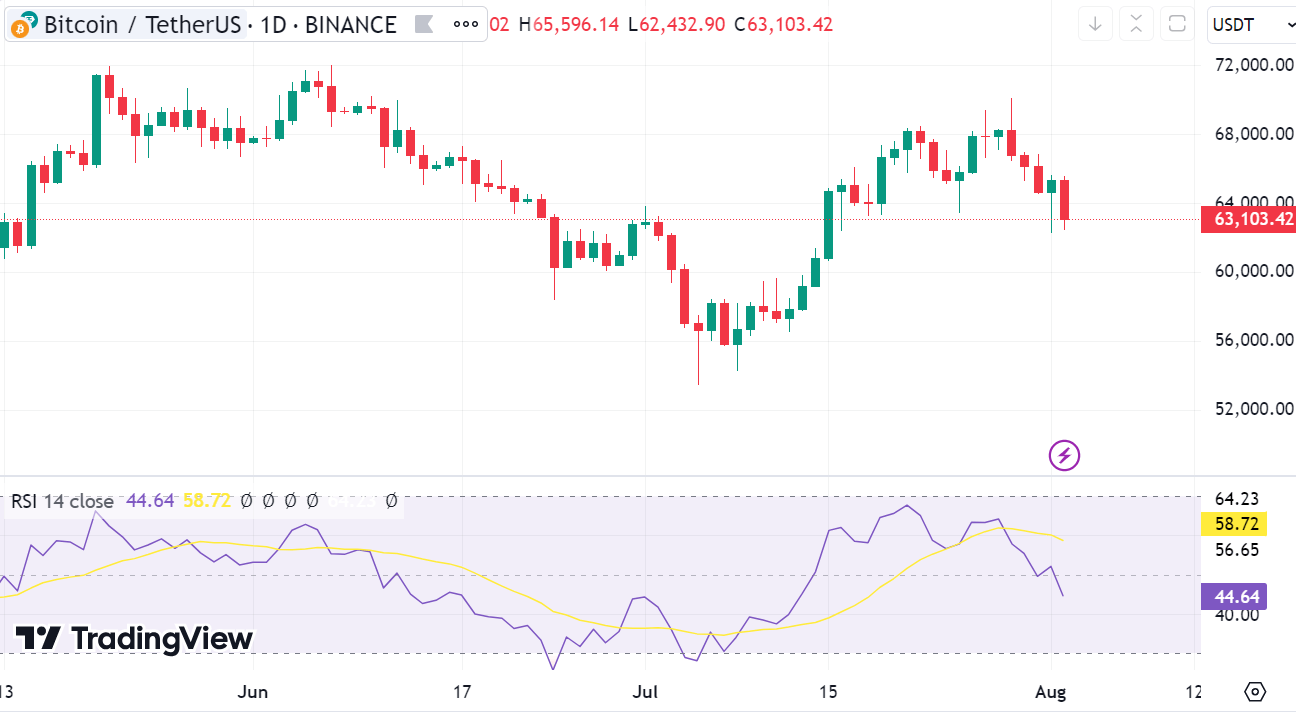

Several altcoins are green as the price of Bitcoin rebounds from the lows reached on Monday amid the staggering sell-off that engulfed crypto and stocks.

As Bitcoin (BTC) price looks to extend its bounce above $55k, meme coin Brett (BRETT) is leading the altcoin flip with over 30% gains in 24 hours. Meanwhile, traders eyeing the new Solana-based meme coin Poodlana (POODL) have increased the presale tempo as the project surpasses the $5 million mark.

Bitcoin trades above $55k as market eyes recovery

Matt Hougan, the chief investment officer of Bitwise, is bullish despite the crypto crash.

He in a post on X on Monday that the meltdown that eviscerated the crypto market on Aug. 5, 2024 was comparable to the crash that hit global capital markets in mid-March 2020.

As happened then, Bitcoin led cryptocurrencies lower amid the chaotic reaction to the Covid pandemic. But the market bounced, and Hougan believes the current downturn could offer such an opportunity.

8/ But March 12, 2020 wasn’t time to panic. It was the best buying opportunity for bitcoin in a decade.

— Matt Hougan (@Matt_Hougan) August 5, 2024

Bitcoin has recovered some of the losses seen when it dropped to below $50k, and could benefit from an explosive bounce if the declines represented a fresh bottom.

BRETT leads market gainers with 30% spike in 24 hours

The crypto market has returned to above $2 trillion in market cap as several altcoins post notable gains in the past 24 hours. Although Ethereum (ETH), Solana (SOL) and BNB (BNB) have registered decent gains during the early Asian hours, the biggest gainer at the time of writing is Base meme coin Brett (BRETT).

According to CoinMarketCap data, BRETT has seen a 33% jump in its price to reach a 24-high of $0.094. Brett’s trading volume has increased 5% to over $93.8 million. While BRETT is outpacing Bittensor (TAO), AIOZ Network (AIOZ), Ondo Finance (ONDO), and Akash Network (AKT) at the time of writing, its price remains in the red over the past week and month.

BRETT price is down 31% over the past week, while its losses over the past month are around 23%.

Poodlana presale: Traders scoop POODL

Poodlana (POODL) is attracting huge attention despite the current market outlook. Having launched its presale on July 17, the new Solana meme coin has seen its total raise surpass $5 million in a record 20 days.

Solana’s newest meme coin describes itself as the project ‘where crypto meets couture.’ It’s inspired by the poodle, a dog breed that’s driving the fashion world wild, with top global celebrities and elites keen on making a statement with poodle fashion.

This merging of fashion and crypto to drive the new era of dog-themed market tokens has found its greatest traction in Asia, with China, Japan and Korea leading the new crypto wave. Poodlana’s presale success suggests its launch could be an explosive debut in the market.

When is the Poodlana DEX launch?

Because Poodlana offered a 30-day presale, the project expects to list its token on Aug. 16. The presle price started at $0.06 and will hit $0.0539 in the last presale stage, before hitting the DEX within an hour of the token sale closing.

That means traders looking to position with a new SOL meme coin at discounted prices have 10 days only to buy POODL. Details also show Poodlana will launch with 100% of its presale tokens unlocked.

Currently, POODL is priced at $0.0416, with the next stage set to see it rise to $0.0458.

You can discover more about this new meme coin by joining the community here.

The post Bitcoin rebounds after massive sell-off; BRETT and Poodlana shine appeared first on CoinJournal.