SUI’s bullish momentum has has boosted it to the day’s top gainer among cryptos as Bitcoin struggles to break the crucial zone of $60,000. Meanwhile, Poodlana has meme coin traders at the edge of their chairs with less than 100 hours to go before it hits the public shelves.

SUI is the day’s top gainer

Among the trending cryptocurrencies in the new week is SUI. As at the time of writing, it was the top gainer among cryptocurrencies with its price up by 20.52% in the past 24 hours as indicated by CoinMarketCap. Notably, it has maintained this impressive momentum for days; having risen by 118.82% in the past 7 days.

Bull traders’ optimism has continued to boost the altcoin following Grayscale Investments’ announcement on 7th August. While launching two new investment trusts for Sui (SUI) and Bittensor (TAO) tokens, the firm’s head of product & research, Rayhaneh Sharif-Askary stated, “We are excited to add Bittensor and Sui to our product suite, and believe Bittensor is at the center of the growth of decentralized AI, while Sui is redefining the smart contract blockchain”.

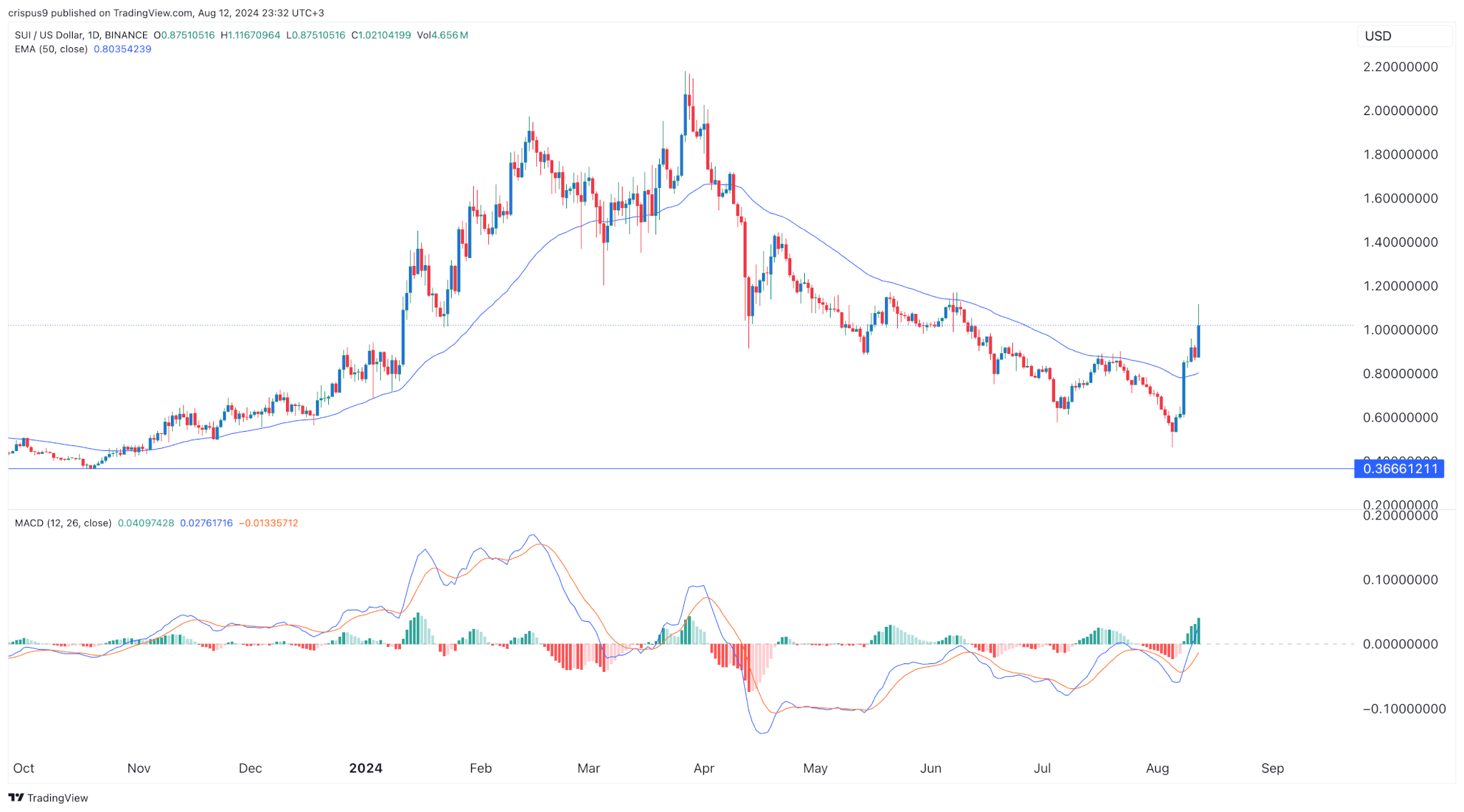

A look at its daily price chart shows SUI above the 50-day EMA and an RSI of 68. Besides, it has risen past the descending channel; aspects that point to a strong bullish trend. In the short term, it will likely be range-bound between 1.1360 and 0.9710 as bulls gather enough momentum to retest June’s high at 1.1785. On the flipside, a pullback past the aforementioned support level may have it drop to 0.8858 before rallying further.

Poodlana’s pre-sale is in its last 100-hour leg

While SUI has been one of the trending cryptos in recent sessions, a greater hype lies in one of the newest projects – Poodlana. Indeed, with all the facts and excitement around it, it may end up being the biggest Solana listing of 2024; possibly even outperfoming Dogecoin.

With less than 100 hours to go before the presale ends, the project has already raised $6.76 million. In addition to the popularity of meme coins, POODL’s status has largely been boosted by its association with luxury. It is named after the Poodle; a dog breed associated with luxury fashion especially in Asia. Besides, it has packaged itself as The Hermes of Crypto.

Notably, Poodlana buyers are optimistic that it will continue on an uptrend once it starts trading an hour after the end of its presale. Granted, those buying at its current price of $0.0499 already have gains locked with the next stage price set for $0.0539. This means that with a modest investment of $150, you get 3,006 tokens. In the next 20 hours, that will equate to 2,782 tokens; a significant difference, right? You can learn more about Poodlana token here.

Bitcoin struggles around $60,000

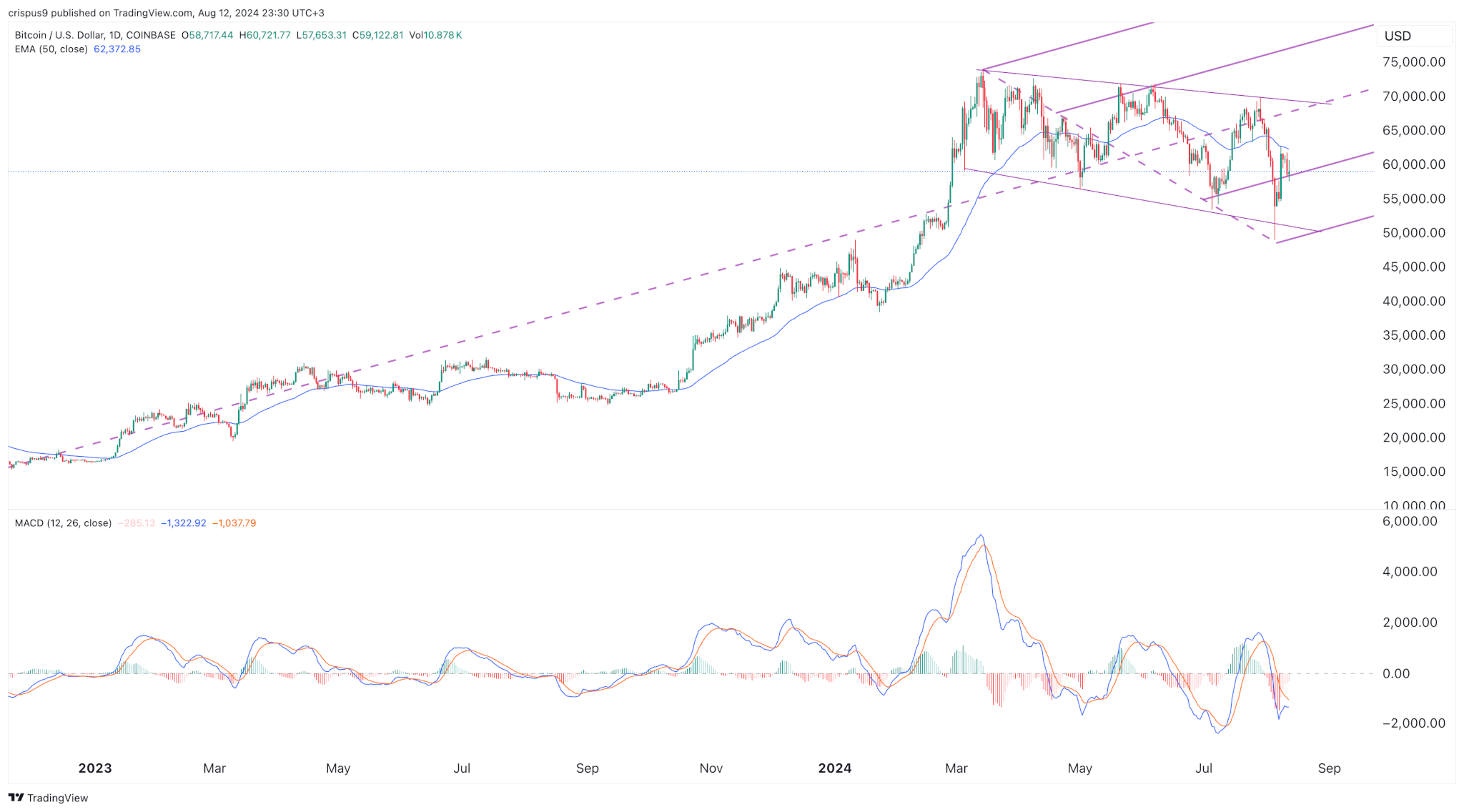

While the extreme fear experienced a week ago appears to have eased, the hesitance is still pulpable. As such, Bitcoin is struggling to break past the $60,000 zone in this week’s first trade session.

On a daily chart, it continues to trade below the 25 and 50-day EMAs. This substantiates last week’s outlook of a dead cat bounce. In the short term, the range between 57,121 and 61,925 is worth watching.

The post Crypto price prediction: Sui, Bitcoin, Poodlana appeared first on CoinJournal.