- Babylon’s Bitcoin staking launch on August 22 drove transaction fees to $132-$137.

- Over 12,700 stakers quickly filled the “locking-only phase” of Babylon’s program.

- Babylon raised $70M in May 2024, following an $18M Series A in December 2023.

On August 22, Babylon, a pioneering Bitcoin staking system, marked a significant milestone with the launch of the first phase of its self-custodial mainnet.

The self-custodial mainnet allows Bitcoin (BTC) to be staked via smart contracts, extending its utility beyond its traditional roles as a medium of trade and a store of wealth.

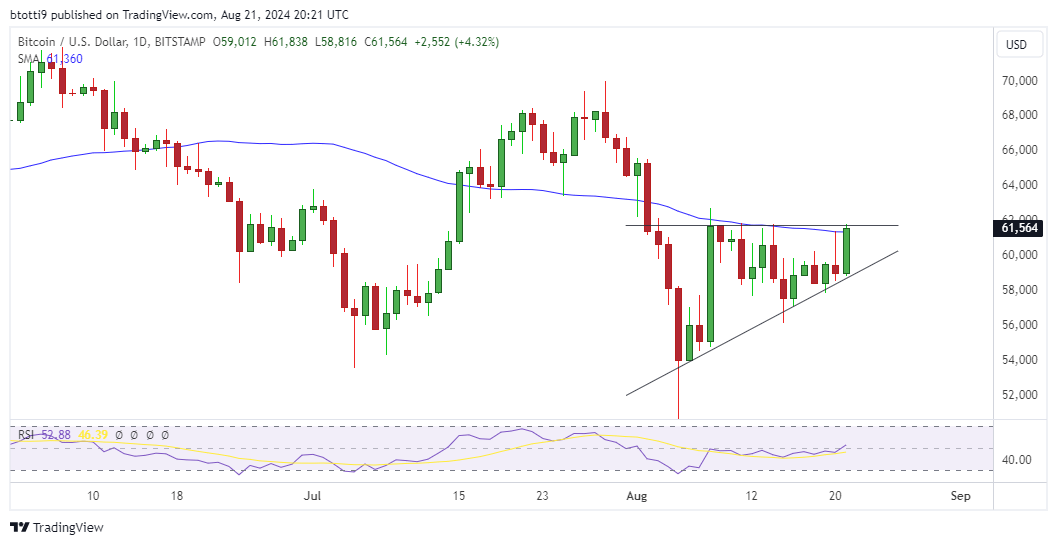

Bitcoin transaction fees rise from under $1 to $137

The debut of Babylon’s staking program led to a notable surge in Bitcoin transaction fees. Early on August 22, the average fee was under $1, but it skyrocketed to between $132 and $137 as the staking system went live.

This dramatic increase was driven by a rush of users eager to participate, resulting in a fee bidding war and pushing transaction costs close to $140, according to CryptoQuant analyst J.A. Maartun.

Live chart 👇https://t.co/6uifYvuvvP

— Maartunn (@JA_Maartun) August 22, 2024

Babylon introducing Bitcoin into a PoS ecosystem

Babylon’s initiative aims to introduce Bitcoin into a proof-of-stake (PoS) ecosystem, offering users the opportunity to earn yield by depositing their crypto directly onto PoS networks.

The initial “locking-only phase” of Babylon’s staking system was quickly filled to capacity, with over 12,700 stakers and 20,610 solo delegates already participating. This rapid uptake highlights growing interest and confidence in the platform’s potential.

The successful launch of Babylon’s staking program underscores its ambition to redefine Bitcoin’s role in the broader crypto landscape, particularly within decentralized finance (DeFi). The move aligns with increasing institutional interest in cryptocurrencies, as evidenced by recent approvals of Bitcoin spot ETFs and significant institutional investment.

Babylon’s funding journey has been equally impressive. Following a $18 million Series A round in December 2023, the platform secured an additional $70 million in funding in late May 2024, led by Paradigm and supported by other prominent investors. This financial backing reinforces the project’s potential and solidifies its place in the evolving Bitcoin ecosystem.

The post Babylon Bitcoin staking drives BTC fees higher as mainnet launches appeared first on CoinJournal.