- Ark Invest sold 44,609 shares of its ARKB Spot Bitcoin ETF for $2.8 million as part of a rebalancing strategy.

- The firm retains $139.7 million in ARKB, making it the second-largest holding in ARKW.

- US spot Bitcoin ETFs saw $4.5 million in inflows, while Ethereum ETFs faced outflows.

Cathie Wood’s Ark Invest has made headlines by offloading 44,609 shares of its ARKB Spot Bitcoin ETF, valued at $2.8 million. The sale, which took place on Monday, is part of Ark’s ongoing rebalancing strategy to adjust its fund weightings.

However, the move is not the first of its kind, with the firm having sold $6.9 million worth of ARKB shares in early August and $7.8 million in July. In total, Ark Invest has divested $17.5 million from its Bitcoin ETF.

Ark Invest avoiding overexposure to any one asset

Despite these sales, Ark Invest continues to hold a significant $139.7 million in the ARKB ETF, positioning it as the second-largest holding in its Next Generation Internet ETF (ARKW). The ETF still maintains a notable 9.93% weighting within ARKW’s portfolio.

Tesla remains the largest asset in the ARKW fund, with a 10.15% weighting, worth approximately $142.9 million.

Ark’s recent sales align with its overarching strategy of preventing any single holding from exceeding 10% of an ETF’s portfolio. By capping weightings, the firm aims to ensure adequate diversification, avoiding overexposure to any one asset.

Ark has actively adjusted its asset allocation to maintain balance across its funds seeing that ARKB’s value has surged up 26.5% year-to-date.

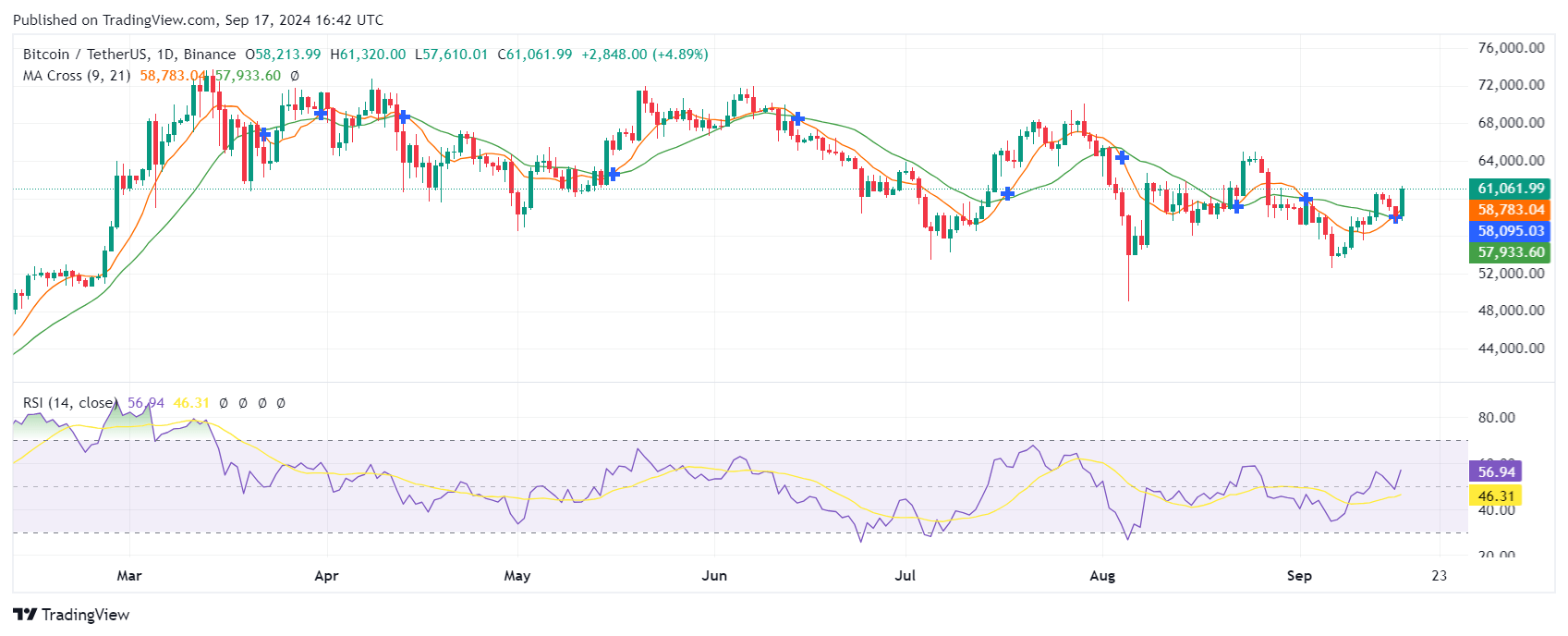

As of Monday, ARKB traded at $63.25, reflecting a 0.8% gain for the day. This rise mirrors broader optimism in the Bitcoin market, with Bitcoin itself trading flat but holding steady at around $63,676.

US spot Bitcoin ETFs see strong inflows

While Ark continues to manage its Bitcoin exposure, US spot Bitcoin ETFs are experiencing strong inflows, with a net addition of $4.5 million on Monday alone, extending their positive streak to three consecutive days.

In contrast, US spot Ethereum ETFs have seen the largest outflows since July.

Ark Invest’s strategic rebalancing underscores its commitment to diversification while navigating the ever-evolving landscape of digital assets.

The post Ark Invest sells $2.8M of its own Spot Bitcoin ETF amid market shifts appeared first on CoinJournal.