- Crypto market drops as Iran launches missile strikes into Israel.

- Bitcoin falls to $62k; Ethereum drops below $2,500.

- The global crypto market cap declines by 2.72% to $2.18 trillion.

The global crypto market has witnessed a sharp decline following reports of Iran firing missiles into Israel.

The heightened geopolitical tensions have sent shockwaves through financial markets worldwide, with crypto assets taking a significant hit.

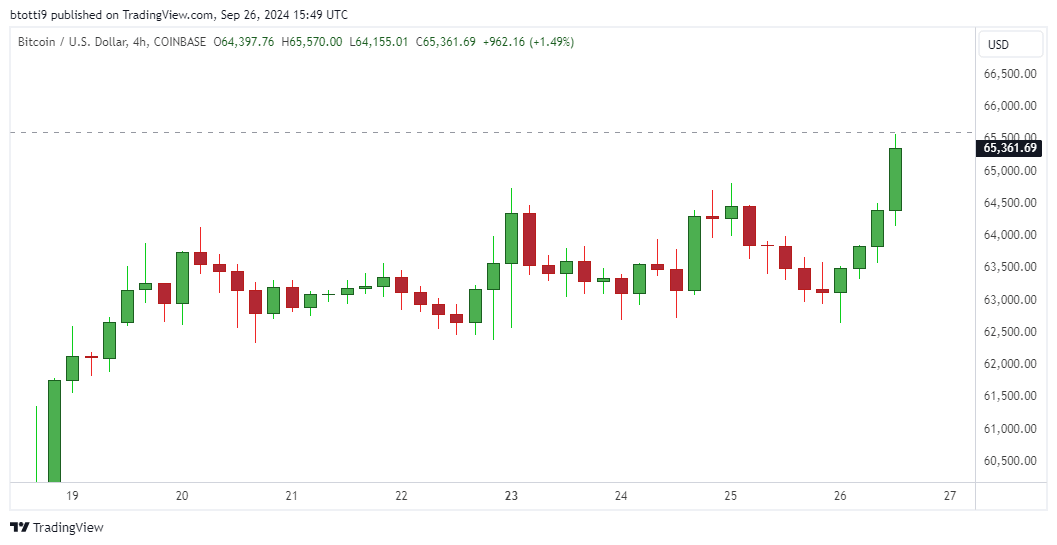

As news of the missile strikes spread, cryptocurrency markets reacted swiftly. Bitcoin (BTC), the largest cryptocurrency by market capitalization, had dropped to $61,932.92 at press time while Ethereum (ETH), the second largest cryptocurrency, witnessed a 3.42% plunge, with its price dipping below $2,499.30.

Altcoins, often more volatile, experienced even steeper declines, with Arweave (AR), Notcoin (NOT), Gala (GALA), and Worldcoin (WLD) dropping by double digits as investors scrambled to offload risky assets.

As the market plunged, the global cryptocurrency market cap dropped by over 2.72% to $2.18 trillion.

The sudden drop in crypto prices underscores the market’s sensitivity to geopolitical events. Historically seen as a hedge against inflation and economic uncertainty, cryptocurrencies have not proven immune to geopolitical shocks.

Investors, rattled by the fear of broader regional instability and its potential impact on global markets, have moved to safer assets such as gold, which saw an uptick in prices.

The attack marks a severe escalation in the already volatile Middle East region. Iran’s missile launches were reportedly in retaliation for the Israeli operations in Lebanon that have resulted in the elimination of Hezbollah’s leader.

Israel has, however, responded swiftly, vowing to defend its territory, raising concerns of an impending large-scale conflict.

While the full extent of the conflict’s impact remains unclear, the continued volatility in the Middle East is likely to keep the crypto market on edge in the coming days.

Traders and analysts are now closely watching both diplomatic developments and market reactions.

The post Crypto market on a free fall as Iran launches missiles into Israel appeared first on CoinJournal.