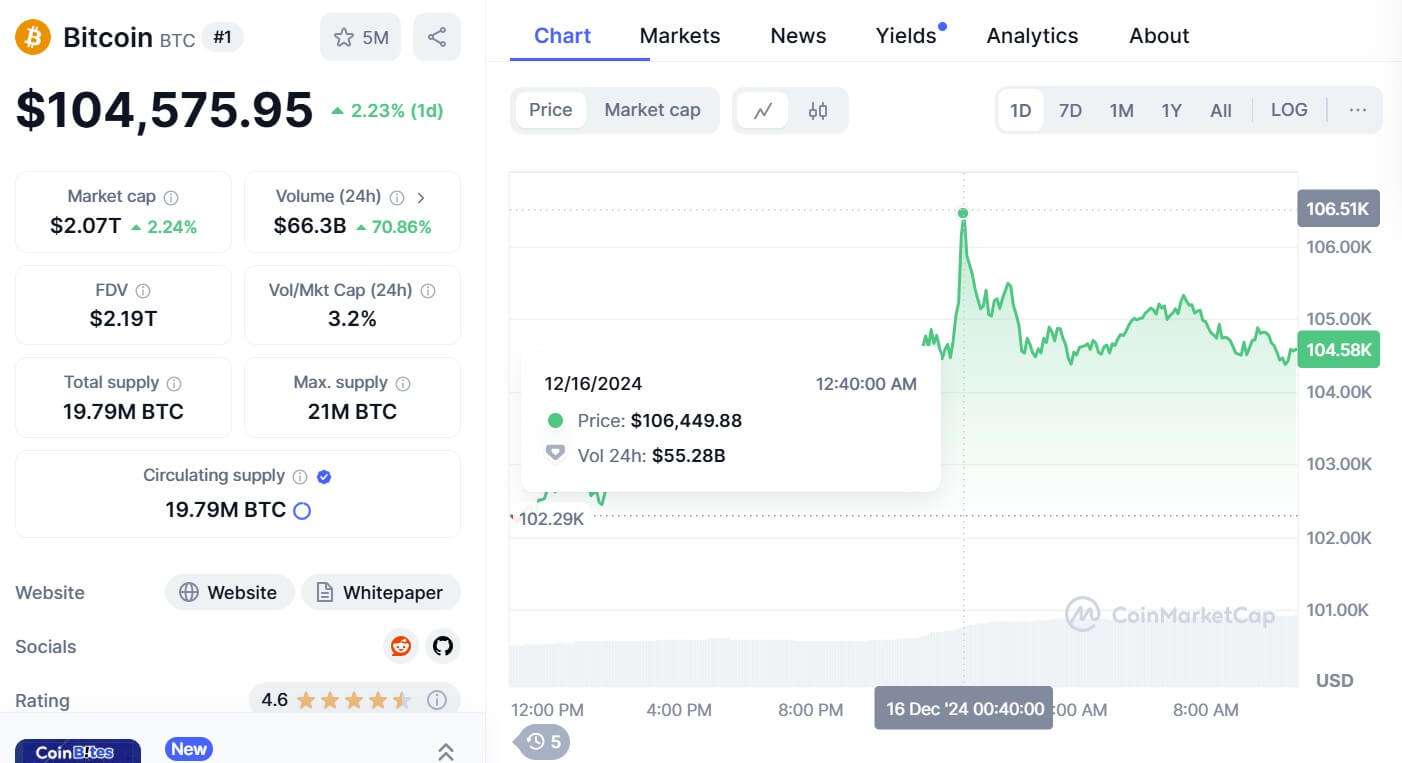

- Bitcoin hit $106,400 in the early hours of December 16

- Crypto trader believes the next three to four weeks are going to be significant for Bitcoin if history repeats

- Investors believe Bitcoin reaching $120,000 by the end of 2024 is achievable

Bitcoin set a new all-time high above $106,000 following news that President-elect Donald Trump is considering plans to create a US Bitcoin strategic reserve.

In the early hours of December 16, Bitcoin topped more than $106,400, according to data from CoinMarketCap.

At the time of publishing, Bitcoin has retraced slightly to $104,700. Over the past year, the world’s largest crypto asset has risen nearly 148% in value. Bitcoin’s previous high was set on December 5, hitting close to $104,000.

News of Bitcoin’s rally comes as Trump announced he’s considering creating a US Bitcoin strategic reserve similar to its oil reserve. Speaking to CNBC last week, Trump said:

“We’re gonna do something great with crypto because we don’t want China, or anybody else … but others are embracing it, and we want to be ahead.”

In relation to a question about whether the US will create a Bitcoin strategic reserve, Trump said: “Yes, I think so.”

In a post on X, Ash Crypto wrote: “Bitcoin is breaking out. If history repeats, the next 3-4 weeks are going to be massive.”

BITCOIN IS BREAKING OUT 🚀

IF HISTORY REPEATS, THE NEXT 3-4

WEEKS ARE GOING TO BE MASSIVE pic.twitter.com/aZwi28ZeTu— Ash Crypto (@Ashcryptoreal) December 16, 2024

Crypto-friendly administration

The incoming Trump administration is seen as more crypto friendly compared to Biden’s team.

During his campaign, Trump promised to make America the “crypto capital of the planet.” Since winning the US election, his team has already made significant appointments, many of whom are crypto-friendly.

Last week, Trump appointed Paul Atkins as the next Chair of the US Securities and Exchange Commission (SEC). He will be replacing Gary Gensler who is stepping down on January 20, 2025.

Trump also named David Sacks as the lead policy advisor on artificial intelligence and crypto, dubbing him the “White House AI and Crypto Czar.” In November, Trump announced that Elon Musk and Vivek Ramaswamy will lead the Department of Government Efficiency (DOGE) to “dismantle government bureaucracy.”

Speaking to the BBC, Peter McGuire from trading platform XM.com, said:

“The Bitcoin rally since the election has been parabolic and the FOMO – or fear of missing out – rally is gathering momentum. Many investors believe $120,000 is achievable by the end of the year and then in 2025 there’s talk of greater than $150,000 by mid-year.”

The post Bitcoin reaches new all-time high of above $106,000 appeared first on CoinJournal.