- President-elect Donald Trump could sign the executive order on January 20 when he’s sworn in

- The order may also create a crypto advisory council

- People familiar with the matter said the order isn’t final and could change before it’s made public

US President-elect Donald Trump is reportedly planning to sign an executive order designed to prioritize crypto as his inauguration day approaches.

Citing people familiar with the matter, the order enables industry insiders to work with agency regulators. It could also create a crypto advisory council, reports Bloomberg.

An earlier report from The Washington Post suggests Trump is expected to sign executive orders – on the first day of his presidency – focusing on crypto de-banking and the repeal of crypto accounting policies requiring banks holding digital assets to count them as liabilities.

Trump, who will be inaugurated on January 20, has enjoyed strong support from the crypto industry. During his campaign trail, he promised to make the US the “crypto capital” of the world, and was the recipient of a $2 million Bitcoin donation from Cameron and Tyler Winklevoss and a $1 million Ethereum donation from Jesse Powell, co-founder of Kraken.

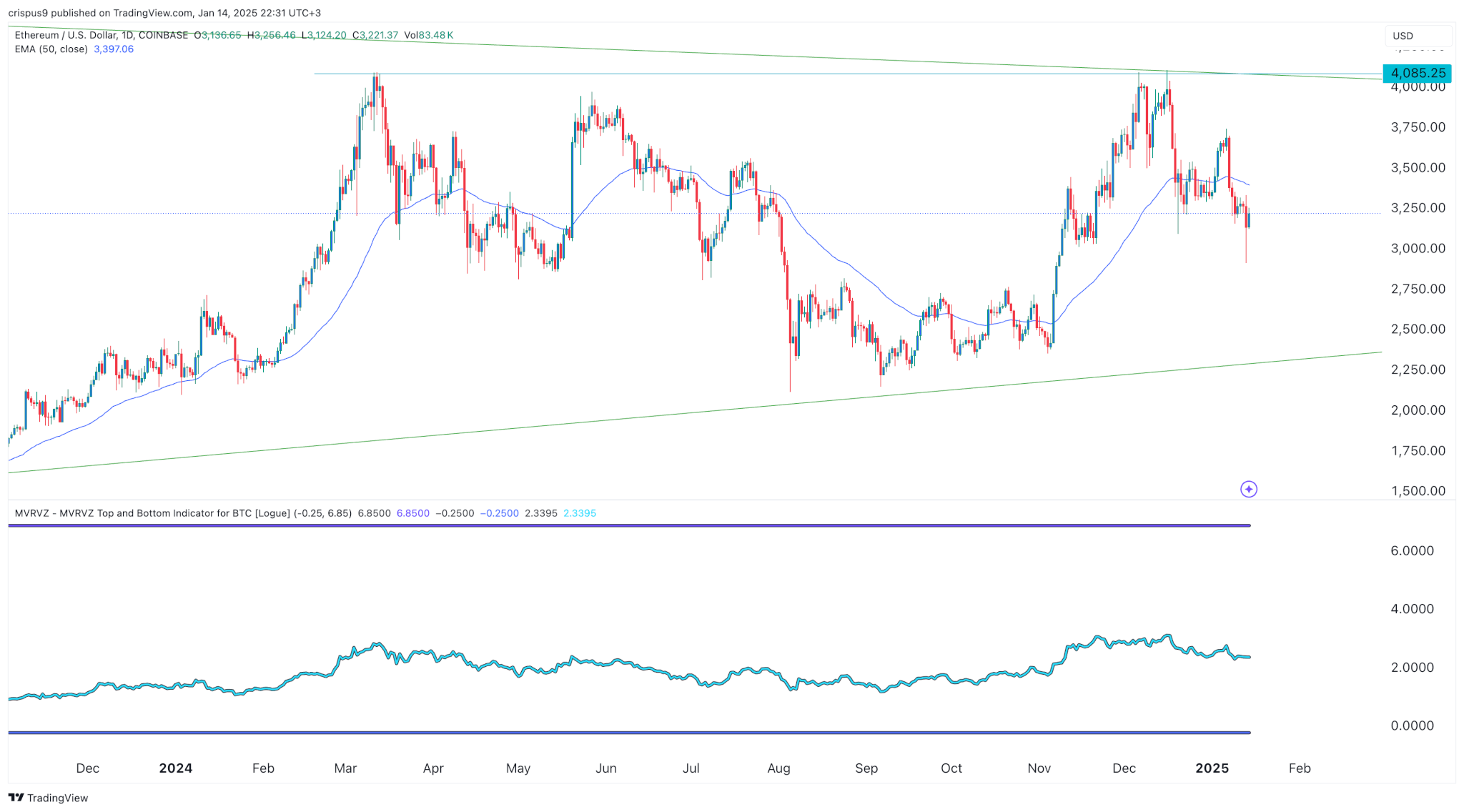

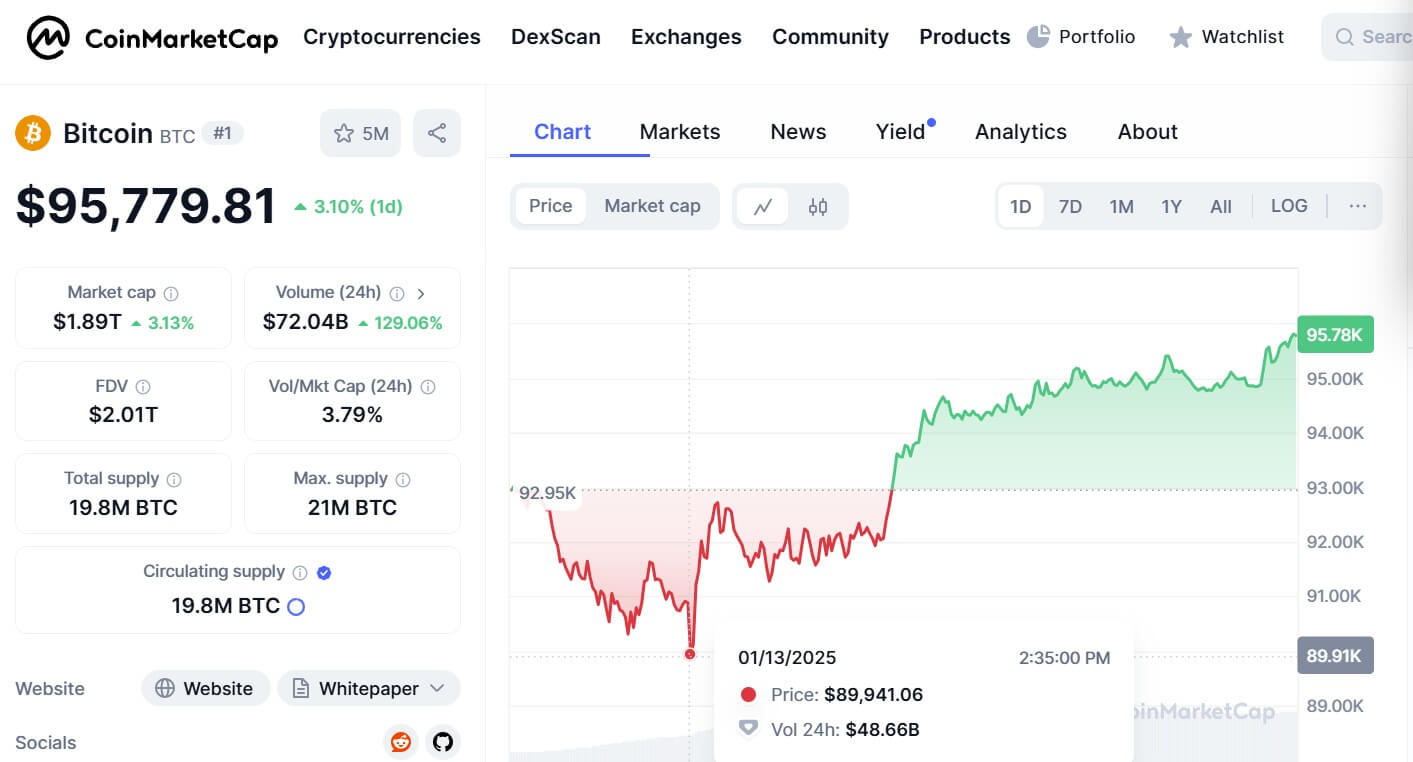

Since winning the US election in November, the crypto market has rallied with Bitcoin hitting a new all-time high of over $108,000.

Trump has also selected several pro-crypto candidates within his incoming administration, including crypto czar David Sacks, Bo Hines as executive director of the Presidential Council of Advisers for Digital Assets, and Paul Atkins as the next US Securities and Exchange Commission (SEC) chair.

Earlier this week, Republican commissioners at the SEC indicated they were set to revise the agency’s crypto policies as Trump prepares to enter the White House next week.

Pushing American tech

Despite facing regulatory hurdles, the crypto market has also seen positive growth under President Joe Biden’s administration.

At the beginning of 2024, for instance, the SEC approved the first US spot exchange-traded funds (ETFs), which have since expanded the market. BlackRock’s IBIT Bitcoin ETF currently accounts for more than 559,000 Bitcoin, valued at $56.2 billion, according to iShares data.

However, with the new incoming administration, Trump is keen to push American technology companies to the front.

Speaking on this, Kara Calvert, vice-president for US policy at Coinbase Global, said: “What I think Donald Trump is going to do is signal that the United States is back and we are ready to lead in this industry. What it’s signalling to other countries is to be careful, or you won’t keep up.”

At the time of publishing, Bitcoin is back within the $100,000 territory, trading at around $102,000.

The post Trump to make crypto a priority with executive order appeared first on CoinJournal.