MEXC, a leading global cryptocurrency exchange, has provided over $414 million through its Insurance Fund Account to cover deficits that occur when users’ losses during liquidation exceed their available margin as of January 23, 2025. This impressive figure underscores MEXC’s commitment to asset security and risk mitigation. Combined with Proof of Reserve, MEXC offers traders robust protection against extreme market fluctuations.

How MEXC’s Insurance Fund Account Mitigates Risk for Traders

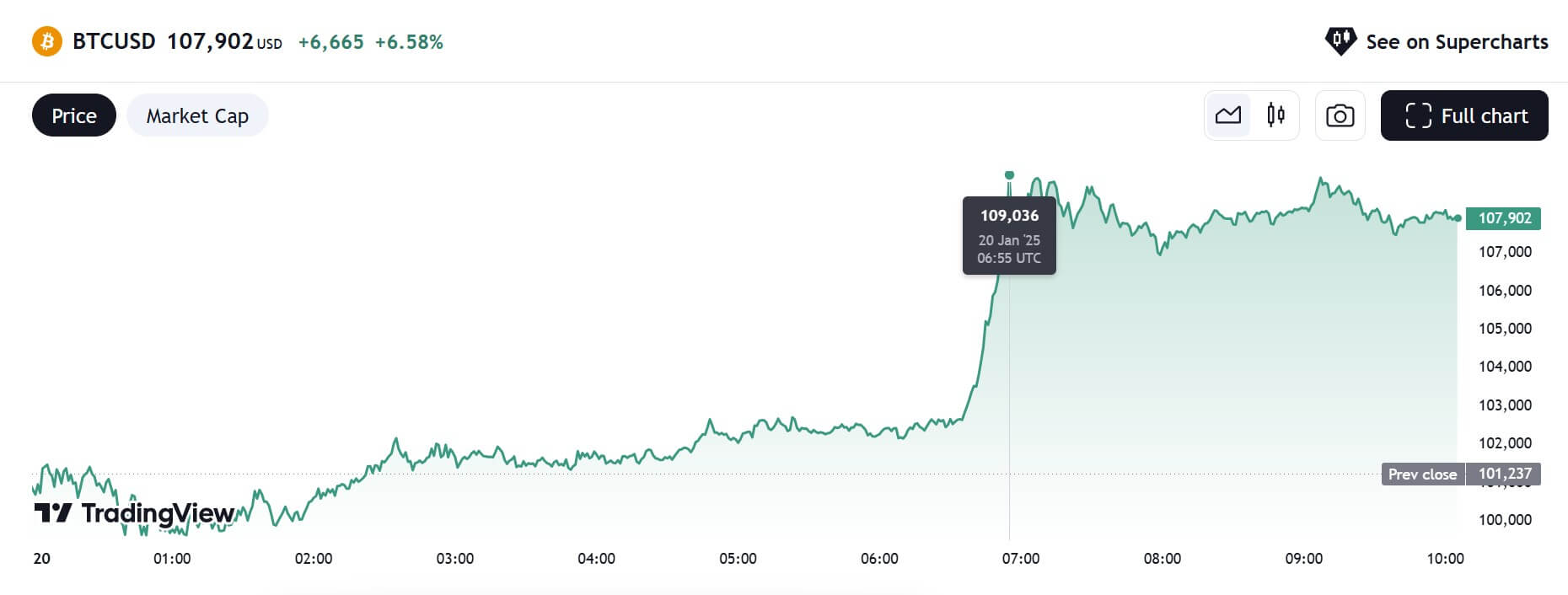

The MEXC Insurance Fund Account, launched in November 2024, is specifically designed to protect traders from extreme market fluctuations, such as those experienced during a bull run, where rapid price swings can lead to a user’s account value to dip below the required margin level, triggering a liquidation. Should the liquidation price be worse than expected, resulting in losses that exceed than the available margin (a scenario known as bankruptcy), the Insurance Fund steps in to cover these excess losses, thus facilitating a smoother liquidation process.

The fund is continually replenished by surpluses generated from liquidation orders executed at better-than-expected prices, ensuring its stability and ongoing protection during periods of high volatility.

In line with its commitment to transparency, MEXC provides users with direct access to both current and historical insurance fund amounts for various cryptocurrencies on the platform.

In addition, MEXC provides Proof of Reserve to ensure asset safety and maintain transparency for its users. This allows users to trade with confidence, free from concerns about withdrawal runs. The reserve rates are updated every two months. As of Dec 1, 2024, the latest reserve rates for various cryptocurrencies are as follows:

- USDT: 104.52%

- USDC: 116.52%

- BTC: 105.88%

- ETH: 105.65%

By offering high leverage alongside an Insurance Fund Account and Reserve Rate exceeding 100%, MEXC ensures multiple layers of protection to safeguard traders’ positions and ensure asset security.

The Go-To Platform for Seamless Crypto Trading

In addition to implementing robust safety measures to ensure a secure trading environment, the platform offers a variety of features and services designed to enhance the user experience. These features help traders minimize costs and maximize returns. MEXC is committed to empowering traders by enabling investments across the widest range of assets, ensuring safe and seamless transactions regardless of market conditions.

- M – Most Trending Tokens: MEXC is known for its rapid token listings and diverse selection of popular tokens, helping users capitalize on emerging opportunities. To date, over 3,000 tokens have been listed on the platform.

- E – Everyday Airdrops: MEXC makes it easy for users to engage in daily airdrop events and receive substantial rewards without complex procedures. In 2024, the platform completed 2,293 airdrop events, distributing over $136 million in rewards.

- X – Xtremely Low Fees: MEXC offers highly competitive trading fees, helping users reduce costs and maximize their growth potential.

- C – Comprehensive Liquidity: Backed by strong liquidity and market depth, MEXC ensures the efficient and seamless execution of every transaction, minimizing slippage even during volatile conditions.

These features have helped MEXC attract over 30 million users across over 170 countries, establishing it as the platform of choice for an increasing number of traders around the world.

Learn more about the MEXC Insurance Fund Account.

About MEXC

Founded in 2018, MEXC is committed to being “Your Easiest Way to Crypto”. Serving over 30 million users across 170+ countries, MEXC is known for its broad selection of trending tokens, frequent airdrop opportunities, and low trading fees. Our user-friendly platform is designed to support both new traders and experienced investors, offering secure and efficient access to digital assets. MEXC prioritizes simplicity and innovation, making crypto trading more accessible and rewarding.

MEXC Official Website| X | Telegram |How to Sign Up on MEXC

Risk Disclaimer:

The information provided in this article about cryptocurrencies does not represent MEXC’s official stance or investment advice. Given the highly volatile nature of the cryptocurrency market, investors are encouraged to carefully evaluate market fluctuations, project fundamentals, and potential financial risks before making any trading decisions.

The post MEXC’s Insurance Fund Account Provides $414M+ to Mitigate Traders’ Bankruptcy Losses appeared first on CoinJournal.