The trend is your friend, but while you can ride it for so long, it’s often safe to know when to climb off the surfboard and get on another wave. This is the same for cryptocurrencies. 2021’s top rewarding cryptocurrencies might not make the best investments in 2022. And so, to avoid capsizing under the reverse currents of a cryptocurrency, we bring you the top 10 cryptocurrencies to watch in 2022.

Solana

Competitive Edge: Solid framework and build (faster transactions and minimal fees)

Solana is one of those altcoins that has continued to grow steadily through the years after its launch in April 2009. At inception, the project’s main focus was to leverage bitcoin’s permissionless nature to provide DeFi solutions like smart contracts, payment processing, peer-to-peer lending, and stable coins. Solana’s framework allows up to 710,000 transactions per second on a 1GB network without data partitioning. The proof-of-scale also allows users a high level of scalability and economies of scale with very high speed and very low transactional cost.

What does this mean for the investor? What does it mean for you? For one, Cryptocurrencies with solid builds have more usage and functionality among users, as such, the market cap will continue to grow as more investors turn to Solana. A growing market cap and steady rise in usage and adaptation mean more value to the network, and an appreciation in price based on functionality rather than random volatility spikes.

Solana may not be one to make a spectacular bull-run right now, but it’s definitely a cryptocurrency to keep your eyes on in 2022.

Competitive Edge: Most popular oracle on the market

Chainlink is an Ethereum token that powers the Chainlink decentralized oracle network. Unlike Ethereum and Bitcoin that runs completely on blockchain technology, Chainlink adopts oracles to help connect blockchain to external data sources, APIs, and payment systems, hence they gain access to different types of data that aren’t available on the blockchain.

App developers use Chainlink to make sure their apps work well. This only means that demand for Chainlink will continue to increase through the years as well as its LINK tokens. There is a bright future for Chainlink because more companies will continue to adapt Chainlink in their operation. Good news for investors as well. Since Chainlink has major industrial applications, it means that the growth of this cryptocurrency will be more organic and sustained than the rest of the more volatile cryptocurrencies.

Competitive Edge: Strong despite the crisis

You might not want to buy Ripple right now, but it’s definitely one to watch. Ripple all so recently lost its place as the third most valuable cryptocurrency, but that’s only because of the case with the SEC. Regardless of the suit that lasted all through 2021, Ripple still went on to gain 346% through the year.

If the coin can still manage to deliver such huge returns despite an ongoing court case, then imagine how well it can fair when the suit is over?

Ripple Labs believe the case will be resolved in 2022, so you might want to keep your eyes out for when this ends.

Binance Coin (BNB)

Competitive Edge: Coin of the largest exchange platform

Binance is by far the world’s largest crypto exchange platform, and its native coin BNB is one every investor must keep on their shortlist.

Binance users who hold BNB enjoy access to discounted trading fees and quick transactions. As Binance continues to grow, BNB will also continue to gain more popularity and increase in market cap.

Just in 2021, Binance coin, BNB, delivered more than 1300% returns to investors. There have been many conversations surrounding the fact that Binance could go public within the next year or two. Imagine how positively that would affect BNB.

If you don’t already own BNB, this might be the perfect time to consider adding it to your crypto investment portfolio.

Competitive Edge: Notorious Bull Run & Underdog of the Year

When it comes to cryptocurrency bubbles on a long streak, Dogecoin can be tagged as one of the world’s most successful cryptocurrencies. We all know how it started. Dogecoin was a meme coin that would come to yield more than 4050% in returns for believing investors.

Its rise began with influential celebrities like Elon Musk endorsing the asset on social media. Other celebrities that influenced the price include Snoop Dogg and Miley Cyrus. But can the meme coin forever last on vibes and cruise?

Rumor has it that DOGE is about to take a more serious twist in its use case. Yes, many investors use it for payment as of now, while others invest in it simply because of its reputation for remarkable growth potential. But one thing is certain: as its applications in payments and corporations increase, so will its value and your returns as an investor.

Bitcoin (BTC)

Competitive Edge: First and most valuable cryptocurrency

There’s no need to say too much about bitcoin. Its reputation precedes it. The first of its kind. King by value and market cap, you definitely want to put your eyes on the charts in 2022. Yes, there may be some dips and dips within those dips, but smart investors know that these falls provide huge potential for even greater rewards.

Competitive Edge: Use Case and 2.0 Upgrade

When it comes to value, Ethereum is unarguably the first runner-up. Its smart contract use case even makes it an indispensable asset among serious business-minded investors.

The Ethereum blockchain is currently in the middle of a huge upgrade that will make it faster and cheaper to use if successful. Ultimately, this means that even more investors will be attracted to Ethereum, and the value will increase.

Polygon

Competitive Edge: Integrating Ethereum Systems

Much like Ethereum, Polygon attempts to deal with many technical issues with Ethereum. By connecting Ethereum-compatible blockchain networks, the platform attempts to create Ethereum’s blockchain network while providing DeFi solutions. Definitely, one to watch in 2022.

Hedera (HBAR)

Competitive Edge: Application with Top Gun Institutions

Hedera is most renowned for its fast transaction and low cost. It is the most-used enterprise-grade public network powering the decentralized economy. The owners of Hedera are some of the biggest institutions in the world. This includes Alphabet (GOOGL), LG, Deutsche Telekom (DTEGY), and TATA Communications. If these massive institutions can find applications for Hedera, it shows that it’s here to stay, and many more organizations will be adopting HBAR over time.

Competitive Edge: Pioneer Ouroboros Concensus Algorithm

Cardano allows users to perform transactions and govern the Cardano blockchain network. Investors always appreciate a great degree of participation. With Cardano’s ledger and smart contracts use cases, you can expect that the influx of investors will continue to rise over the years, hence the value of ADA.

The post Top 10 Cryptocurrencies to Watch in 2022 appeared first on Coin Journal.

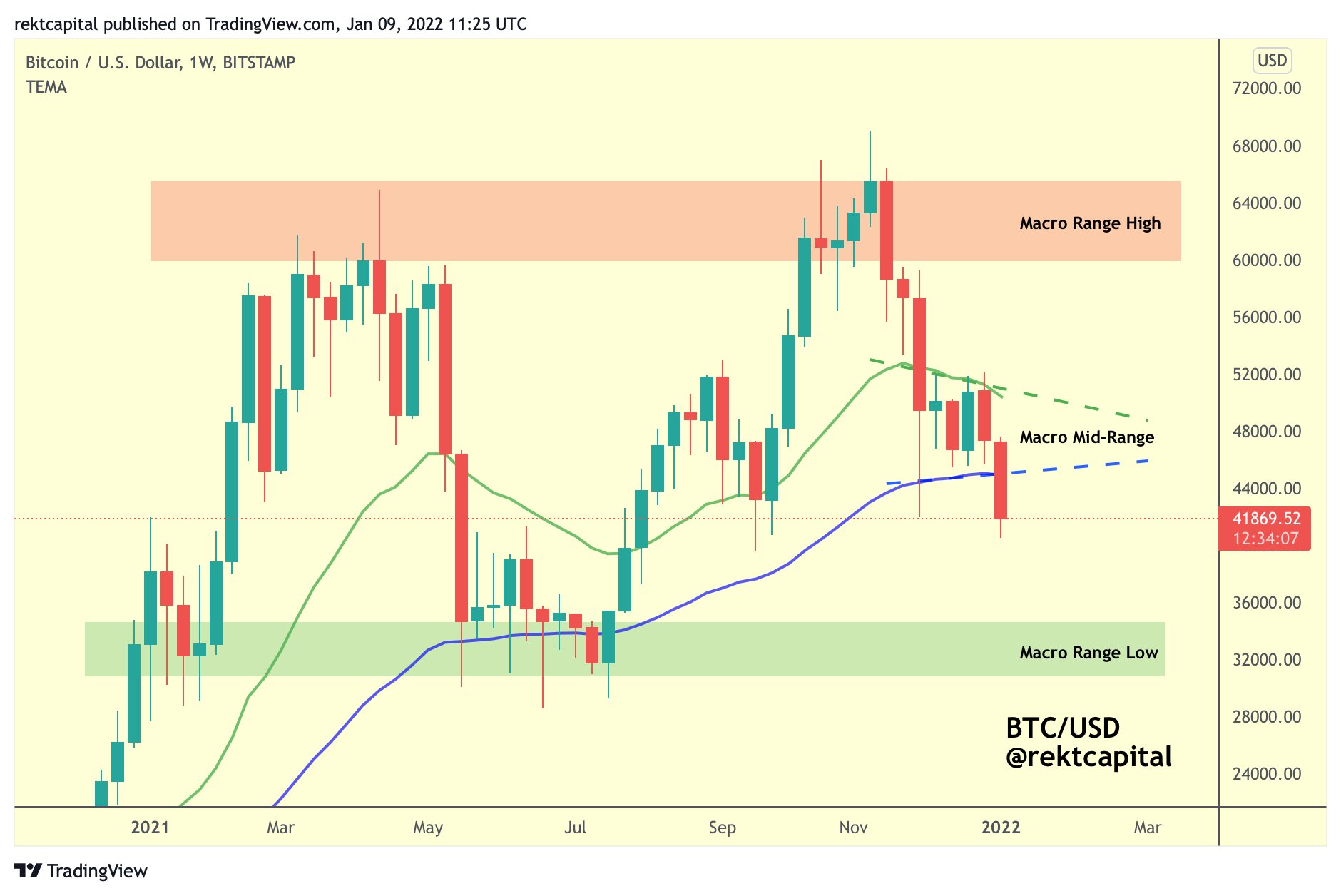

Chart showing BTC price below the two EMAs. Source: Rekt Capital on Twitter.

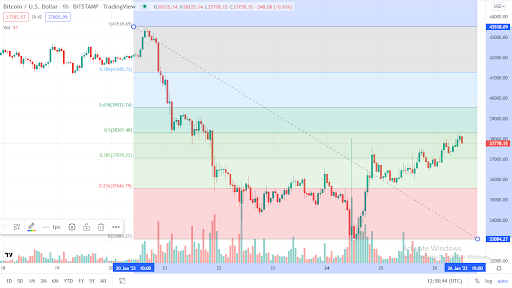

Chart showing BTC price below the two EMAs. Source: Rekt Capital on Twitter.

Source: TradingView

Source: TradingView