If CoinMarketCap was your first port of call to check your portfolio this morning, your heart rate may have spiked. That’s because the following message would have greeted you on the homepage:

Navigating to the graph section, you then would have seen the below monstrosity for the global cryptocurrency market cap:

Are your palms sweaty? Knees weak, arms heavy?

But fear not, in an exclusive reveal, we can confirm that the cryptocurrency market cap did not, in fact, collapse 92% overnight. Don’t worry, everything is going to be OK.

Of course, it’s merely a technical issue with the CoinMarketCap site. But the fact that, when I first saw the graph, my mind immediately jumped to how much I could make from selling one of my kidneys is testament to how volatile the crypto market is. That even for a split second, I got the fright of my life; that there is even a 0.001% chance it could be true. And I wasn’t alone – there was a large trend increase for the term “global crypto market cap”, despite markets not moving much this morning.

Can you imagine reading the stock market has crashed 92% overnight? You’d immediately laugh. After all, the S&P 500 has a circuit breaker which automatically halts trading in the event of a 7% drop. For cryptocurrency, a 7% drop is just a slow day at the office (indeed I need to go back a whole SIX DAYS, to last Thursday, to see the most recent daily fall of greater than 7% for Bitcoin).

Maybe I’m still scarred from memories of the crash last May, when $1 trillion in market value evaporated in a week. Or January 2018, when Bitcoin shed 65 percent in a month. Or the start of the pandemic in March 2020, when Bitcoin fell 50% in two days. Or…well I don’t need to go on, you get the picture.

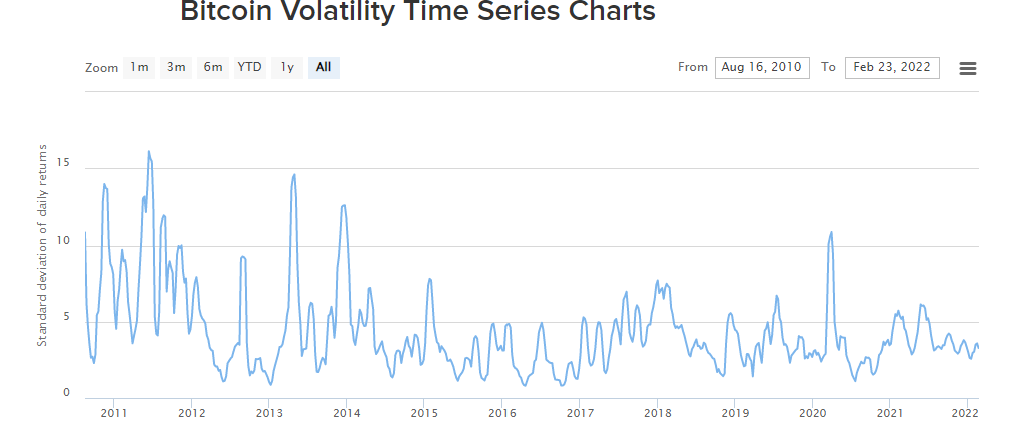

Because for all the institutional adoption, mainstream media coverage and incredible progress in the cryptocurrency space over the last two years, let us not forget that it’s still a nascent asset class. Bitcoin, people often overlook, was created only 13 years ago. When the stock market crashed in October 2008, blockchain technology didn’t exist. There is a hope in time that the volatility will come down to “manageable” levels, but right now we are still privy to the capricious desires of the crypto gods.

To put some numbers around this volatility (although, if you are a crypto holder, your heart rate will tell you all you need to know), the latest 30 day estimate of Bitcoin’s volatility is 3.32% according to buybitcoinworldwide.com – i.e. Bitcoin fluctuates 3.32% daily relative to its price. For context, gold is at 1.2% with most major fiat currencies falling between 0.5% to 1% relative to the US dollar. Of course, these are just 30 day estimates, yet still the volatility of Bitcoin blows the reference cases out of the water. And it’s been quite a “boring” year thus far in 2022 for Bitcoin, relatively speaking.

Furthermore, total cryptocurrency market cap captures all coins – not just Bitcoin. And yes, you know it, Bitcoin is the most stable of the cryptocurrencies. Relative to some of the moves alt coins have made over the last year or two, the Bitcoin chart resembles a US T-bill.

So, if you’re like me and your stress levels spiked this morning, don’t worry – we are still alive and well. Sure, our life expectancy has probably dropped a little lower, although I guess that’s what we sign up for as cryptocurrency holders. As the old saying goes: If you can’t handle the heat, go buy bonds.

Having said that, however, to the folks at CoinMarketCap – please, don’t scare us like that again.

The post Cryptocurrency survives another day appeared first on Coin Journal.

Data Source: Tradingview

Data Source: Tradingview

Chart showing Bitcoin’s support and resistance levels.Source:

Chart showing Bitcoin’s support and resistance levels.Source:

Data Source: Tradingview.com

Data Source: Tradingview.com