Bitcoin has lost more than 20% of its value over the last seven days and could record further losses this week.

The cryptocurrency market has recorded perhaps its worst week so far this week. Bitcoin and the other leading cryptocurrencies have been underperforming over the past few days.

Bitcoin, the world’s leading cryptocurrency, has lost more than 20% of its value over the last seven days. It was trading above $20k per coin a week ago but is now trading around $16,500 per week.

The bearish performance comes following the collapse of the cryptocurrency exchange FTX. FTX was one of the top five crypto exchanges in the world, and its collapse has thrown the crypto market into a deep bearish trend.

The crypto exchange filed for Chapter 11 bankruptcy last week following its collapse. The total cryptocurrency market currently stands at around $831 billion, having lost more than $150 billion over the past few days.

With Bitcoin holding its ground above $16k, the leading cryptocurrency could record further losses over the coming days.

Key levels to watch

The BTC/USD 4-hour chart is extremely bearish, as Bitcoin has been underperforming over the past few days. Bitcoin’s technical indicators show that the bears are currently in control.

The MACD line is deep within the negative territory, indicating that the bulls might not regain control for a while. The 14-day relative strength index of 35 shows that Bitcoin could enter the oversold region if the bearish trend continues.

At press time, BTC is trading at $16,620 per coin, down by more than 1% in the last 24 hours. With the bears still in control, BTC could dip below the $16,004 support level in the near term.

In the event of an extended bearish run, Bitcoin could trade around the $15,669 level for the second time in a week.

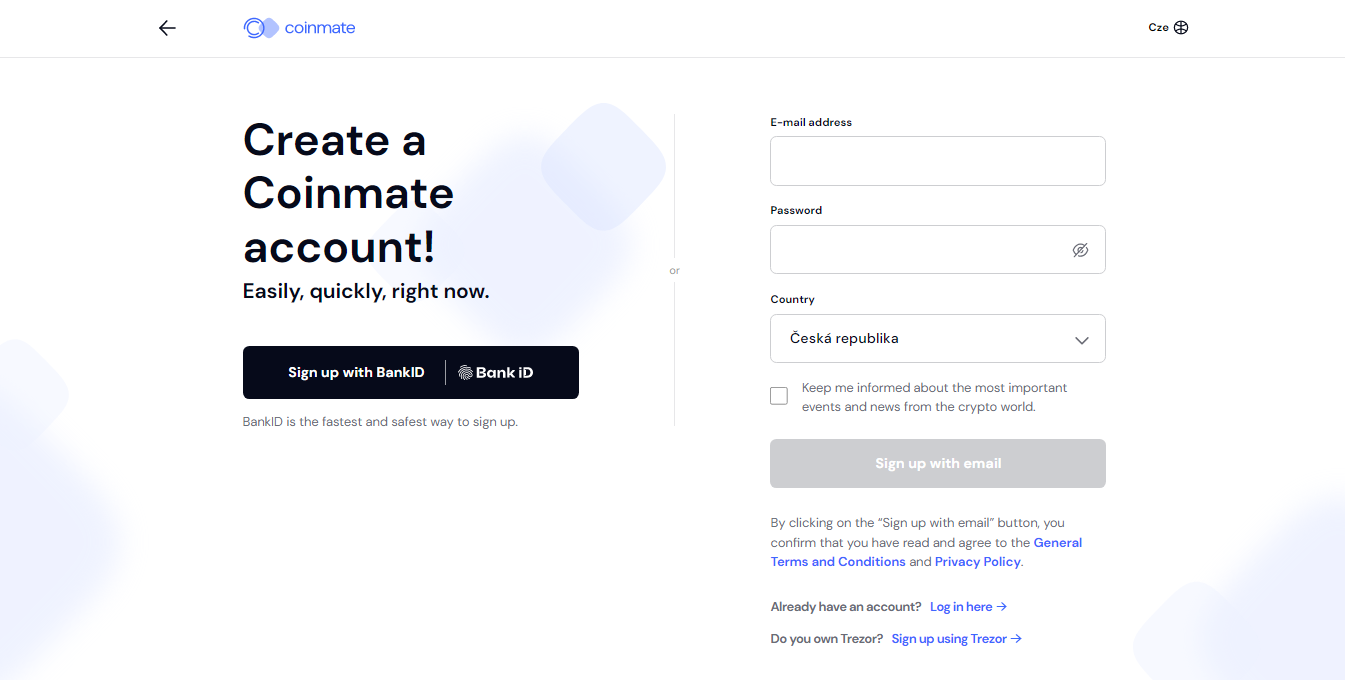

Where to buy Bitcoin now

eToro

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Skilling

Skilling is a Scandinavian based cryptocurrency broker which has a desktop website as well as apps for iOS and Android devices. It supports over 50 cryptocurrencies and it has a demo account to allow users to gain familiarity with the platform. Skilling has no hidden fees, it is an officially regulated broker and it supports a wide range of payment methods.

The post Bitcoin maintains its price above $16k but could dip lower soon appeared first on CoinJournal.