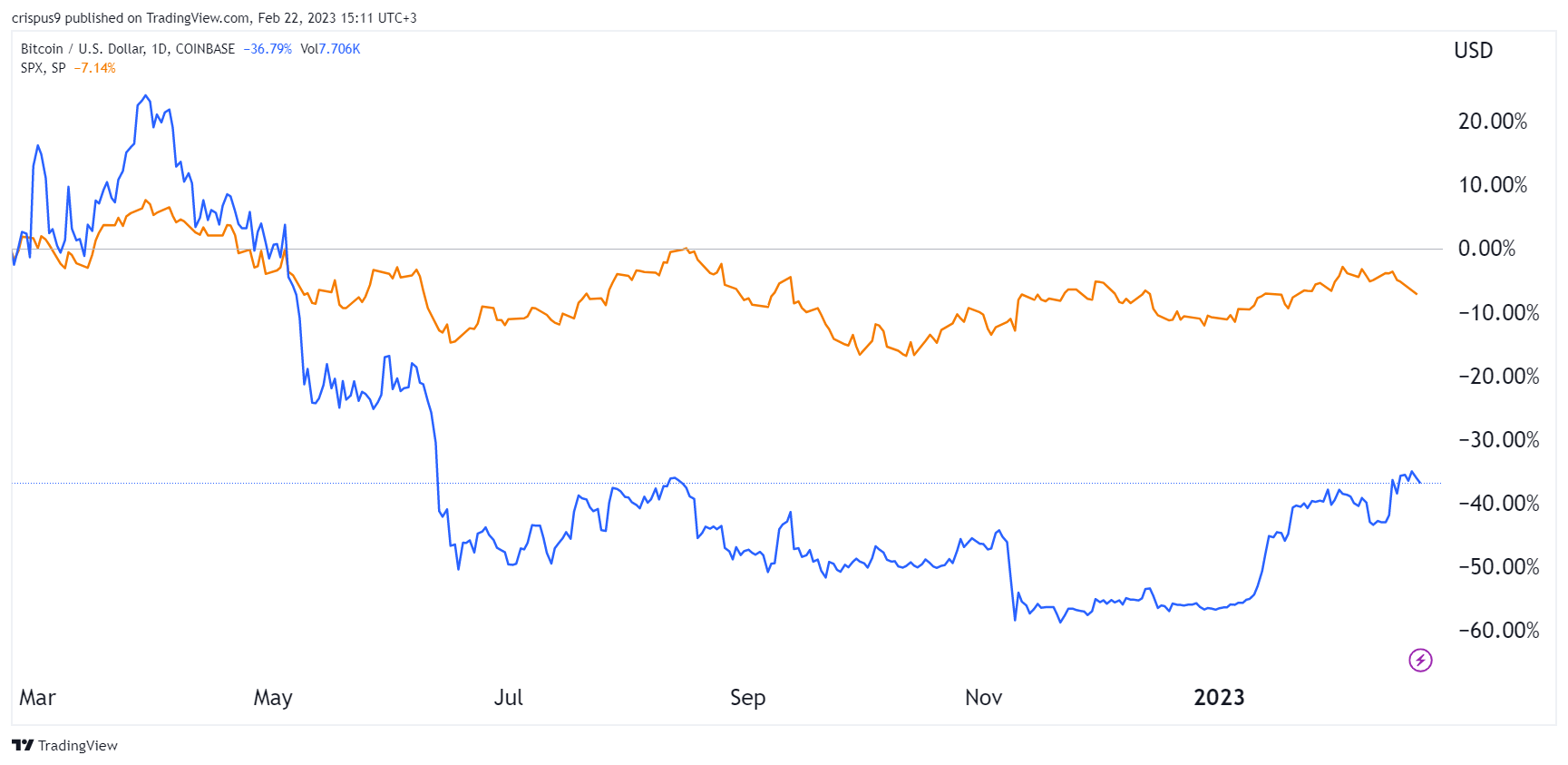

- Bitcoin and crypto prices fell as markets reacted to January PCE data.

- The Fed’s favourite inflation measure came in hot, jolting markets lower with S&P 500 declining nearly 1.4% and Dow dropping about 400 points.

- Crypto analyst Rekt Capital says BTC price remains in positive territory as long as bulls hold support above $23k.

Bitcoin price continues to struggle after the rejection from the $25k resistance, but today’s dip comes as the market reacts to hotter-than-expected Personal Consumer Expenditure (PCE) data.

As stocks got whacked on Friday, with the S&P 500 falling nearly 1.5% and the Dow Jones Industrial Average dropping 400 points, BTC price retreated under $24k to hit lows of $23,130 across major exchanges.

Crypto, Wall Street drops on CPE data

The CPE is the Federal Reserve’s most preferred inflation measure and sentiment has shifted on the latest data release as investor jitters fill up again.

The Fed uses the CPE price index to assess how sharply prices have risen within the US economy, and data shows prices spiked 0.6% in January and 5.4% year-over-year. Core CPE also came in hot, at 4.7% against the forecast 4.3% to suggest inflation remains an issue.

“Inflation remains too high. We’re going to have to do more to get back to 2%,” said Cleveland Federal Reserve President Loretta Mester. “I see a little more impetus in the inflation measures than my colleagues. We’re going to have to bring interest rates above 5% and hold there for a time,” she added during an interview with CNBC.

Bitcoin price outlook

The reaction on Wall Street also cascaded into the crypto market, with BTC price declining below a key support line recently highlighted as a “confluent support zone.” The uncertainty around the Fed’s interest rates saw most stocks scorched in early trades, a scenario also replicated in crypto with Ethereum dropping below $1,600.

For Bitcoin’s short-term price outlook, popular crypto trader and analyst Rekt Capital says bulls could remain in control if BTC holds above $23k. However, a bearish outlook would materialize if price breaks lower.

“BTC Weekly retest of the confluent area that is the Lower High and Monthly Range High resistance is now in progress. Price needs to hold here for the retest to be successful. However, Weekly Close below this area would be a bearish sign,” the analyst noted.

A failed #BTC Weekly retest of ~$23400 as support would mean that price remains inside the Monthly Macro Range

Let’s see how the Monthly Closes

1M Close above ~$23400 -> likely range breakout

1M Close below -> $BTC stays in & range & could dip lower in range#Crypto #Bitcoin pic.twitter.com/xTAqH7pVlm

— Rekt Capital (@rektcapital) February 24, 2023

The post Bitcoin bounces off $23k support as stocks fall on hot PCE data appeared first on CoinJournal.