Key Takeaways

- Ethereum has fallen against Bitcoin thus far this year

- This is unusual as the market has risen, and altcoins tend to outperform Bitcoin in bull markets

- Nonetheless, Bitcoin maxis represent everything that is and about the space, writes our Analyst Dan Ashmore

- Their celebrations also forget the fact that Ethereum has still crushed Bitcoin over the past five years

- Despite Ethereum’s outperformance, Ashmore explains why Bitcoin remains the only crypto asset for him, despite his disdain of Bitcoin maximalism

I am a Bitcoin investor. But there are few things more toxic in the cryptocurrency space than Bitcoiners persecuting others for investing in different coins.

Of course, the people who do this are only a tiny minority. Colloquially known as Bitcoin maximalists, this group are just so damn loud and aggressive that it makes it seem as if they are plenty in number. They’re not.

Do I personally invest in cryptos beyond Bitcoin? Not really, beyond a bit of fun on the side. I’m a bit of a boomer investor and hence altcoins have never made it into my long-term portfolio. But that doesn’t mean I have to spend my nights berating people online for whatever they do with their money. It’s really strange behaviour.

Ethereum the biggest target

Ethereum, being the second biggest cryptocurrency on the planet, is naturally the biggest target of these maxis, who typically travel in packs through the virtual world, but are rarely seen outside of the Internet in broad daylight.

And Ethereum is the reason I am crafting this piece today because Twitter, which is the always-positive kingdom in which these maxis are most commonly found, is alive with celebrations that Bitcoin is accelerating against Ethereum, with the latter falling sharply in the last few days and close to its lows this year against Bitcoin.

A couple of things on this. And again, I am a Bitcoin investor so I don’t really have any reason to be biased here (or if anything, I do in the opposite direction).

But sharing the 2023 chart is guilty of a little bit of cherry-picking. It is no secret that over the last few years, throughout the bull market surge of the pandemic years in 2020 and 2021, Ethereum has absolutely crushed Bitcoin.

Since April 2020, it is up 2.53X against Bitcoin, to be precise.

Ethereum, like most altcoins, tends to outperform Bitcoin in bull markets and underperform in bear markets. This is no secret and makes intuitive sense – it is further out on the risk spectrum and essentially trades like a levered bet on Bitcoin. Nothing mind-blowing in that.

And hence it makes sense that Bitcoin lagged Ethereum during the bull market of 2020 and 2021. But look at the below chart since Bitcoin’s all-time high in November 2021 (we can use this as the marker for the top in the crypto market): it’s been quite steady, down only 3.5%, a near-negligible number in the volatile world of cryptoland.

The fall of ETH vs BTC in 2023 also doesn’t really look overly dramatic with a bit of zooming out and a wider y-axis. It’s all about perspective, right?

So ETH crushed BTC in the last bull market, and has more or less tracked it in the bear market. By all accounts, it is not much cause for celebration for the maxis.

Why am I holding Bitcoin?

It begs the question: why am I holding Bitcoin over Ethereum? Well, I believe in the asymmetric return profile of Bitcoin and I like the way it fits in with my portfolio. I am a boomer investor at heart, a lover of diversification and a big fan of the old portfolio allocation studies.

Stocks are and always have been the cornerstone of my portfolio, but Bitcoin presents as a nice diversifier, alongside some other asset classes.

I’m also not as bullish on Ethereum long-term. Put frankly, I am not sure I understand it fully yet. My knowledge of Bitcoin is deeper and, since I entered the space in 2017, I have been intrigued by its macro implications and how unique it is. Ethereum is more technical and, for me, I am less clear on what its place in the world is.

That is not to hammer Ethereum. As I said, I’m not sure I understand it fully, even having bought my first ETH six years ago.

And more importantly, past performance is not indicative of future success. Perhaps the past few months are perfectly indicative of this, which I will dig into in the final section.

Why is Bitcoin outperforming now?

It is definitely notable that Bitcoin has accelerated against its counterpart (I nearly said rival!) this year, given the market has risen across the board. Typically, this has been when ETH has made gains.

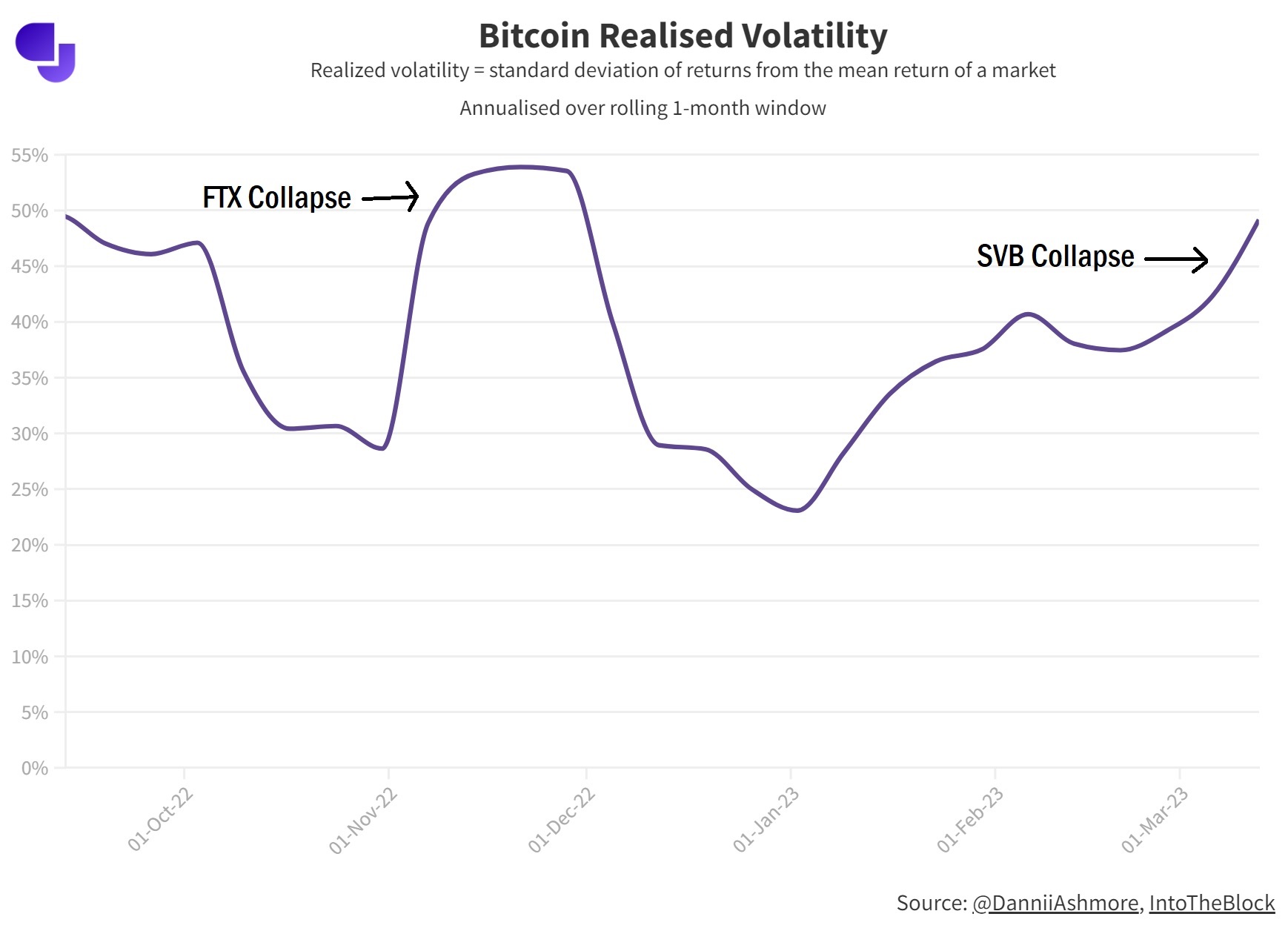

I would love to explain why, but it is not that easy. What I tend to think is that it summarises quite how unique the current market climate is. We have a nasty mix of inflation (despite it softening in recent months) and high rates, while the world fears the possibility of a looming recession.

Bitcoin and Ethereum have never existed in this sort of market environment before – until last year, they had never been around during anything other than a raging bull market in the financial space, with all risk assets exploding since Bitcoin’s launch close to the nadir of the GFC in 2009.

All Bitcoin and Ethereum have known is a low-rate, up-only market. So we need to bear that in mind (pun very much intended) when thinking about why market trends are shifting – the sample space is very small here and we have undoubtedly seen a transition to a new environment since the Federal Reserve began hiking rates last year.

The other aspect of this is that the bounceback this year has come after an incredibly harrowing period in the crypto market. There could simply be too much fear and PTSD following the bloodbath of 2022 for the market to scale back into altcoins.

Most altcoins offer minimal or no value, and hence are nothing but a byproduct of the low-rate environment which had persisted since the GFC until last year. This shift by the Fed amounts to a structural change and it is certainly harder to envision the sorts of gains that previous years brought when T-bills are available for investors at north of 4%, while the tech sector struggles through mass layoffs and collapsing share prices.

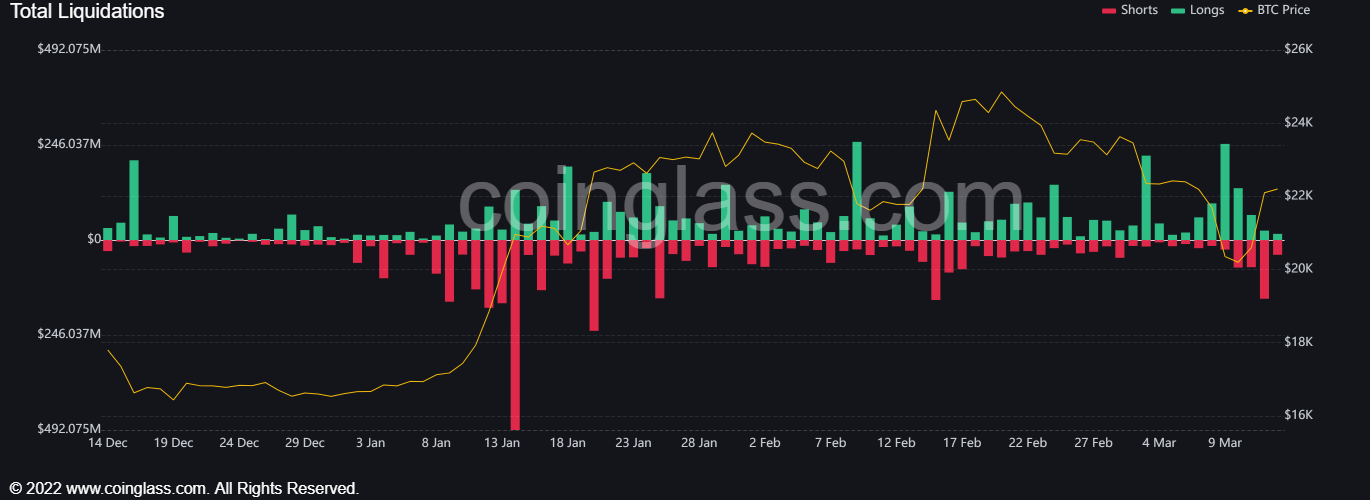

This could be contributing to Bitcoin moving quicker than altcoins, including Ethereum, compared to what it has done in prior periods of rising prices. There could just be more lasting damage in the crypto space this time around, given the high-profile scandals of FTX, Celsius, LUNA and all the other cowboys that threw the entire space into a circus.

So just because Bitcoin has underperformed against Ethereum over the last six years does not mean that will continue into the future. Who knows, this nascent industry is barely a few years old.

But regardless of speculation about the future, one thing that Bitcoin’s underperformance against Ethereum over the last half-decade does mean, however, is that Bitcoin maxis should really stop and think before celebrating ETH falling close to its year-to-date low against BTC.

Then again, thinking is not a favourite pastime of that cohort.

The post Why is Ethereum falling against Bitcoin? Maxis loudly celebrate but miss the point appeared first on CoinJournal.