Key Takeaways

- Bitcoin’s correlation with gold is currently at its lowest level since FTX collapsed in November

- Our Head of Research writes that while one day Bitcoin may become a store of value, the numbers say it currently trades like an extreme risk-on asset

- Bitcoin lost 76% of its value amid the pullback in risk assets once central banks around the world transitioned to tight monetary policy amid the inflation crisis

- Meanwhile, gold traded flat and is currently close to all-time highs

- Bitcoin’s correlation with growth stocks and riskier sectors of the stock market remains tight

One of the ultimate bull scenarios for Bitcoin is that it morphs into some kind of digital gold.

For whatever reason, humans have been obsessed with this weird, shiny metal for thousands of years. Stories date back even further, but we have concrete evidence that gold was an important symbol of wealth in Ancient Egypt in 3000 BC, as well as part of everyday life and mythology.

Bitcoin, on the other hand, was not around in Ancient Egypt. Nor was it around for the Middle Ages, the Great Depression in the early 20th century, a World War (yet?), the inflation and energy crisis of the 1970s, and it even missed most of the subprime mortgage crisis of 2008.

In fact, Bitcoin was launched in January 2009, the Genesis blocked mined only two months before the stock market bottomed. Over the next twelve years, not only did the stock market recover, but it went absolutely bananas. Between the 2009 trough and the peak at the end of 2021, the S&P 500 multiplied 7X while the Nasdaq jumped nearly 13X. In other words, Bitcoin was launched into one of the most explosive and longest bull markets in history. Until 2022, it had never known anything but basement-level interest rates and up-only markets.

Gold’s hedge properties are what Bitcoin seeks

Once 2022 came, risk assets sold off. The Nasdaq shed a third of its value; the S&P 500 fell 20%. Bitcoin had dipped plenty before, but make no mistake: this was the first time it was staring a bear market in the wider economy in the face.

Despite certain enthusiasts claiming Bitcoin would act as a hedge asset, this did not happen. By the end of 2022, Bitcoin was 76% off its high. In the most explosive inflationary environment since the 1970s and Bitcoin’s first bear market, the asset was getting crushed. There was no debate: Bitcoin was trading like a risk-on asset. And today, it still is.

That is not to say that the narrative could flip in the future. Personally, that is what I view as Bitcoin’s upside: a store of value akin to gold. But while we can debate whether that may one day happen, it is unequivocal that Bitcoin currently trades like a risk-on asset. These are the facts of the case, and these are undisputed, to borrow Kevin Bacon’s phrase from the absolute classic that is A Few Good Men.

Gold, on the other hand, traded flat during 2022, and is currently trading close to all-time highs.

Bitcoin and gold correlation dipping

For all the reasons discussed above, the correlation between gold and Bitcoin is particularly interesting to track. Using the 60-Day Pearson indicator, I have plotted it on the below chart.

Immediately, the past month jumps out. The correlation was a near-perfect 0.86 at the start of June, and had been around this level since late April. And then, it fell. It currently sits at 0.16, the lowest mark since FTX collapsed in November, sending the crypto market into a tailspin. But why?

Well, I don’t really know. And that is kind of the point. Bitcoin, as it tends to do sometimes, is rising at the moment. Most likely, this is due to news of asset managers Blackrock and Fidelity filing ETFs, but maybe it’s just Bitcoin doing its thing. Perhaps it is merely bouncing back from the sharp fall it took after the Binance and Coinbase lawsuits were announced back-to-back two weeks ago.

But if we stretch out the time horizon on the previous graph, we see that the correlation between gold and Bitcoin bounces around a lot.

It is challenging to put any pattern on that, to say the least. I thought I might try a different metric, so in the next graph I have used 90-Day Pearson instead of 60-Day. Predictably, the trend is less volatile, but there still appears to be no meaningful relationship here.

I think it’s pretty clear that assessing the correlation coefficients directly proves that there is zero positive relationship between these two assets.

Federal Reserve holds the key

In truth, I believe this actually says more about gold than Bitcoin. Gold is in a funny place at the moment, trading more off expectations of inflation and interest rate movements rather than current conditions. The correlation between gold and the stock market is therefore higher than what we have typically seen in the past. This is why we are seeing gold often advance when soft CPI numbers are announced, or when dovish Fed comments surface regarding interest rate policy.

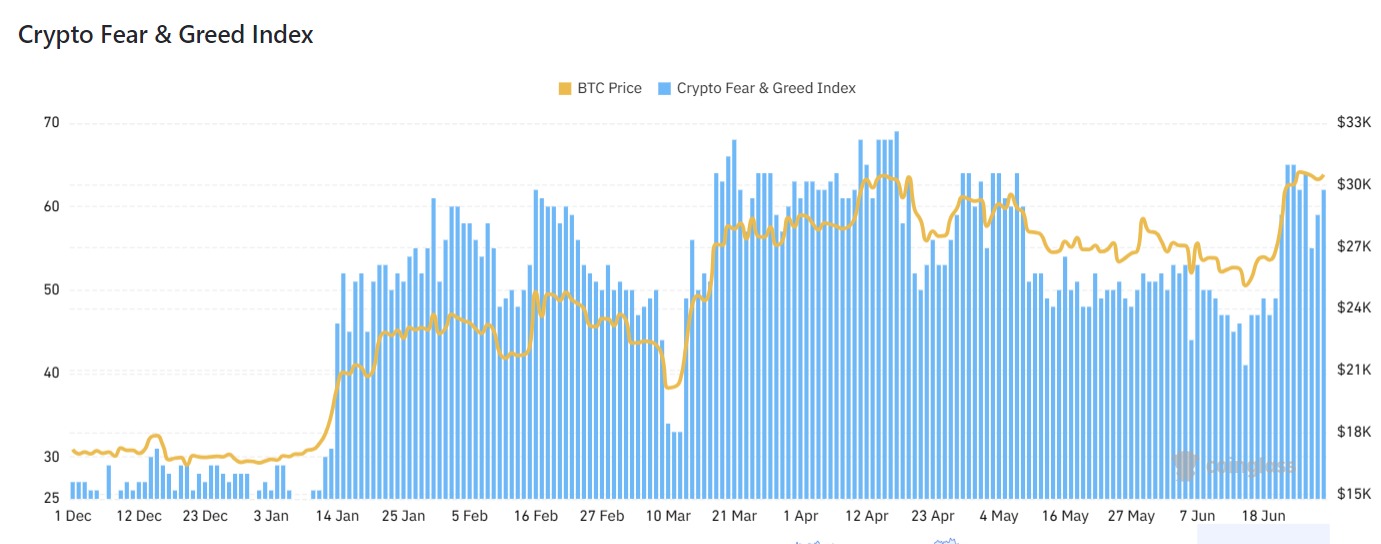

If we step back and look at the big picture, it really is not complicated. Bitcoin has gone from $68,00 in November 2021, when money was cheap and risk assets were trading at outrageous valuations, to $15,500 last November, seven months into the swiftest hiking cycle in recent memory and the worst inflation crisis in 50 years. Then, it doubled to $30,000 as inflation numbers fell away and expectations around the length of the hiking cycle softened.

Along with all the fakeouts and reverberation in between, that is a hell of a lot of movement and clearly trading like an extreme-risk asset. Meanwhile, gold has been far less volatile, relatively range-bound between $1,600 and $2,000 for three years now.

Again, while Bitcoin may one day seize the crown of an uncorrelated asset, or a portfolio hedge to inflation, that is clearly not the case today. The below chart is the simplest method of all to show this, plotting Bitcoin’s hand-in-hand relationship with the tech-heavy Nasdaq composite since the economy transitioned to this risk-off, tight monetary policy period.

A few months ago, Bitcoin rose during the banking crisis, sparking some to declare it as decoupling from risk assets and the fiat world. As I wrote back then, this is nothing more than wishful thinking. Rather, it moved off expectations that the Fed would not be able to hike as aggressively in future if banks were going under due to the strain of these higher rates (indeed, soon after, the correlation rose back up).

The latest dip in correlation with gold, falling back down from the ultra-high 0.86ish value it has been for six weeks or so, is similar. There is nothing ambiguous about the situation at the moment – Bitcoin is trading like a risk-on asset. It may one day claim that coveted title of digital gold, but right now it is nowhere near.

The post Bitcoin correlation with gold drops, highlighting risk-on nature remains appeared first on CoinJournal.