- SEC delayed its decision this week on applications for a Bitcoin ETF.

- Former SEC chair Jay Clayton talked Bitcoin ETF with CNBC on Friday.

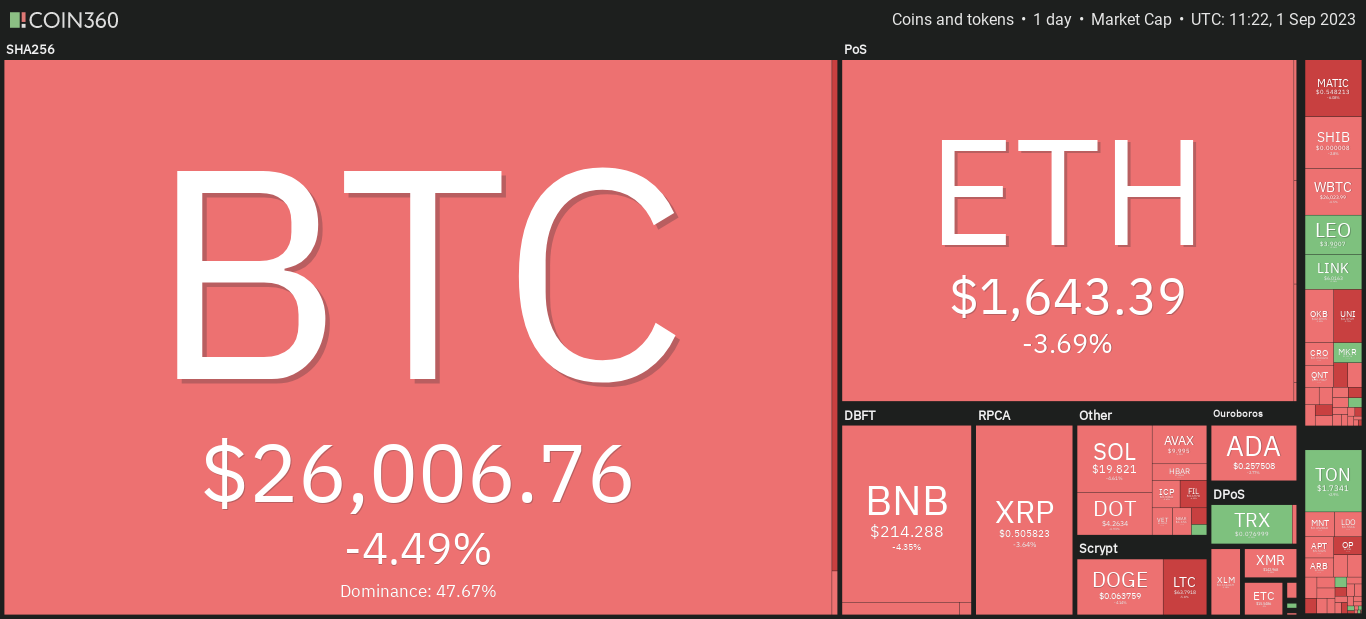

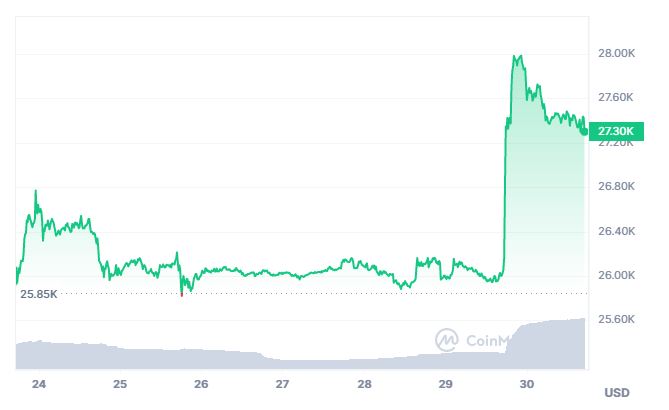

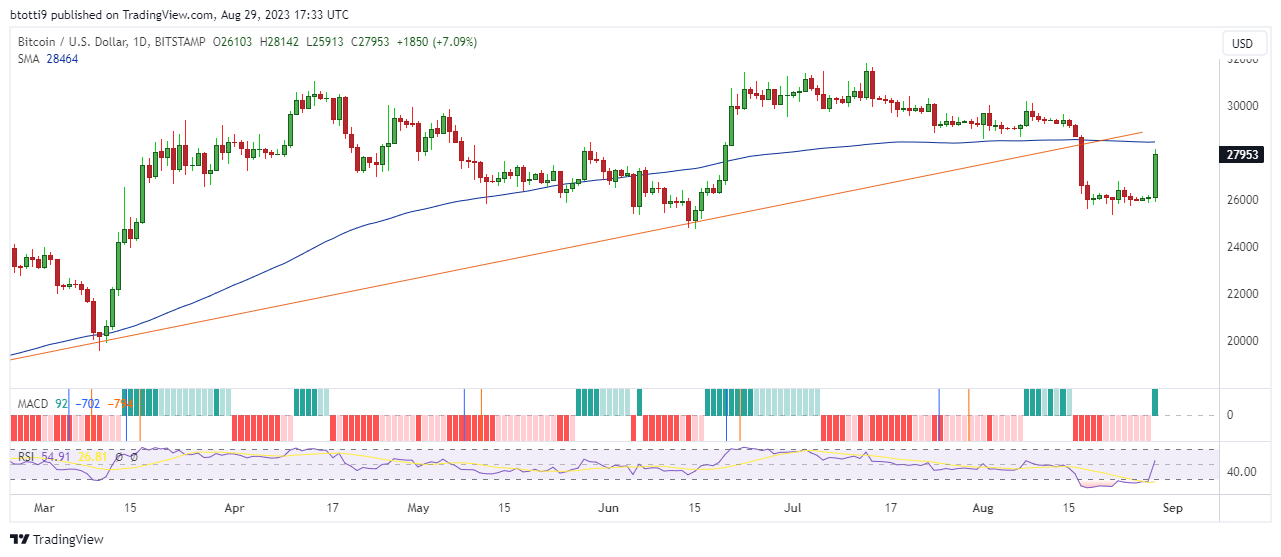

- The world’s largest cryptocurrency is down 18% versus its YTD high.

The U.S. Securities and Exchange Commission delayed its decision on a bunch of applications for a Bitcoin ETF this week.

Jay Clayton talks Bitcoin ETF with CNBC

Applicants that its most recent deferral affected include WisdomTree, Valkyrie, Invesco, Vaneck and BlackRock Inc.

Still, Jay Clayton – the former Chair of the Securities & Exchange Commission is convinced that approval for the said exchange-traded fund is a matter of “when” and not “if”. On CNBC’s “Squawk Box”, he said:

Bitcoin is not a security. So, I think an approval is inevitable. The dichotomy between a futures product and a cash product can’t go on forever. That’s the path we are on.

At writing, the world’s largest cryptocurrency is down about 18% versus its year-to-date high in mid-July.

Why is SEC delaying deciding on Bitcoin ETF?

Clayton sees the hype around a Bitcoin ETF as a tell that retail and institutional investors alike want access to the digital asset.

Note that a U.S. court ruled in favour of Grayscale this week in its lawsuit against the SEC (find out more). According to the former head of that government agency:

SEC has been given time by the DC Circuit to reassess and perhaps come up with other reasons. Maybe there will be some but I don’t see those.

A Spot Bitcoin ETF is a big deal as many experts believe it could boost demand for the cryptocurrency which may eventually translate to significant price appreciation.

The post Former SEC chair on Bitcoin ETF: ‘I think approval is inevitable’ appeared first on CoinJournal.