-

Binance coin has been bearish since the FTX collapse

-

The cryptocurrency trades on an upside at $255

-

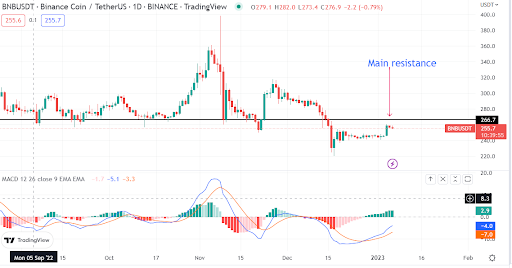

BNB faces resistance at $266, a crucial resistance level

While 2022 was largely bearish for almost every cryptocurrency, Binance (BNB/USD) was relatively stable. That’s not to mean that the cryptocurrency was bullish, but at least bears did not run riot as they did for most cryptocurrencies. It helped BNB hold strengths. At one time before the collapse of FTX, BNB neared the $400 price level. Since then, BNB has remained bearish. What happened?

The collapse of FTX ignited fears that no crypto exchange was too big to fail. Investors rushed to decentralised exchanges that benefited from huge outflows from centralised peers. Binance, the world’s largest centralised crypto exchange, was among the culprits of the shift. That sent the native token BNB tumbling to $220 by mid-Dec.

Further fears were heightened by Binance’s proof of reserves. As CoinJournal reported, an audit report raised questions showing that the exchange was not sufficiently collateralised. BNB has been suffering in the aftermath, although the latest recoveries are promising.

BNB is facing resistance at $266 after recent recoveries

BNB is mildly bullish on the daily chart. A bullish MACD crossover was initiated, supporting an improved momentum for the cryptocurrency. However, the MACD indicator is bearish. Bulls are yet to close above the neutral zone, which separates the bullish and bearish momentum.

BNB also trades below the resistance at $266. This is the level bulls defended strongly before the FTX-inspired crash. Therefore, the level is a key test for the bulls.

BNB price action next

A continuation of the current recovery could see BNB return to its former self and turn $266 into support. For this to happen, bulls must overcome the resistance and break higher.

On the flip side, bears will try to position themselves as the BNB price reaches $266. Already, there is some resistance developing below the resistance zone. A failed breakout will see bears try to force a correction. That could see BNB continue to consolidate below before buyers have another chance.

Where to buy BNB

eToro

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600. Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

The post BNB prediction as price maintains a recovery appeared first on CoinJournal.