- ETH price rose to highs of $2,009 on Binance.

- Ethereum’s Shanghai/Shapella upgrade went live successfully on Wednesday,12 April, 2023.

- Crypto analyst Rekt Capital says Ether’s price movement is a “leading indicator” for altcoins and that coming weeks could be interesting.

Ethereum price rallied past the $2,000 level on Thursday, rising to highs of $2,009 on crypto exchange Binance.

The uptick for the ETH price above the key hurdle came after the world’s largest proof-of-stake blockchain network underwent a successful software upgrade.

As CoinJournal highlighted earlier Thursday, ETH had looked to break above the psychological level following the Shanghai upgrade. After the upgrade went live and withdrawals of staked ETH enabled, bulls defied negative projections to break above a supply zone that has held since August 2022.

ETH breaks $2,000 as analyst says altcoins could be interesting in coming weeks

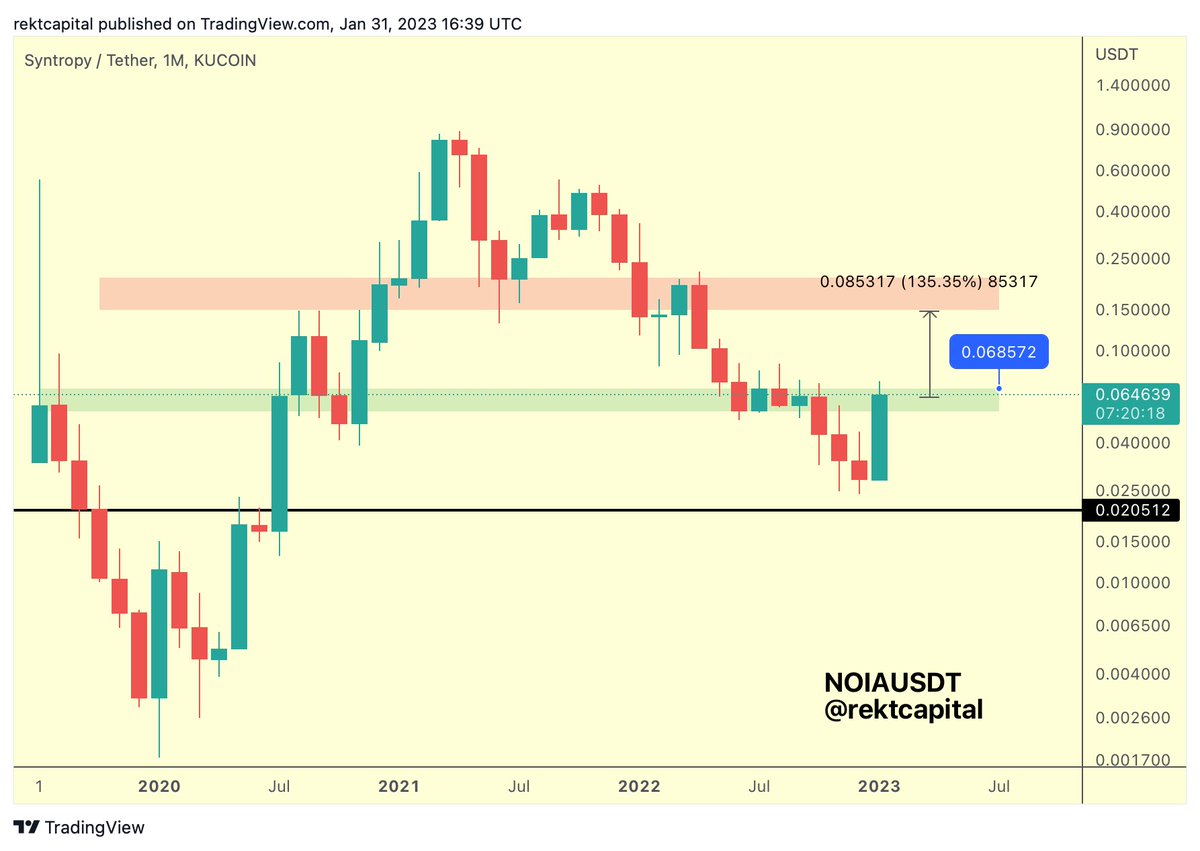

According to crypto analyst Rekt Capital, the top altcoin is a “leading indicator for smaller altcoins.” He suggests the breakout for Ethereum could trigger new momentum for some of the leading altcoins, probably highlighting the possibility of an alt season kicking off.

“ETH is a Leading Indicator for smaller Altcoins. This is why the #ETH breakout may very well set the stage for an interesting period for other Altcoins in the coming weeks,” the highly respected crypto trader and analyst said.

Rekt believes the Bitcoin bull market is just starting, but Ethereum’s price movement suggests current prices might be a great entry point for many alts.

“ETH at $2000. That’s one reason why it might be worth entering Altcoins early on in this #BTC Bull Market,” the analyst tweeted.

$ETH at $2000

That’s one reason why it might be worth entering Altcoins early on in this #BTC Bull Market$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) April 13, 2023

Ether is currently trading around $1,998, roughly 4.8% up in the past 24 hours.

The post ETH is a leading indicator for smaller altcoins, top analyst says appeared first on CoinJournal.