The crypto market is known for its volatility and it has some standout tokens that are liked by both investors and analysts such as – DOGS Token, NEIRO, and Rexas Finance (RXS). Each of these tokens represents different sectors of the blockchain industry with different applications and can appreciate substantially in value over the next couple of months. Let’s find out how viable the price projections of these tokens are and what excites the crypto market about these tokens.

DOGS Token

Current Price: $0.0008

DOGS Token is earning popularity both in the DeFi ecosystem and meme coin industries. The light-hearted design of DOGS Token combined with the passionate following and inventive staking features make DOGS Token one of the more intriguing meme coins. Like Dogecoin and Shiba Inu Token before it, DOGS Token may find a niche in mimetic culture and expand within its community.

Price Prediction:

Short-Term (2024): Based on experience, the DOGS Token price can be anticipated to go through short-term fluctuations typical with most meme coins, and in this regard, it is expected to perform some upward movement towards the end of the forecast period to a rate of up to $0.10 by the end of the year.

Long-Term (2025): If DOGS Token enjoys continued success in community-building and usefulness in DeFi, the analysts expect the token value to be between $0.30 to $0.50 by the year-end of 2025. However, the major contributing factor that would push this growth is a more general bull cycle in the cryptocurrency market.

NEIRO

Current Price: $0.08

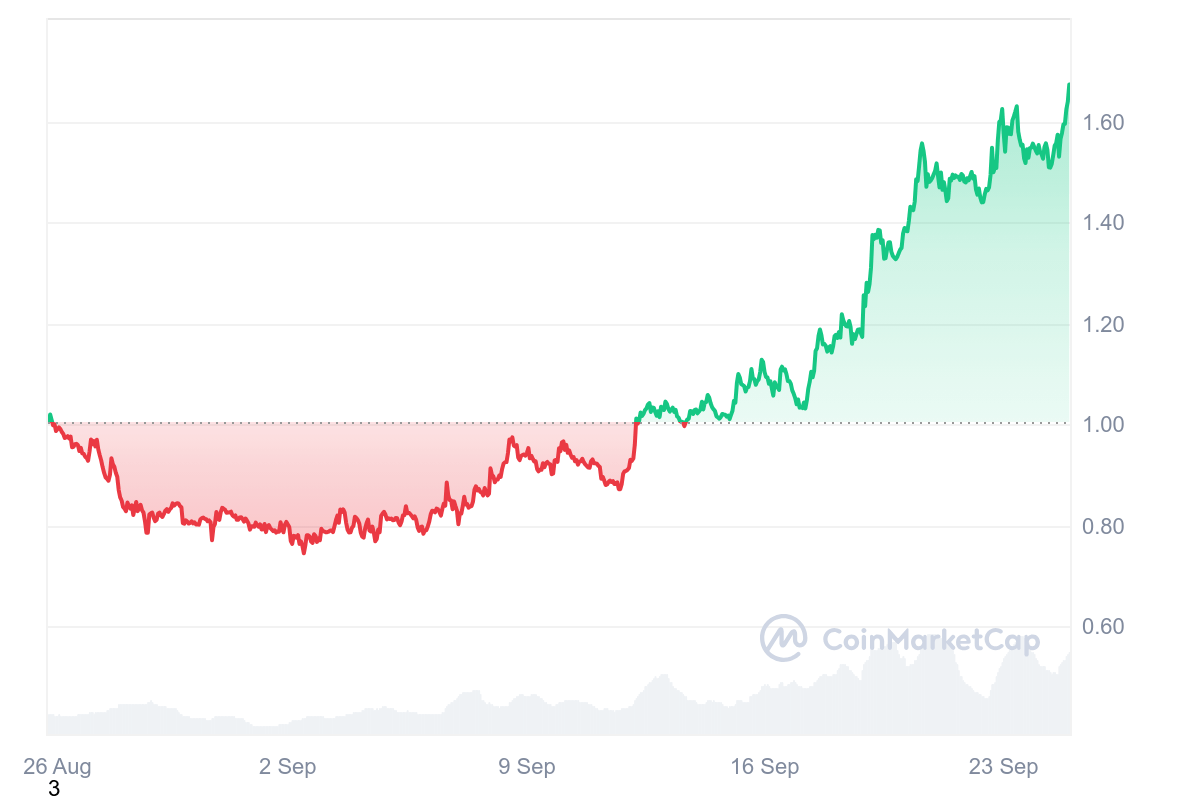

As the most successful blockchain project that opened in 2024, NEIRO is the one that is going onto the shores very fast. There is also a technicality to the platform in building the decentralized environment for the safe transfer of data and the building of dApps as it is less supported by memes than the DOGS Token. The launch of the NeiroChain on September 19 has helped sop this growth making it an appealing investment to people seeking infrastructure projects within the blockchain industry.

Price Prediction:

Short Term (2024): After NEIRO Launch in July 2024, the token surge continued and became bullish. At current prices of around $0.08, it seems that the NEIRO token can grow even larger and the experts tend to be positive about it. However, by the end of 2024, NEIRO looks forward to a price adjustment of between $0.15 to $0.20 owing to growth on the NeiroChain.

Long-Term (2025): The price of NEIRO could also rise to between $0.50 and $0.75 by 2025 due to the growth of its ecosystem and the onboarding of developers. The application and distribution of commendable dApps and secure data transmission is a rare and effective combination in the market ensuring its sustainability in the long run.

Rexas Finance (RXS)

Current Price: $0.05

Rexas Finance (RXS) provides great headway as one of the highly talked about projects dominating the real-world asset (RWA) tokenization landscape recently. Having reached presale in the third stage with each token sold for five cents, expect further radical change in asset management as tokenization is brought into such areas as real estate and commodities among others. There is great interest from retail and institutional investors because of the idea of splitting ownership, providing more liquidity, and transparency of the real assets.

Price Prediction:

Short-Term (2024): Considering the ongoing presale of RXS, the tokens are likely to experience a continuing increase in demand. With a listing that some insiders predict could result in 500X growth of the token’s value, some analysts believe RXS will most likely follow this listing with a price surge to about $0.20 and above within a very short time.

Long-Term (2025): Rexas Finance states that its main value is the value that the company will develop over time. Since it is still early in the growth of the RWA market, the valuation could just as easily roam between $1.00 and $2.00 by the close of the year 2025, depending on the adoption rate and the prevailing market conditions. Given that the market for tokenization of real-world assets is expected to be worth trillions, Rexas Finance still has hopes of entering the list of the top 50 or perhaps the top 20 trending cryptocurrencies in the years to come.

Why These Tokens Stand Out

This meme coin DOGS Token was created for meme coin investors and has survived due to a rather large and active community. Thus it can be expected that along with the rapid price growth of the community-driven meme, there is potential for price declination at least for the short term.

NEIRO is aimed at providing such value through blockchain technology and emphasizes decentralized applications and data security. With the increased demand for building infrastructure projects, NEIRO is anticipated to capture investors who are more long-term in nature and who seek practical implementation of blockchain technology.

Blockchain technology is being used by Rexas Finance (RXS) to pioneer destruction in more traditional industries with an emphasis on real-world asset tokenization. Over the years this market has been expanding and with the exclusivity offered by RXS, there is bound to be a rise in value in the future.

Conclusion

In conclusion, investing in each of the three tokens, that is DOGS Token, NEIRO and Rexas Finance (RXS) could be advantageous in the year 2024 and after. DOGS Token provides investment prospects, NEIRO gives tech advantage, and Rexas Finance is going for a massive market with practical real-life uses. Any one of the tokens can be said to bring a different risk-reward balance depending on one’s investment approach, but all appear to be well-positioned for massive gains in the years to come.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

The post Top 3 Crypto Price Prediction: DOGS Token, NEIRO, Rexas Finance (RXS) appeared first on CoinJournal.