There are a lot of investors who made millions of dollars from Shiba Inu back in 2021. So, it’s natural that you will be looking for the next SHIB or that meme coins that will grow 100x or more in just a few months. But why meme coins? Here are some facts:

- As history would have it, meme coins have often exploded really fast, leading to massive gains.

- The hype around meme coins will not go away even as the crypto market sees more innovative projects.

- There are many meme coins to buy, but not all have that prospect of growth that you are looking for.

Finding underrated coins is not always easy. But here are three options that should be on your watchlist:

Looser Coin (LOWB)

The challenge for most meme coins is that they can easily be dumped by founding whales when the price is right. Loser Coin (LOWB) does not offer that risk.

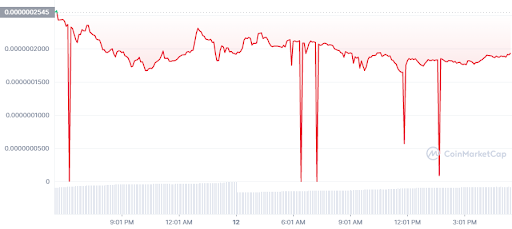

Data Source: Coinmarketcap

Data Source: Coinmarketcap

In fact, this coin was founded by two poor guys from China and has been in circulation for quite some time. But more importantly, the coin has a market cap of just $3.5 million, so you have so much potential in there.

Tiger King (TKING)

Tiger King (TKING) is another meme coin that is largely inspired by the TV show by the same name. We have had some controversy around the Tiger King himself, but that only served to create the buzz around the coin. While we are not saying TKING will be the next SHIB, it is worth watching. The coin has a market cap of $4 million.

ElonBalls (ELONBALLS)

ELONBALLS (ELONBALLS) has incorporated NFTs into its ecosystem to try and add some fundamental factors. It is also an unknown and underrated coin with a market cap of $5 million. There is a chance that ELONBALLS could become huge in the years ahead.

The post The top underrated meme coins that could deliver insane growth appeared first on Coin Journal.

Data Source: Tradingview

Data Source: Tradingview

Data Source: Coinmarketcap.

Data Source: Coinmarketcap.

Data Source: Tradingview

Data Source: Tradingview