The Origin Protocol (OGN) has taken a plunge today of nearly 10%. This comes even as most coins post gains. But despite this, the long-term indicators for OGN remain positive. How long they stay, that way is another story. But here is what matters:

-

The OGN token remains slightly above its 25- and 50-day simple moving averages.

-

The coin is currently trading at $0.45, down by around 10% over the last 24 hours.

-

OGN is also down nearly 88% from its all-time highs last year.

Data Source: Tradingview

Data Source: Tradingview

Can Origin Protocol (OGN) stay above water?

The fact that OGN is slightly higher than its 25 and 50-day simple moving averages is a good sign. It means that it’s yet to enter the bear market. But there are worries that this may not be the same any longer. The good news is that OGN appears to have completely bottomed.

It is 88% lower than its ATH and has trended downwards for the last week. In most cases, coins will reverse the trend once they bottom out. This reversal could come very soon for OGN. In fact, despite the 10% loss today, some analysts expect OGN to consolidate.

The coin could easily retest $0.8 in the near term, something that will lead to gains of at least 40%. However, the key support zone to watch at the moment will be $0.34. Any drop below that price will trigger a bearish fall.

Is Origin Protocol (OGN) a good investment?

The Origin Protocol is a DeFi project that brings NFT integration as well. It also has a yielding stablecoin as part of its ecosystem, something that makes it quite unique compared to other projects.

Although OGN has been on free fall since the end of 2021, it still has outstanding long-term potential. For this reason, you can consider it if you are looking to add more DeFi coins into your wallet.

The post Origin Protocol (OGN) maintains positive momentum indicators despite plunging 10% today appeared first on Coin Journal.

Source: TradingView

Source: TradingView

Data Source: Tradingview

Data Source: Tradingview

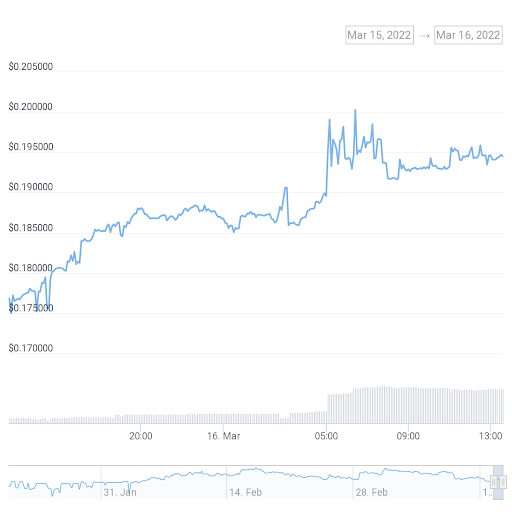

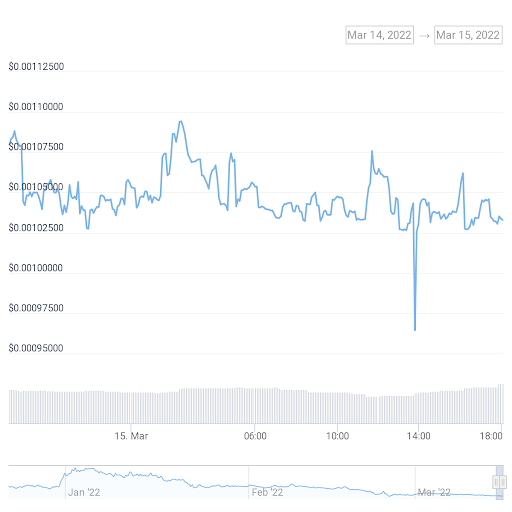

Data Source: CoinGecko

Data Source: CoinGecko