-

MATIC, LINK und AXS sind die Go-to-Token für den 28. Dezember.

-

Das Handelsvolumen von Chainlink ist in den letzten 24 Stunden um 17 % gestiegen.

-

AXS verzeichnete in den letzten 24 Stunden einen Anstieg des Handelsvolumens um 36 %.

Polygon ist ein Protokoll sowie ein Framework, das zum Aufbau und zur Verbindung von Blockchain-Netzwerken verwendet wird, die Ethereum-kompatibel sind.

Chainlink ist ein dezentralisiertes Blockchain-Oracle-Netzwerk, das auf Ethereum aufbaut und darauf läuft.

Axie Infinity ist ein NFT-basiertes Online-Videospiel, das auf Ethereum basierende Kryptowährungen verwendet.

Sollten Sie Polygon (MATIC) kaufen?

Am 28. Dezember hatte Polygon (MATIC) einen Wert von 2,641 USD.

Um eine bessere Vorstellung davon zu bekommen, was genau das für den MATIC-Token bedeutet, werden wir seinen momentanen Wert mit seinem Allzeithoch sowie seiner Performance im November vergleichen.

Der Allzeithochwert des MATIC-Tokens war am 27. Dezember, als er einen Wert von 2,92 USD erreichte.

Am 3. November hatte der Token seinen höchsten Wert bei 2,1198 USD.

Sein tiefster Stand des Monats war am 18. November, als der Wert des Tokens auf 1,4795 USD fiel. Hier können wir sehen, dass der Wert des Tokens um 0,6403 USD oder um 30 % gesunken ist.

Vom 18. November bis 28. Dezember stieg der Wert des Tokens jedoch um 1,1615 USD oder um 78 %.

Vor diesem Hintergrund können wir davon ausgehen, dass MATIC bis Ende Januar 2022 einen Wert von 2,8 USD erreichen wird, was es zu einem soliden Kauf macht.

Sollten Sie Chainlink (LINK) kaufen?

Am 28. Dezember hatte Chainlink (LINK) einen Wert von 22,37 USD.

Um eine bessere Vorstellung davon zu bekommen, was genau das für den LINK-Token bedeutet, werden wir seinen momentanen Wert mit seinem Allzeithoch sowie seiner Performance im November vergleichen.

Der Allzeithochwert des LINK-Tokens erreichte am 10. Mai einen Wert von 52,70 USD. Hier können wir sehen, dass der Token an seinem ATH-Wertpunkt um 30,33 USD oder um 135 % höher war.

Wenn wir die Wertentwicklung des LINK-Token im Laufe des Vormonats durchgehen, erreichte der Token am 10. November seinen höchsten Wert bei 38,12 USD.

Sein niedrigster Wert war am 28. November, als der Wert des Tokens auf 23,23 USD fiel. Hier können wir sehen, dass der Wert des Tokens um 14,89 USD oder 39 % gesunken ist.

Mit einem Preis von 22,37 USD ist LINK jedoch ein solider Kauf, da es das Potenzial hat, bis Ende Januar 2022 25 USD zu erreichen.

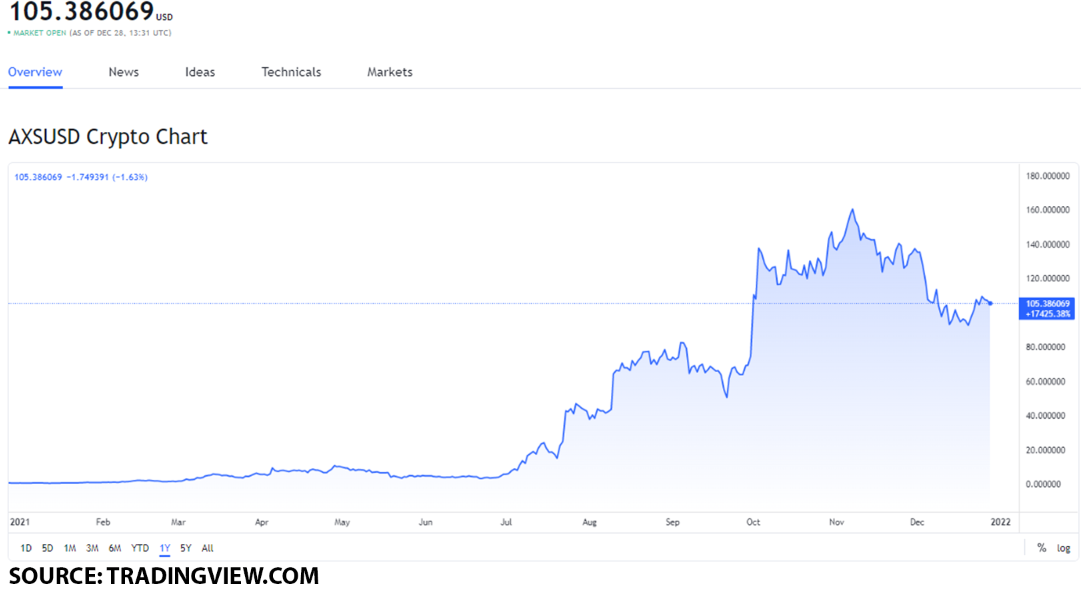

Sollten Sie Axie Infinity (AXS) kaufen?

Am 28. Dezember hatte Axie Infinity (AXS) einen Wert von 105,38 USD.

Um eine bessere Vorstellung davon zu bekommen, was genau das für den AXS-Token bedeutet, werden wir seinen momentanen Wert mit seinem Allzeithoch sowie seiner Performance im November vergleichen.

AXS hatte seinen Allzeithochwert am 6. November, als der Token einen Wert von 164,90 USD erreichte. Der Wert des Tokens war an seinem ATH-Punkt um 59,52 USD oder um 56% höher als heute.

Wenn wir die Performance des AXS-Token im letzten Monat durchgehen, können wir sehen, dass der Token am 6. November mit 163,48 USD seinen höchsten Wert hatte.

Sein niedrigster Wert war am 19. November, als der Wert auf 123,09 USD fiel. Der Wert des Tokens ist demnach um 40,39 USD oder um 24 % gesunken.

Vor diesem Hintergrund ist AXS ein solider Kauf bei 105,38 USD, da es das Potenzial hat, bis Ende Januar 2022 110 USD zu erreichen.

The post Top-Ethereum-Ökosystem-Token am 28. Dezember: MATIC, LINK und AXS appeared first on BitcoinMag.de.