Telegram würde sich lieber aus Märkten wie Frankreich zurückziehen, als Hintertüren zur Verschlüsselung privater Nutzernachrichten zuzulassen, so der Telegram-CEO Pavel Durov.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Telegram würde sich lieber aus Märkten wie Frankreich zurückziehen, als Hintertüren zur Verschlüsselung privater Nutzernachrichten zuzulassen, so der Telegram-CEO Pavel Durov.

Bitcoin’s recent climb, momentarily cresting $87,700, is drawing significant attention, with prominent analysts pointing towards macroeconomic shifts and potential government actions as key drivers that could propel the cryptocurrency well beyond the $100,000 threshold.

The convergence of a weakening US dollar, anticipated US Treasury debt buybacks, and sustained institutional interest is painting an increasingly bullish picture for the digital asset.

A primary factor supporting Bitcoin’s ascent is the declining value of the US dollar, which recently touched lows not seen since March 2022.

As the dollar weakens, assets like Bitcoin often become more appealing to global investors seeking a hedge against fiat currency devaluation.

Adding potent fuel to this narrative is the prospect of the US Treasury repurchasing its own debt.

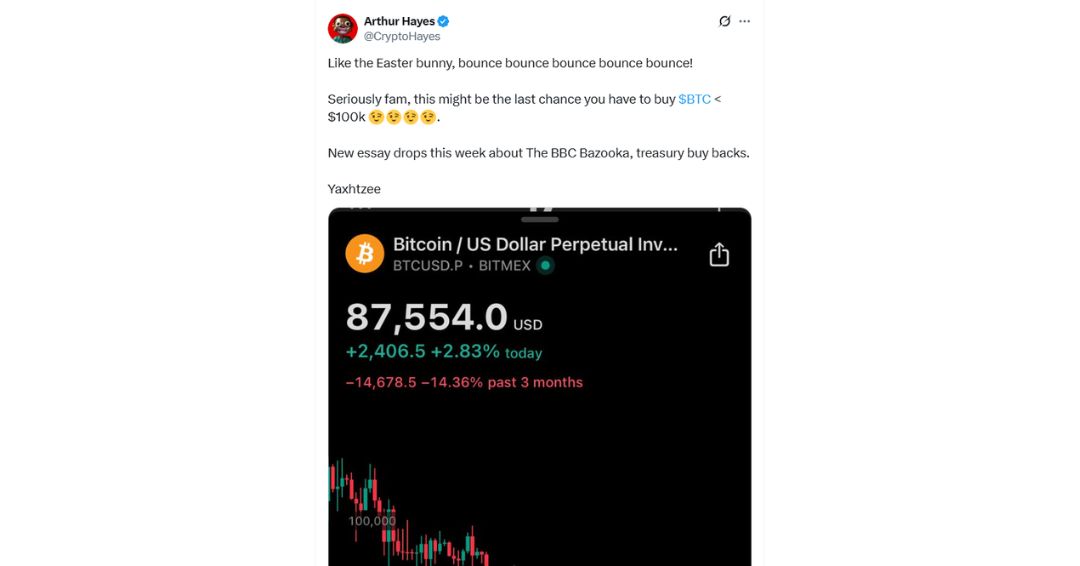

Arthur Hayes, the influential co-founder of BitMEX and current CIO of Maelstrom, has highlighted this potential move as a significant catalyst.

He posited that upcoming Treasury buybacks could inject substantial liquidity into the financial system, effectively acting as a “bazooka” for Bitcoin’s price.

Hayes went so far as to suggest this period might represent the “last chance” for investors to acquire Bitcoin below the $100,000 mark, anticipating that these buybacks could easily push the price past that psychological barrier.

The bullish sentiment finds resonance in technical analysis and continued institutional adoption.

Ryan Lee, Chief Analyst at Bitget Research, noted that Bitcoin’s price chart recently completed a “descending wedge breakout,” a technical pattern often interpreted as supportive of further upward movement.

This technical picture is complemented by Bitcoin’s growing correlation with gold, another traditional safe-haven asset, which itself has surged nearly 30% this year.

Furthermore, global institutional appetite for Bitcoin appears unwavering despite recent price volatility.

Reports indicate that investment firms, notably from Japan and the UK, have maintained their commitment, channeling capital into the cryptocurrency.

This sustained institutional inflow signals enduring confidence in Bitcoin’s long-term value proposition.

As Bitcoin tests resistance levels nearing $90,000, some analysts are setting their sights considerably higher.

Jamie Coutts of Real Vision forecasts that expanding fiat money supply (M2) could drive Bitcoin to as high as $132,000 by the end of the year.

This projection finds company with analysis from economist Timothy Peterson, who, citing historical market patterns, suggests Bitcoin could potentially reach $138,000 within the next three months.

The intricate macroeconomic picture is further complicated by the political landscape.

President Donald Trump’s public calls for the removal of Federal Reserve Chair Jerome Powell have intensified market expectations of potential interest rate cuts.

Such cuts, aimed at stimulating the economy, would likely exert further downward pressure on the US dollar, potentially creating an even more favorable environment for Bitcoin’s price appreciation.

Despite the confluence of positive indicators, some market observers urge caution regarding short-term price action.

Analyst Michaël van de Poppe warned that weekend rallies can sometimes prove ephemeral and that Bitcoin might face a pullback before decisively conquering key resistance zones.

The $91,000 level is widely seen as the next significant hurdle.

Until Bitcoin firmly establishes itself above this mark, the possibility of short-term corrections remains.

Nonetheless, the combination of weakening fiat dynamics, anticipated liquidity injections via Treasury buybacks, robust institutional support, and supportive technical patterns creates a compelling narrative for Bitcoin’s continued ascent towards, and potentially well beyond, the $100,000 milestone.

The post Bitcoin eyes $100K? Hayes cites treasury buybacks, weak dollar as catalysts appeared first on CoinJournal.

Bitcoin steigt heute deutlich über 87.500 US-Dollar. Doch wie könnte die Kursrallye jetzt Fortsetzung finden?

Der Bitcoin-Kurs hat seinen höchsten Stand seit Ende März erreicht. Der Vermögenswert steht kurz vor einem Ausbruch.

Bitcoin and Solana have emerged as top performers as crypto majors and meme tokens strive to recover. While investors shift to Bitcoin for its stability, Solana has become a key player in DEX trading.

At the same time, investors are on the look out for fresh projects with robust growth potential. PepeX, which has emerged as one of the top meme ICOs to watch out for in 2025, offers its holders an irresistible opportunity to rake in hefty gains during its presale and beyond. Its infrastructure seeks to restore transparency, fairness, and accessibility in the meme crypto space.

Bitcoin price began the new week on a high; rallying to a three-week high in early Monday session. Since hitting a five-month low two weeks ago, the crypto major has rebounded by about 17%. At the time of writing, it was trading at $87,488.

Despite the persistent economic uncertainties, bulls are optimistic that Bitcoin price will soon retest the crucial zone of $90,000. CoinGecko’s 2025 Q1 crypto industry report showed that despite the drop in investor activity, Bitcoin’s dominance in the cryptocurrency space hit a level last recorded in early 2021 at 59.1%.

Having rebounded past the 25 and 50-day EMAs, the bulls have an opportunity to retest the crucial support-turn-resistance zone of $90,000. However, the bulls will need to gather enough momentum to break the immediate-term resistance at $89,075. On the lower side, $82,959 is set to offer steady support to Bitcoin price.

AI-related cryptocurrencies have captured investors’ attention as they look past the majors for projects with robust growth potential. In the past 24 hours, AI meme market cap rose by 6.5% to $2.34 billion.

Notably, most of these fresh projects are moving past meme jokes to offer solutions to existing challenges within the crypto space. PepeX is one such crypto. As the world’s first AI-powered tokenization launchpad, it seeks to solve the persistent issues of security, fairness, and transparency. Indeed, it comes at an opportune time and investors are taking note of it.

In the recent past, platforms like Pump.fun have allowed pump-and-dump schemes that saw investors lose hefty amounts of money. To solve this issue, PepeX has integrated anti-sniping tools and a bubble map tool to discourage early dumping and any shady launches. Besides, the creators’ holdings are capped at 5% of the total supply, which they could lose to its community should the project fail.

This one-of-a-kind infrastructure has attracted the attention of meme coin enthusiasts, enabling it to raise over $1.4 million just four weeks into its presale. In addition to its real-world use case and subsequent growth potential, early adopters have an opportunity to rake in huge gains during the 30-stage presale.

With every three-day stage, the token price increases by 5%. What started at $0.02 is currently at $0.0243 and is set to rally further to $0.0823 before the token hits the public shelves in Q3. Read more on how to buy PepeX.

In the recent months, altcoins and meme coins have been under selling pressure. However, as the assets find their footing, Solana has emerged as one of the top performers.

Notably, its dominance in the decentralized exchange (DEX) space has fueled its recovery. As highlighted by CoinGecko, Solana dominated DEX trades at a rate of 39.6% in Q1’25.

A look at its daily chart shows Solana price trading above the 25 and 50-day EMAs. In the short term, I expect $126.90 to be a steady support zone as the bulls strive to break the resistance at $144.50. If successful, the next target will be at $155.

The post PepeX maintains upside momentum as Bitcoin, Solana dominate the majors appeared first on CoinJournal.