The crypto market continues to struggle with downward pressure, with over $230 million in liquidations recorded in a single day.

Per data from Coinglass, total liquidations were up 157% in the past 24 hours. Over this period, more than 95,478 traders had been liquidated.

At the time of writing, the total liquidations stood at $232 million. Data showed the largest single liquidation order coming in on Binance for an ETH/USDT position valued at $5.59 million.

ETH, XRP and SOL liquidations

The crypto market’s total capitalization stands at $2.8 trillion, with Bitcoin’s dominance at 58.9%.

However, the latest wave of liquidations has hit traders hard, particularly those convinced the price was on the upward mend.

With leveraged positions largely longs, most of the rekt positions were bullish bets. Coinglass data shows over $73 million and nearly $44 million are for Bitcoin and Ethereum.

XRP and Solana also witnessed huge liquidation.

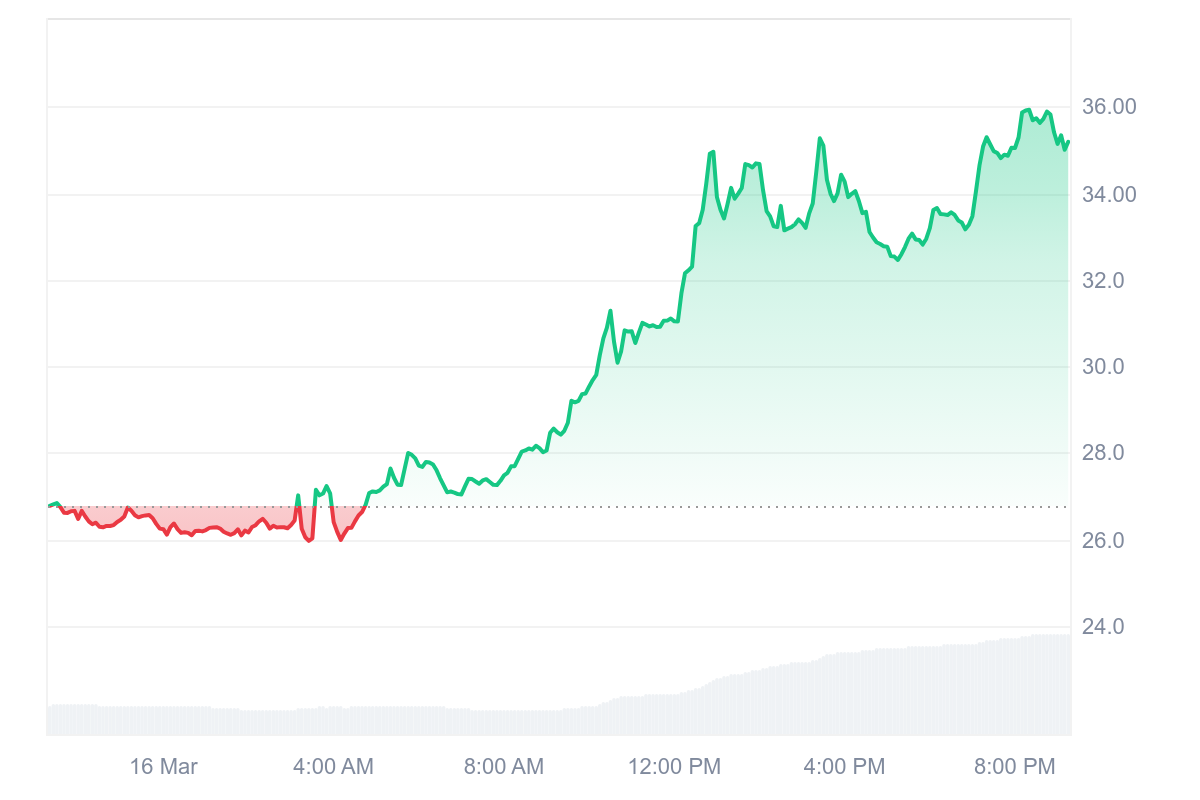

Crypto price outlook

As noted, Bitcoin (BTC) saw over $73 million in liquidations. This followed another massive short position for BTC, with a whale taking a 40x leverage. The whale’s liquidation is above $86,000. BTC price currently hovers around $83,316. What happens to the whale?

Crypto trader and analyst Ash Crypto notes an announcement from Strategy founder Michael Saylor buying more BTC could see the $380 million whale record substantial losses.

“If Saylor announces that he is buying $2 billion Bitcoin soon or even hints it, $380 million 40x short whale will get liquidated in a single candle,” the analyst posted on X.

Another analyst shared:

🚨 Breaking: The whale who opened a $320M short on $BTC at $84,040 yesterday has set take profits:

1st TP: $69,414

2nd TP: $58,664I hope he and everyone who copied his trade get liquidated, triggering a cascade of liquidations to pump the market pic.twitter.com/tIQ31T9T9x

— 𝗰𝘆𝗰𝗹𝗼𝗽 (@nobrainflip) March 16, 2025

Currently, Bybit, Binance and OKX lead the total liquidations mark.

As bulls plot to fell the bears, the rising liquidations underscore the risks of leverage. In a volatile market, millions or even billions could get wiped out in hours.

The post Crypto market sees over $230 million in liquidations appeared first on CoinJournal.