- The SEC has received six XRP ETF applications over the last several weeks as interest in traditional crypto investment vehicles continues rising

- Coinshares sent a proposal for XRP and Litecoin ETFs while Grayscale sent one for XRP amid several proposals for Solana ETFs

The SEC has received no less than six applications for XRP exchange-traded funds (ETFs) from major issuers like Canary Capital, Grayscale, Bitwise, WisdomTree, 21Shares, and Coinshares.

The latest application, Grayscale, began the 21-day comment period on Friday where members of the public can submit feedback on the proposed ETF.

While this happens, five Solana ETF applications from 21Shares, Bitwise, Grayscale, VanEck, and Canary await a decision.

The rise of interest in ETFs

The recent swarm of ETF applications is emblematic of a shift in the regulatory landscape to a more friendly environment. This shift began at the twilight of former Securities and Exchange Commission (SEC) chair Gary Gensler’s tenure with the approval of the Bitcoin and Ethereum ETFs in 2024.

Now that Mark Uyeda, a pro-crypto official, is in office, combined with the most pro-crypto Congress the US has ever seen, the regulatory landscape is expected to be friendlier. Furthermore, Ripple Labs’ win against Gensler’s SEC has also placed it in a favourable growth position.

President Donald Trump signed an executive order to create a sovereign wealth fund that will include cryptocurrencies. While Bitcoin is expected to be on the list, recent developments may place XRP in the fund as well.

In January, Trump met with Brad Garlinghouse, CEO of Ripple, who is pushing for the sovereign wealth fund to contain more than one cryptocurrency, ideally XRP as well.

Some thoughts on maximalism… let me say this as clearly as I can – the crypto industry has a real shot, here and now, to achieve the many goals we have in common, IF we work together instead of tearing each other down. This is not, and never will be, a zero-sum game.

• I own…

— Brad Garlinghouse (@bgarlinghouse) January 27, 2025

An XRP ETF approval could cement the crypto as a candidate for the reserve.

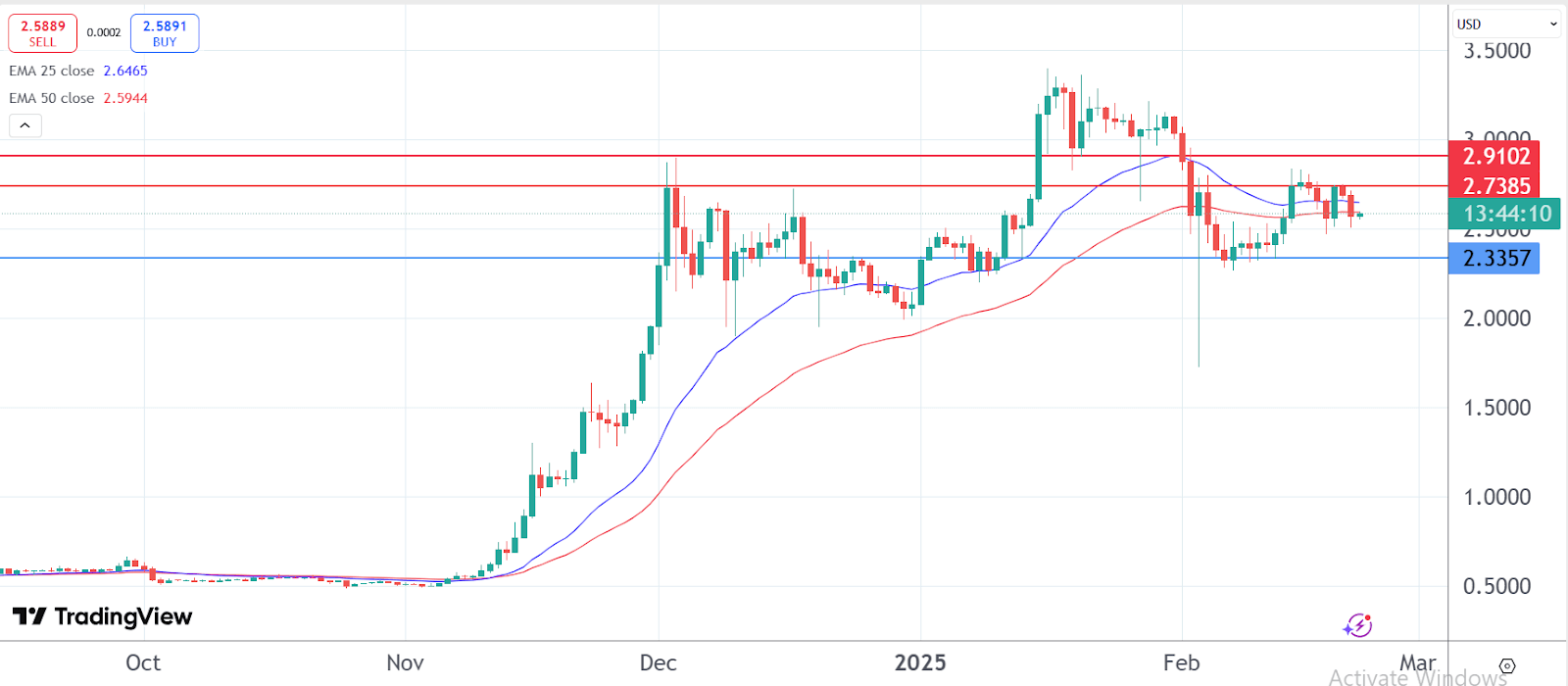

Ripple is the third largest crypto by market cap and trades at $2.48 as of publishing.

Litecoin ETF approval

Despite this, Bloomberg ETF analysts James Seyffart and Eric Balchunas believe that a Litecoin ETF has a 90% chance of being approved in 2025.

In a post on X, the pair mainly focused on Dogecoin, Litecoin, Solana, and XRP. In their view, Dogecoin ETF has a 75% chance of approval, a Solana ETF has a 70% chance, and an XRP ETF has a 65% approval rating.

Seyffart added that it’s unlikely the market will see an XRP ETF until the whole Ripple/XRP/SEC case is settled, finished, or has some sort of outcome.

“The SEC needs to untangle that mess,” he said.

The post The SEC mulls over XRP ETF applications as interest rises appeared first on CoinJournal.