Aya Miyaguchi, bisherige Geschäftsführerin der Ethereum Foundation, hat bekannt gegeben, dass sie ihre Rolle als Geschäftsführerin aufgibt und künftig als Präsidentin der Ethereum Foundation tätig sein wird.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Aya Miyaguchi, bisherige Geschäftsführerin der Ethereum Foundation, hat bekannt gegeben, dass sie ihre Rolle als Geschäftsführerin aufgibt und künftig als Präsidentin der Ethereum Foundation tätig sein wird.

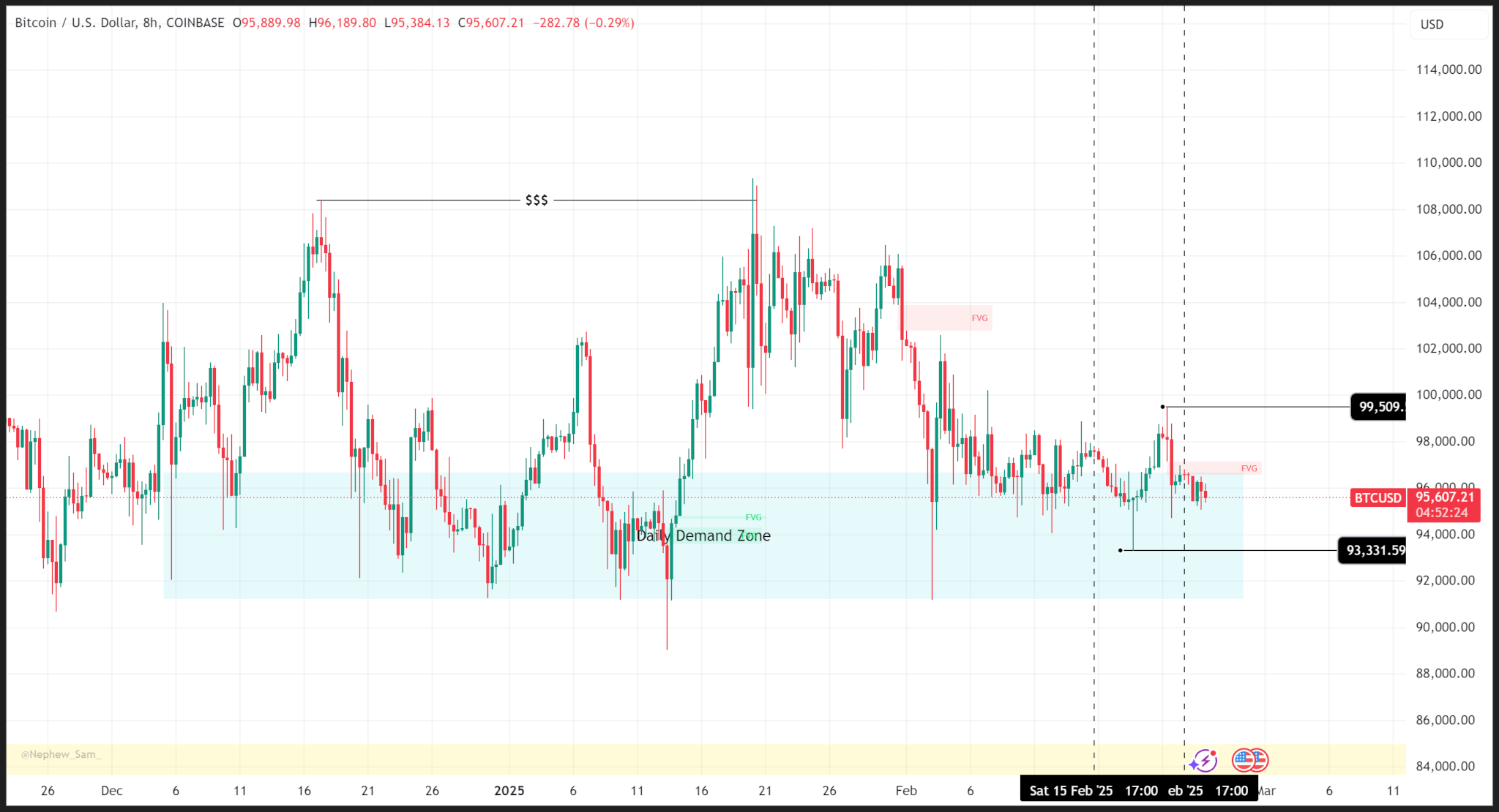

Bitcoin’s price action continued trading rangebound, with weekly highs and lows of $99,509 and $93,331, as uncertainty looms around inflation, US President Donald Trump’s policies, and geopolitical events.

Zooming out, we see that price action has ranged at the daily support level for the last three weeks as current market conditions lack sufficient catalyst to push prices to new highs.

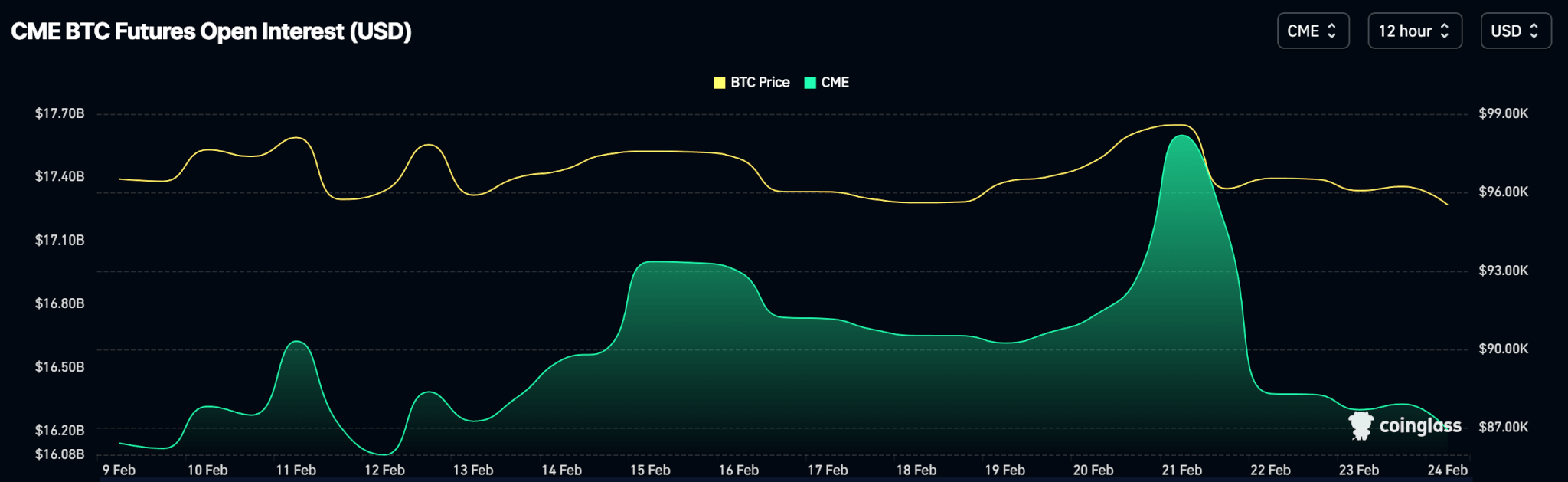

Open interest mimics price action as the week began with a reduction in the volume of open contracts which picked up on Wednesday, February 19, congruent with price action.

Bitcoin must remain above the daily support of $90,673 to remain in bullish territory. A close below this level on the daily time frame could trigger a fall to the $84,000 level.

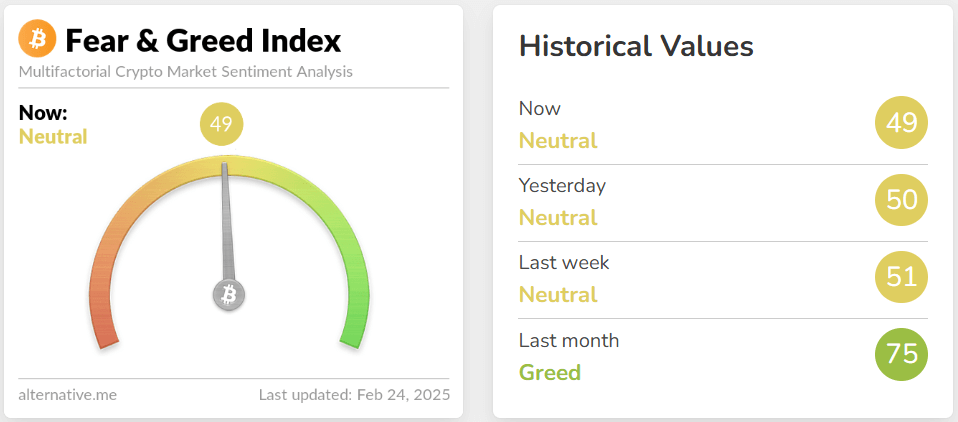

Meanwhile, market sentiment has cooled significantly over the last month and is in neutral territory.

Bitcoin trades at $87,900 as of publishing.

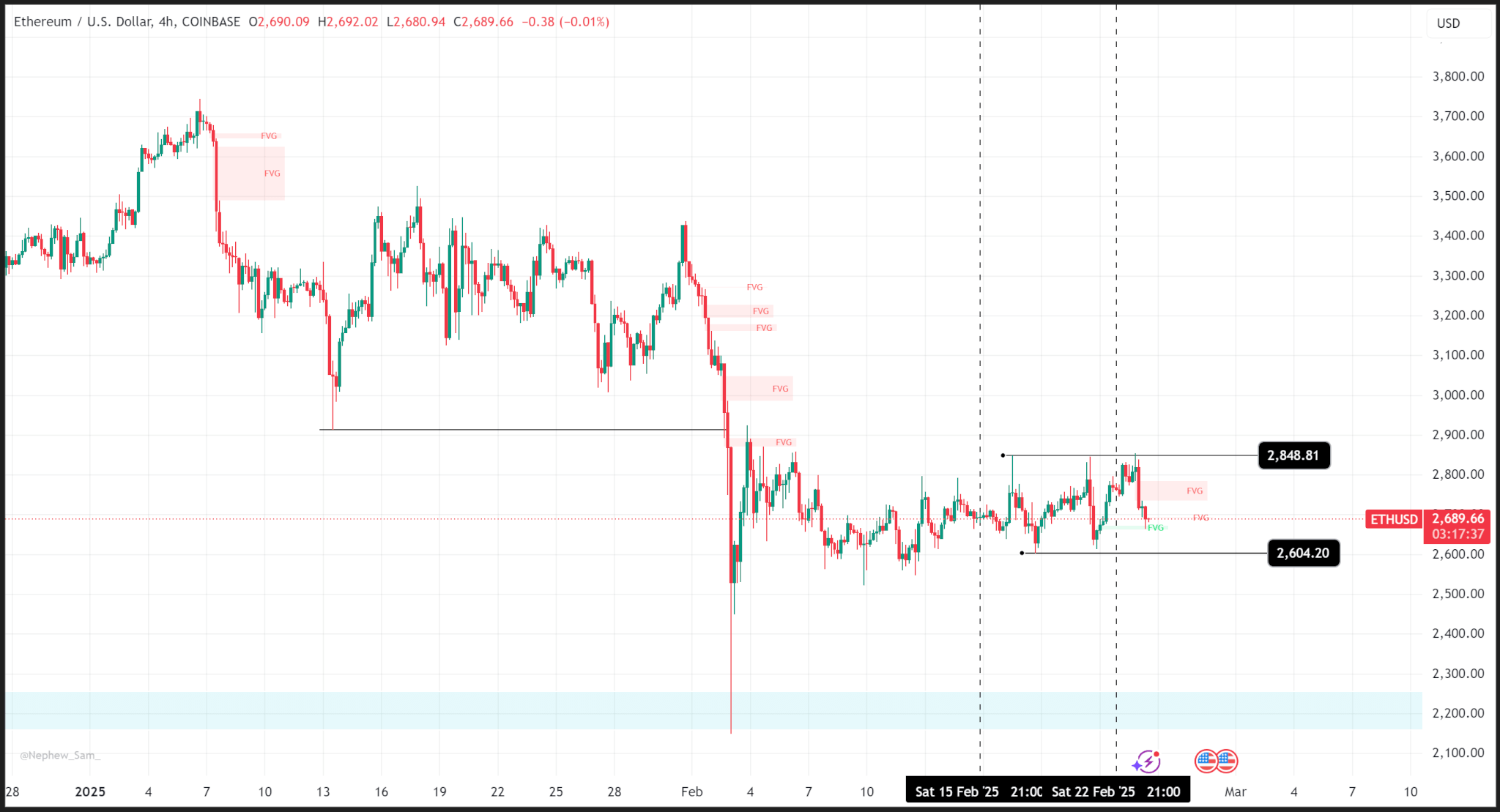

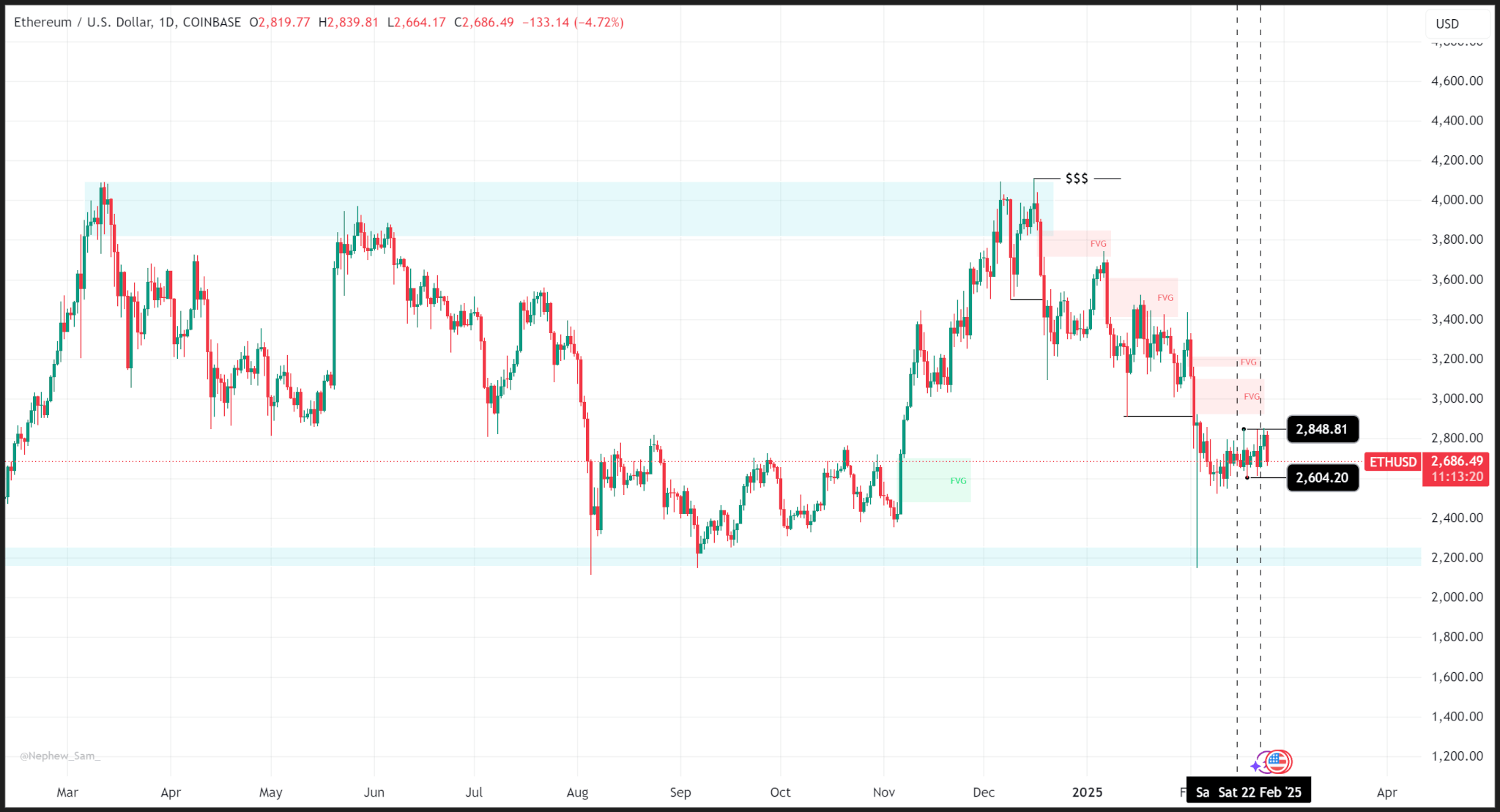

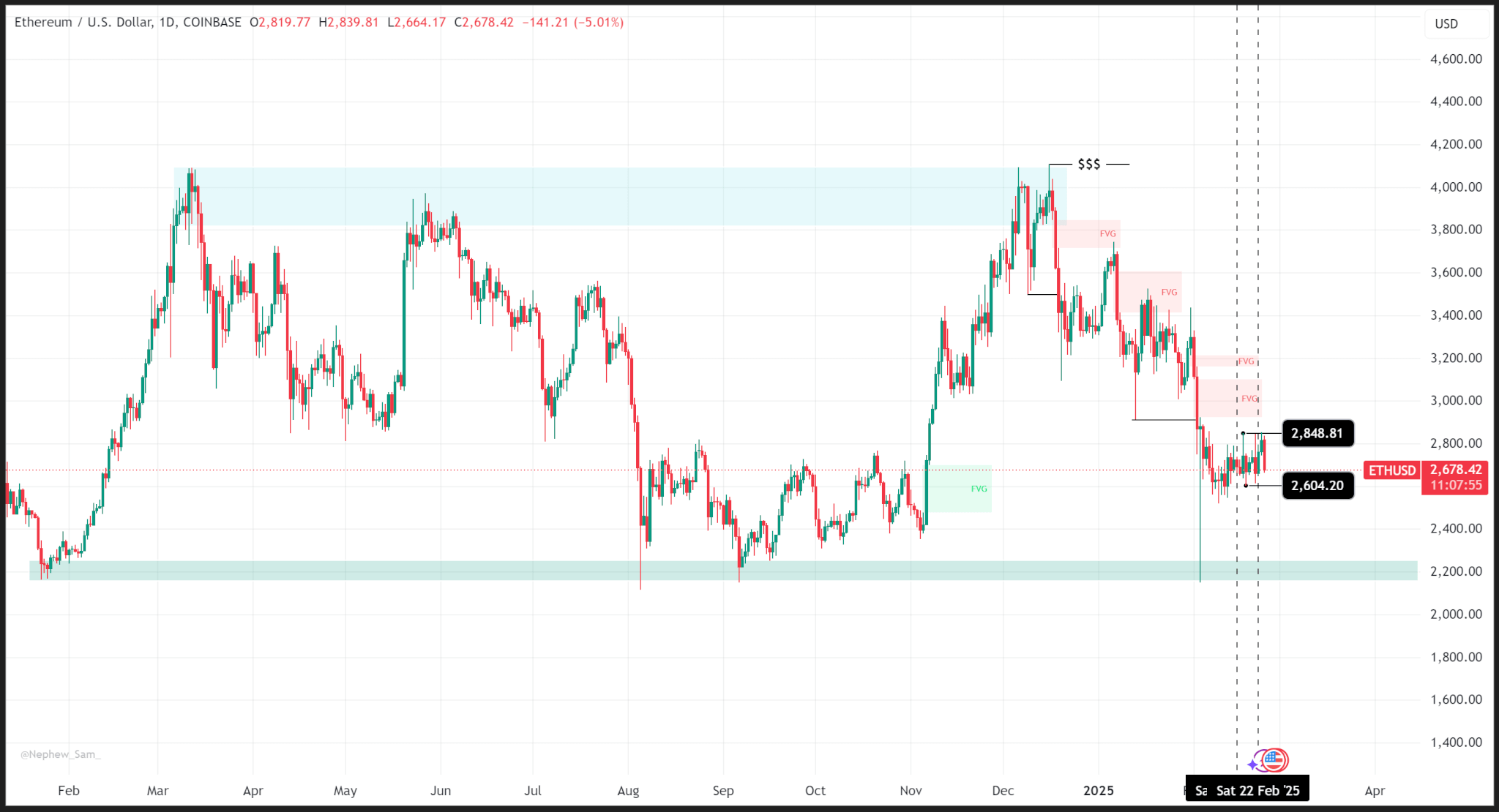

Ethereum’s price action ranged last week logging a weekly high and low of $2,848 and $2,604 despite last week’s news of the Bybit hack.

Zooming out, we see a bleaker picture as ETH has been trending lower since December 09 after failing to break above its March 2024 high.

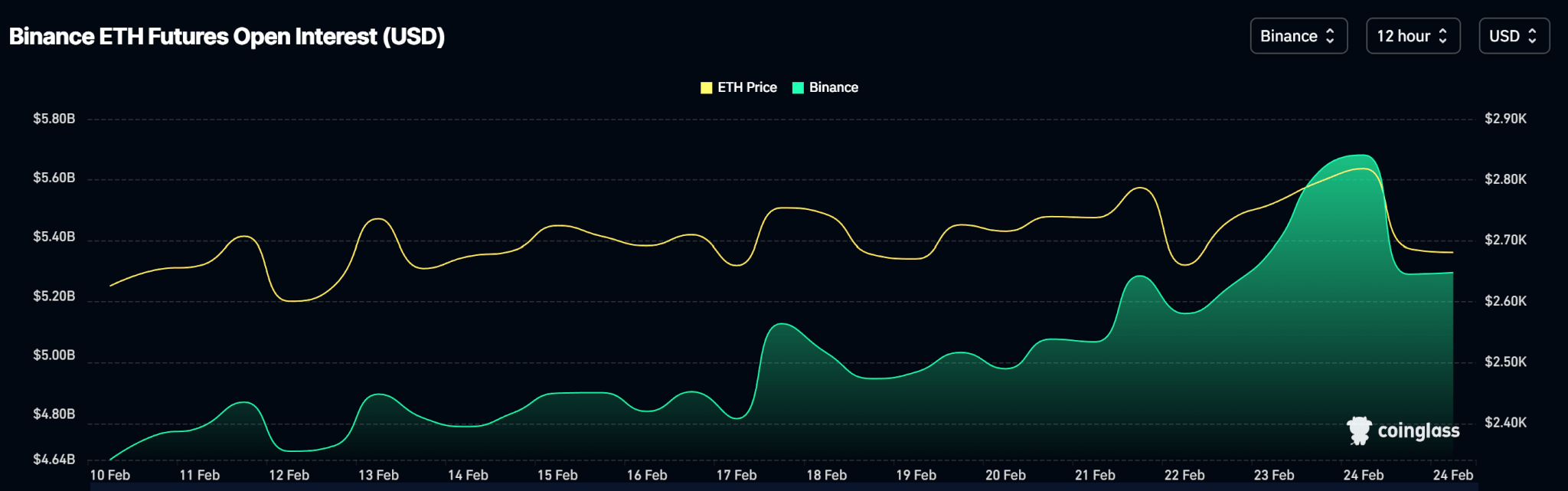

Open interest data shows a steady rise in contract volume throughout the week though price traded rangebound.

We reckon the next major support zone for ETH is the $2,500 level which has proven to be a strong liquidity level in the past.

ETH trades at $2,384 as of publishing.

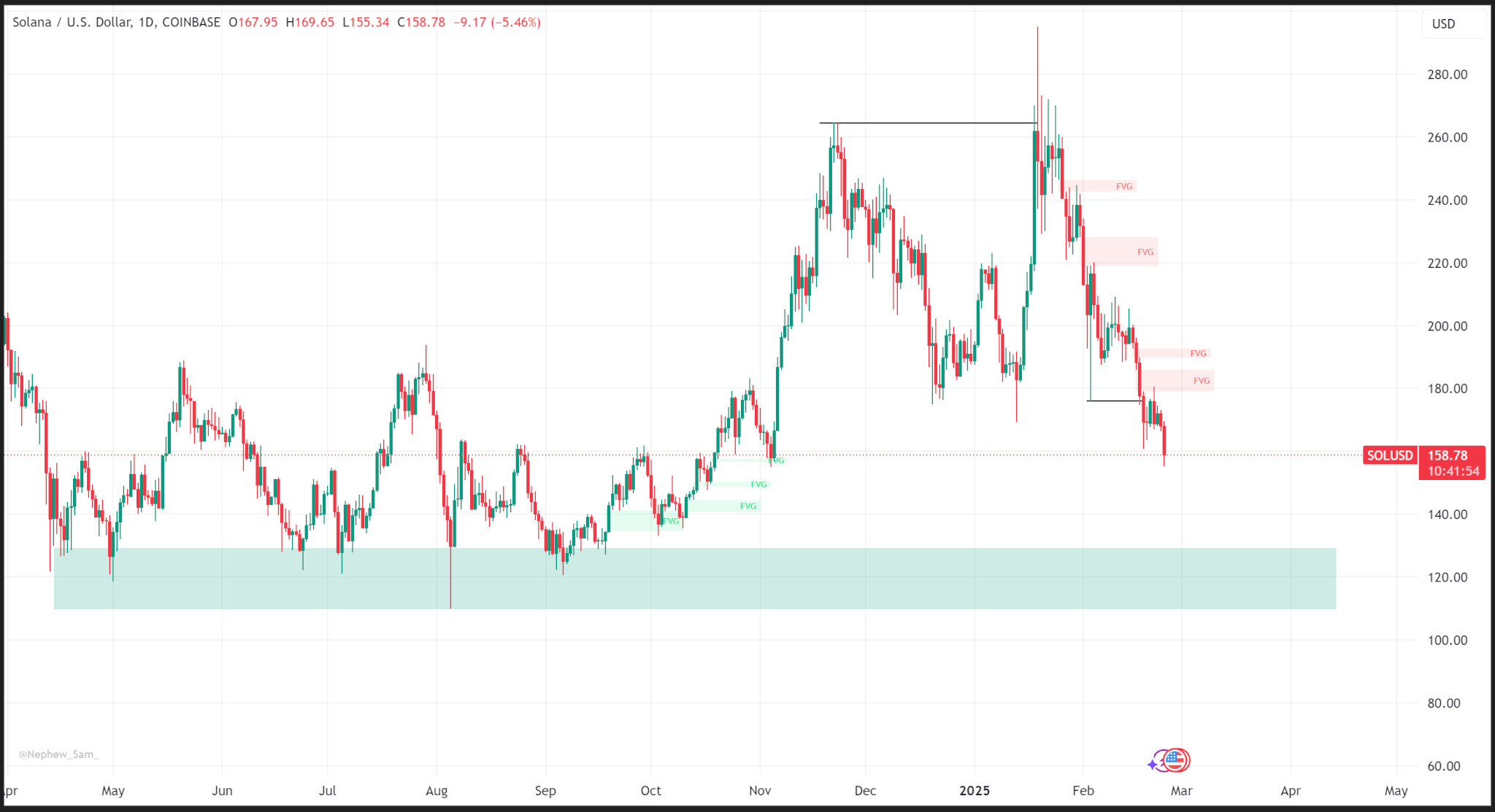

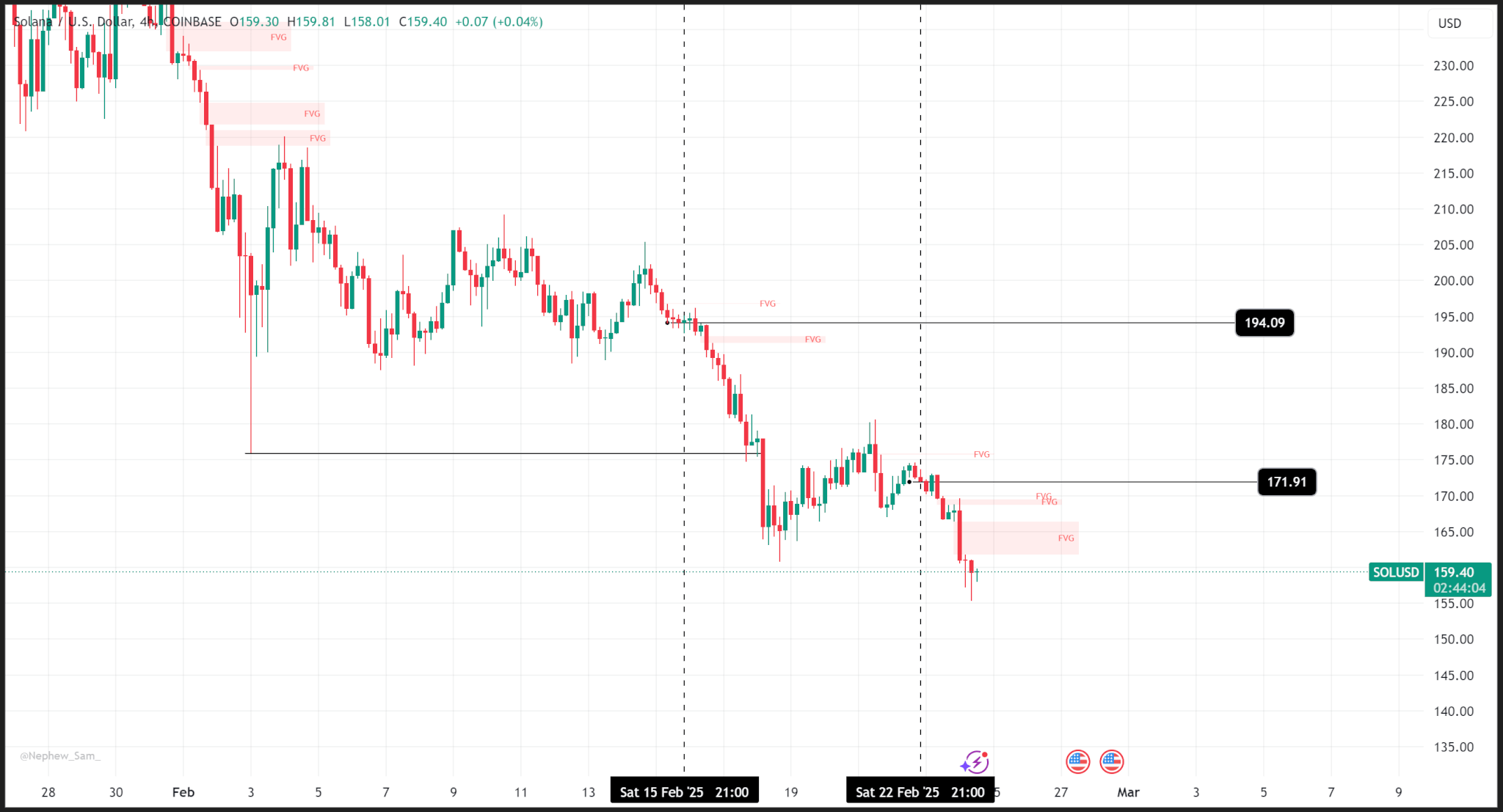

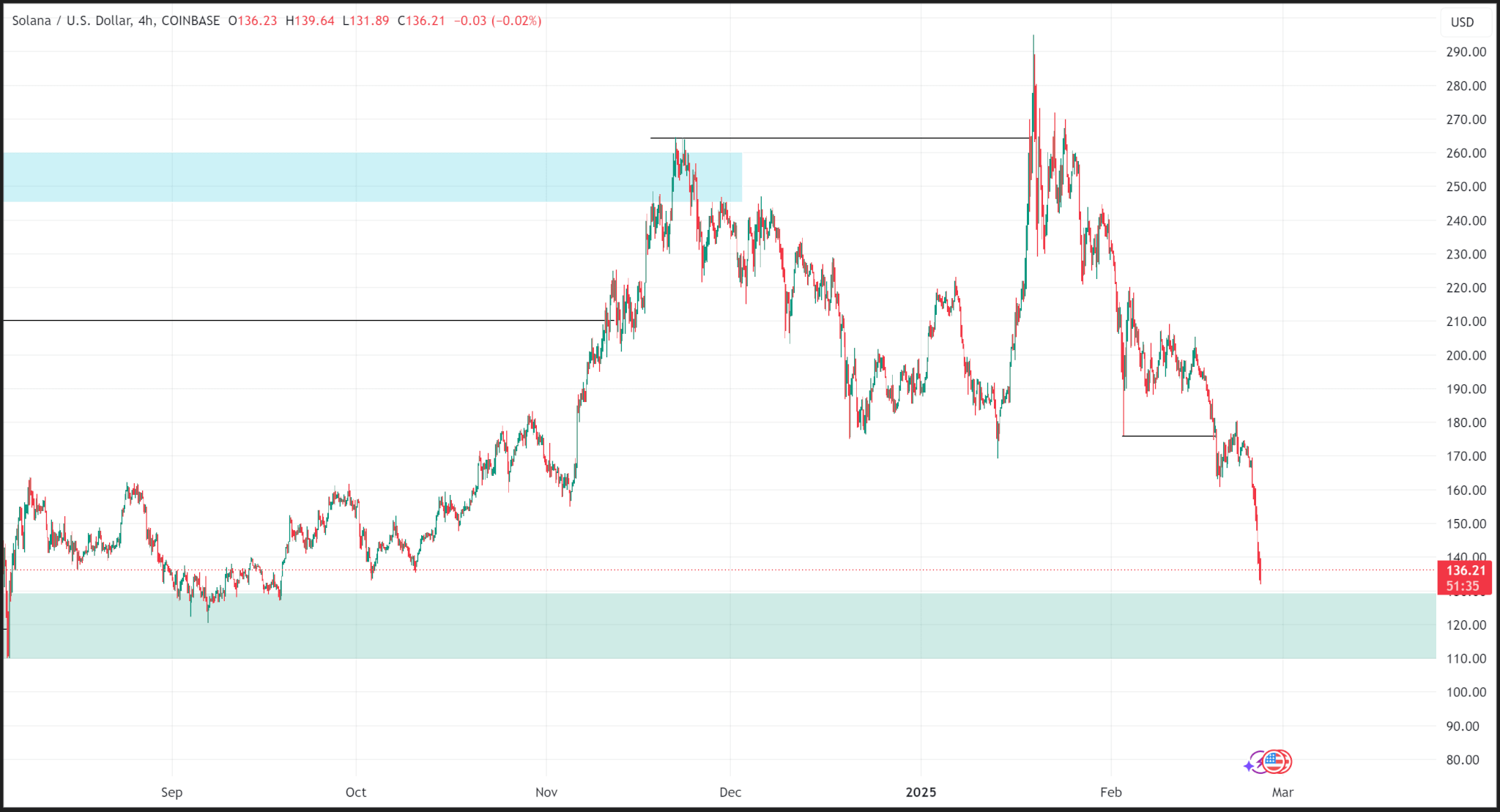

Like Ethereum, Solana’s price has been declining since it failed to swing higher and form new candles above the last all-time high on the daily time frame.

Unlike Ethereum, last week’s price action was bearish as the price fell from a weekly open around $194 to a close around $171.

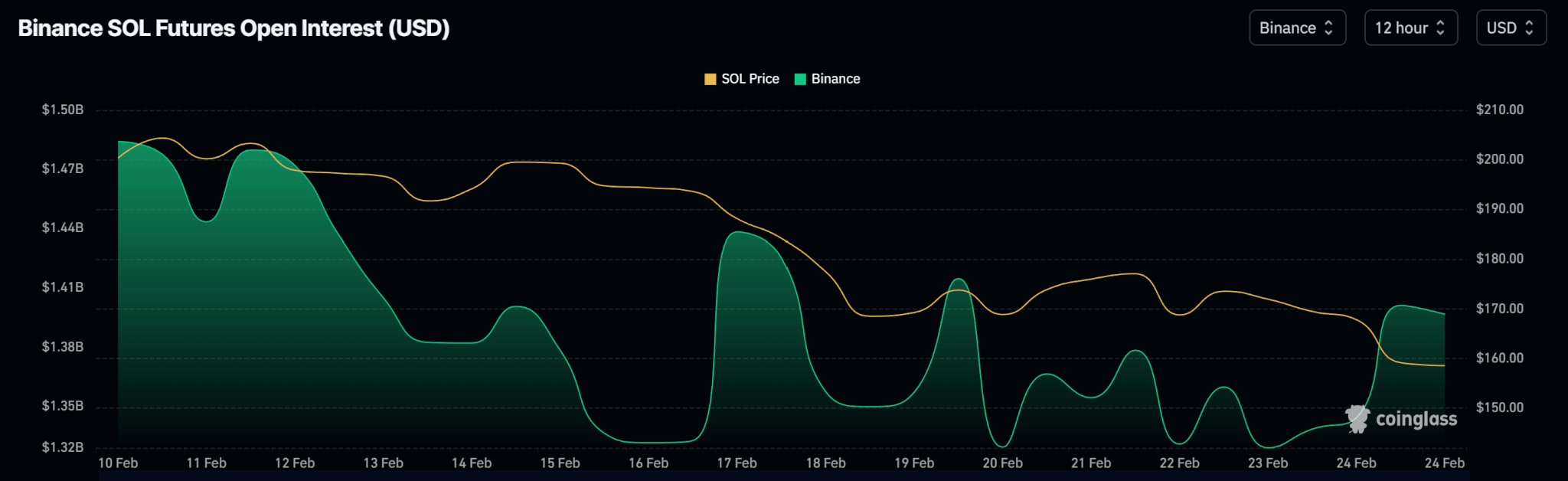

Open interest charts show topsy-turvy movement in open contract volumes as the price falls.

The next major support zone for Solana is at the $129 level. However, we may see smaller rallies as price trends lower overall.

The post Weekly price analysis: prices range on uncertain economic outlook appeared first on CoinJournal.

Adressen, die mit dem Bybit-Exploit in Verbindung stehen, tauschten über DEXs ETH im Wert von 3 Millionen US-Dollar in DAI.

Bitflow, a decentralized exchange built on the Stacks ecosystem, has unveiled Automated Dollar-Cost Averaging (DCA), a groundbreaking feature that introduces AI-driven investment strategies to Bitcoin and its associated assets.

The automated DCA allows users to automate recurring purchases of Bitcoin (BTC), stablecoins, Stacks’ native STX token, sBTC, and popular Runes tokens like $DOG, all while retaining complete control over their funds.

Designed to simplify and enhance participation in the growing Bitcoin-native economy, Bitflow’s latest offering marks a significant milestone in decentralized finance (DeFi) on the Stacks Layer 2 network.

At the heart of the Automated Dollar-Cost Averaging (DCA) is Bitflow Keepers, an intelligent automation engine that powers the DCA feature. This technology enables trustless, recurring transactions without requiring users to time the market or execute trades manually.

By supporting a wide range of assets, including SIP-10 tokens and the memecoin sensation $DOG (DOG•GO•TO•THE•MOON), Bitflow ensures that users can diversify their portfolios seamlessly.

For the first time, DeFi enthusiasts on Stacks can program their investment strategies, transforming Bitcoin into a dynamic, yield-generating asset.

Particularly, Bitflow’s non-custodial design keeps transactions fully onchain, providing transparency and security while eliminating dependence on third-party intermediaries.

Dylan Floyd, Bitflow’s Co-Founder and Lead Developer, emphasized the transformative potential of this feature, noting that Bitcoin DeFi is entering a new era of automation, where users can harness advanced tools to grow their holdings efficiently.

Notably, the Automated DCA feature is the first step in a roadmap aimed at integrating AI-driven automation into DeFi. Upcoming enhancements will include automated yield farming strategies, enabling users to optimize returns on BTC-based assets without constant oversight.

Plans are also in place for market-triggered swaps, which will allow traders to set conditions for executing transactions based on price movements or volatility, adding a layer of sophistication to Bitcoin trading.

Additionally, Bitflow intends to improve liquidity by facilitating seamless asset transfers between Bitcoin’s Layer 1 and Stacks’ Layer 2, bridging the gap between the two ecosystems.

This ambitious agenda underscores Bitflow’s role as a pioneer in the Stacks ecosystem, where it serves as a liquidity hub for trading Bitcoin assets.

By incorporating Runes and SIP-10 tokens into its decentralized exchange, Bitflow is broadening the scope of Bitcoin-native finance, appealing to both seasoned traders and newcomers looking for efficient ways to engage with the market.

The post Bitflow brings AI-powered DeFi to Stacks with Automated DCA for Bitcoin and Runes appeared first on CoinJournal.

On February 22, 2025, Montana’s House of Representatives decisively voted down House Bill No. 429, a proposal that aimed to establish Bitcoin (BTC) as a state reserve asset.

The 41-59 vote marked a significant setback for advocates of integrating cryptocurrency into Montana’s financial strategy, highlighting a deep divide over the role of digital assets in public finance.

Introduced by Representative Curtis Schomer earlier in February, the bill sought to diversify the state’s investment portfolio by creating a special revenue account. This account would have allowed the state treasurer to allocate up to $50 million for investments in stablecoins, precious metals, and cryptocurrencies with a market capitalization exceeding $750 billion over the past year, a threshold currently met only by Bitcoin.

Supporters argued that such a move could yield higher returns than traditional bond investments, positioning Montana as a forward-thinking player in the evolving financial landscape.

Despite clearing the House Business and Labor Committee on February 19 with a 12-8 vote, backed by Republicans and opposed by Democrats, the bill faced stiff resistance during its second reading in the House.

Fiscal conservatives, including many Republicans, voiced concerns over the speculative nature of Bitcoin, emphasizing the state’s duty to protect taxpayer money.

Representative Steven Kelly captured this sentiment during the House Floor Session, stating, “It’s still taxpayer money, and we’re responsible for it. We need to protect it. These types of investments are way too risky.”

Representative Jane Gillette echoed these doubts, pointing out that the bill lacked clear guidelines on how the funds would be managed, while Representative Bill Mercer warned that Bitcoin’s history of dramatic price swings made it an imprudent choice for public funds.

On the other side, advocates like Representative Lee Demming argued that embracing digital assets could safeguard Montana’s reserves against inflation and bolster long-term financial growth, a perspective shared by Bitcoin proponents nationwide.

The rejection of HB 429 effectively kills the proposal for now, requiring any future efforts to start anew in Montana’s legislature.

Montana’s decision stands in contrast to a growing trend among US states exploring Bitcoin as a reserve asset.

Approximately 24 states, including Utah, Arizona, Oklahoma, Texas, and Ohio, have introduced similar legislation, with Utah’s HB230 making the most progress by allowing up to 5% of public funds to be invested in digital assets.

Nationally and globally, the push for Bitcoin reserves is gaining traction, with countries like Switzerland, Brazil, Japan, and Russia also weighing the cryptocurrency’s potential as a strategic asset.

Dennis Porter, CEO of the Satoshi Action Fund, which collaborated with Montana legislators like Schomer and Senator Daniel Zolnikov, expressed disappointment with Montana’s move but remained optimistic about the broader movement. He noted that Bitcoin’s decentralized structure and limited supply make it an attractive hedge against economic uncertainty.

The post Montana house representatives reject Bitcoin reserve bill appeared first on CoinJournal.