- PancakeSwap (CAKE) today surged by 64.58%, hitting an intraday high of $3.16.

- Binance ecosystem resurgence has been a major boost for PancakeSwap.

- Whale moves signal CAKE price optimism.

PancakeSwap’s native token, CAKE, has seen a remarkable surge, jumping from an opening price of $1.92 to an intraday high of $3.16 according to CoinGecko data, marking a 64.58%.

Trading currently at around $3, CAKE’s price movements reflect a broader market optimism that is driven by several specific catalysts unique to PancakeSwap and the BNB Chain ecosystem.

Surge in trading volume on BNB Chain

The primary driver behind CAKE’s price increase is the resurgence in activity on the BNB Chain.

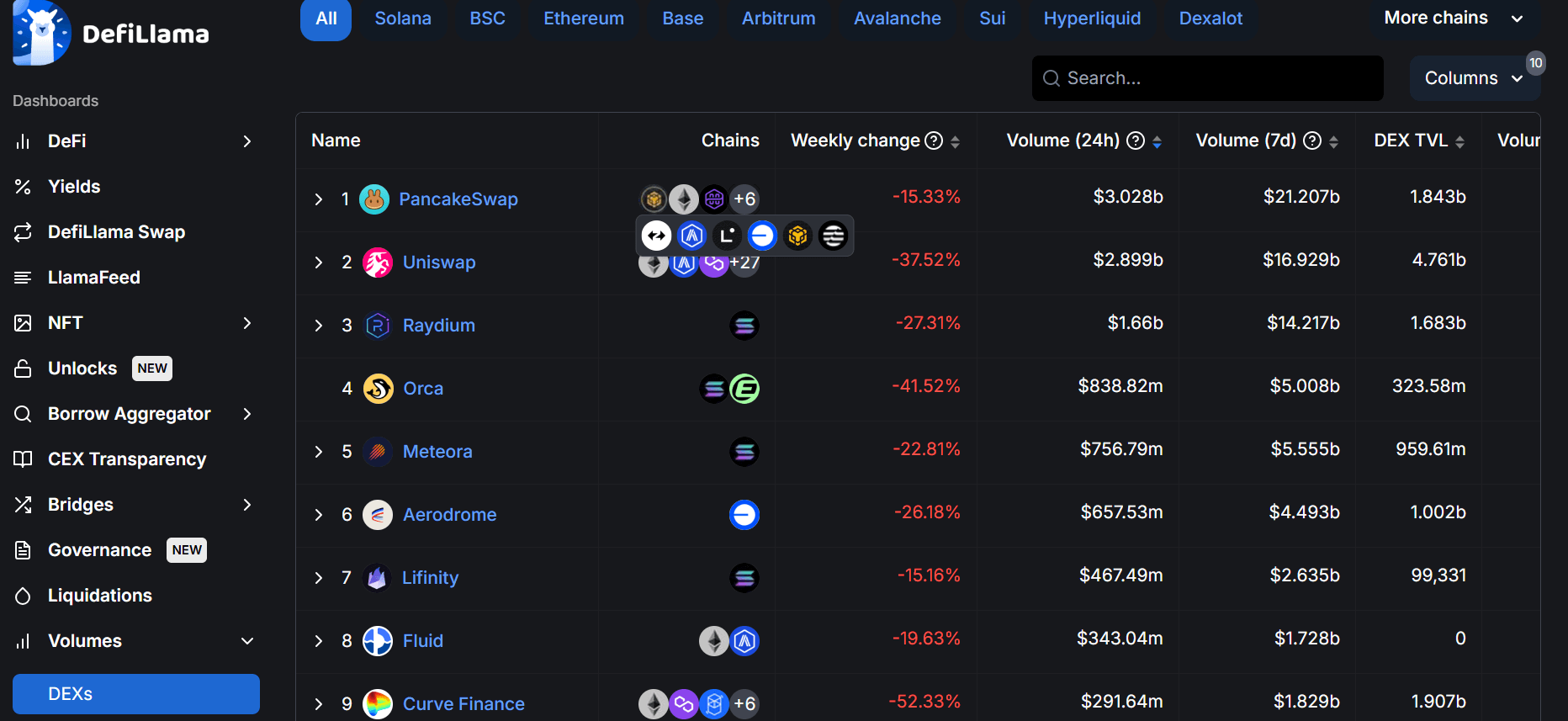

PancakeSwap has outperformed decentralized exchanges (DEXs) on nine chains including BSC, Ethereum, Polygon zkEVM, and Abirtum in terms of trading volume, both on a weekly and daily basis.

This spike in volume is a direct result of renewed user interest in the BNB Chain, which has been witnessing a revival. It can also be attributed to the weekly CAKE revenue-sharing model that has been distributing significant CAKE tokens to revenue-sharing pool participants weekly, with the most recent distribution occurring on February 13.

🎉 30,493 CAKE has been distributed to all revenue-sharing pool participants!

🆕 veCAKE is now live – claim your rewards weekly, including revenue shares!

⏳ Lock or migrate your CAKE by Feb 19, 23:59 UTC to start earning revenue shares, claimable from Feb 27.

🔗 Claim… pic.twitter.com/OsU5f9toBp

— PancakeSwap (@PancakeSwap) February 13, 2025

The increased activity has not only bolstered the platform’s liquidity but also enhanced the utility and demand for CAKE.

Binance’s influence

Binance, which controls nearly 55% of cryptocurrency trading activity, has also significantly contributed to PancakeSwap’s price surge. The exchange’s success directly benefits platforms like PancakeSwap, which are part of the broader Binance ecosystem.

Additionally, Binance’s decision to resuscitate its decentralized ecosystem, coupled with the launch of features that allow for the creation of meme cryptocurrencies, has funnelled more users and traders to PancakeSwap. This has made it a burgeoning hub for both established and new speculative tokens, thereby increasing the intrinsic value of CAKE.

Whale activity and positive market sentiment

Another notable factor in CAKE’s price rally is the activity from significant market players or “whales.”

Reports indicate that a former PancakeSwap advisor and BNB whale made substantial withdrawals of CAKE and other tokens from Binance, signalling optimism among whales.

As @cz_binance shilled about @BNBCHAIN, most of tokens on #BNB pumped & some whales have accumulated.

9 hours ago, @theveeman withdrew 500k $CAKE (~$1..21M) and 3.88M $TST (~$698k) from #Binance.

Address:https://t.co/SbosgzKKhc pic.twitter.com/UwUfqP1V2w

— The Data Nerd (@OnchainDataNerd) February 13, 2025

Influential figures’ moves often sway market sentiment, leading to increased buying pressure on CAKE.

Meme tokens and ecosystem expansion

PancakeSwap’s decision to list new memecoins like the Test Token (TST) has further fueled its growth.

Trade $TST, $TRUMP, $PEPE, & more on PancakeSwap Perpetual V2 and share $10,000

📅 Feb 13 – Mar 5

1️⃣ Lucky Draw: $3,000 – 60 winners, $50 Each

2️⃣ Leaderboard: $7,000 – Top 10 traders with the highest volume👉 Trade https://t.co/yRIZv9RSm8

📚 More https://t.co/GUghY3Vkd3 pic.twitter.com/e6KJZtUa6i

— PancakeSwap (@PancakeSwap) February 13, 2025

By expanding into the meme token space, which is popular among retail investors, PancakeSwap is not only diversifying its offerings but also tapping into a demographic known for driving high trading volumes.

This strategic move could transform PancakeSwap’s profile from primarily hosting blue-chip tokens to being a go-to platform for all types of cryptocurrencies.

With all these developments, the price of PancakeSwap (CAKE) could see more gains with the next key target being $3.66.

The post Why is PancakeSwap price rising today? appeared first on CoinJournal.