XRP steigt fast 20 % in einer Woche. Das Jahr 2025 beginnt bullisch. Analysten erwarten eine Rallye, die XRP über 10 US-Dollar treibt.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

XRP steigt fast 20 % in einer Woche. Das Jahr 2025 beginnt bullisch. Analysten erwarten eine Rallye, die XRP über 10 US-Dollar treibt.

Metaplanet is on a mission to boost its Bitcoin holdings to 10,000 in 2025 while leveraging its partnerships to boost Bitcoin adoption worldwide.

In a post on X, Simon Gerovich, CEO of Metaplanet, said that the Tokyo-listed company is aiming to “expand our Bitcoin holdings to 10,000 BTC by utilizing the most accretive capital market tools available to us.”

Reflecting on its 2024 performance, Gerovich highlighted that the company “broke records, expanded our Bitcoin treasury, and reinforced our position as Asia’s leading Bitcoin treasury company.”

Happy New Year to Our Valued Shareholders! As we step into 2025, I couldn’t be more excited about what lies ahead for Metaplanet. Last year was transformational, as we broke records, expanded our Bitcoin treasury, and reinforced our position as Asia’s leading Bitcoin Treasury… pic.twitter.com/K2HsOS8TaZ

— Simon Gerovich (@gerovich) January 5, 2025

Since May 2024, Metaplanet has been acquiring Bitcoin at a steady rate as a strategic treasury reserve. In June, it purchased $6.2 million worth of Bitcoin. This was followed by a $2.5 million purchase in July, a $7 million Bitcoin purchase in October, and an additional $11.7 million in November.

Its latest Bitcoin purchase was in late December totaling 620 Bitcoin for $60 million. To date, Metaplanet currently holds 1,761.98. In comparison, MicroStrategy holds 447,470 Bitcoin with its most recent purchase of $101 million taking place at the end of December 2024.

According to a December 23 notice from Metaplanet, it saw its Bitcoin yield reach nearly 310% between October 1, 2024 to December 23, 2024. This is compared to a 41% Bitcoin yield reached between July 1, 2024 to September 30, 2024.

On top of building its Bitcoin holdings, Gerovich added on X, among other things, that Metaplanet is focusing on building partnerships to “advance Bitcoin adoption in Japan and globally” while exploring “innovative opportunities to grow Metaplanet’s impact in Japan and the Bitcoin ecosystem.”

The post Metaplanet wants to boost its Bitcoin holdings to 10,000 in 2025 appeared first on CoinJournal.

Injective (INJ) has emerged as one of the standout crypto performers today, witnessing a significant price surge following the approval of its INJ 3.0 governance proposal.

The cryptocurrency has soared by around 13%, reaching a 24-hour high of $26.62, with a weekly gain of 27%, reflecting robust investor confidence in its prospects.

Today’s Injective price rally lies in the successful passage of the INJ 3.0 governance proposal, known as IIP-392, which was overwhelmingly supported by the Injective community with a 99.99% approval rate.

The IIP-392 proposal is set to dramatically reduce the circulating supply of INJ tokens, positioning it to become one of the most deflationary assets in the crypto space. The deflationary mechanism is expected to enhance the token’s value over time by reducing supply while demand potentially rises, a strategy that has historically buoyed asset prices in cryptocurrencies.

This governance move is not happening in isolation. It coincides with a broader market trend, particularly the enthusiasm around Bitcoin’s halving event, which often catalyzes interest in other cryptocurrencies, especially those with significant updates or innovations. Injective’s alignment with this event could be seen as strategic timing to capitalize on the market’s focus on deflationary tokens.

The market’s response has been overwhelmingly positive, with trading volumes for INJ jumping by 198% to $312.13 million, and a +17.67% increase in futures open interest to $200.32 million according to data from Coinglass, signalling not just short-term speculation but a belief in the long-term value proposition of Injective (INJ).

Injective’s commitment to reducing token supply through governance, coupled with its focus on AI, places it at the intersection of two highly sought-after trends in the crypto world.

While the outlook for INJ remains bullish, the volatile nature of cryptocurrency markets necessitates caution.

Investors should watch for the successful execution of the INJ 3.0 plans, alongside monitoring broader market sentiment, which can be swayed by global economic shifts or political events, such as the potential impact of a Donald Trump election win on tech stocks and cryptocurrencies.

The post Injective (INJ) soars after INJ 3.0 governance proposal approval appeared first on CoinJournal.

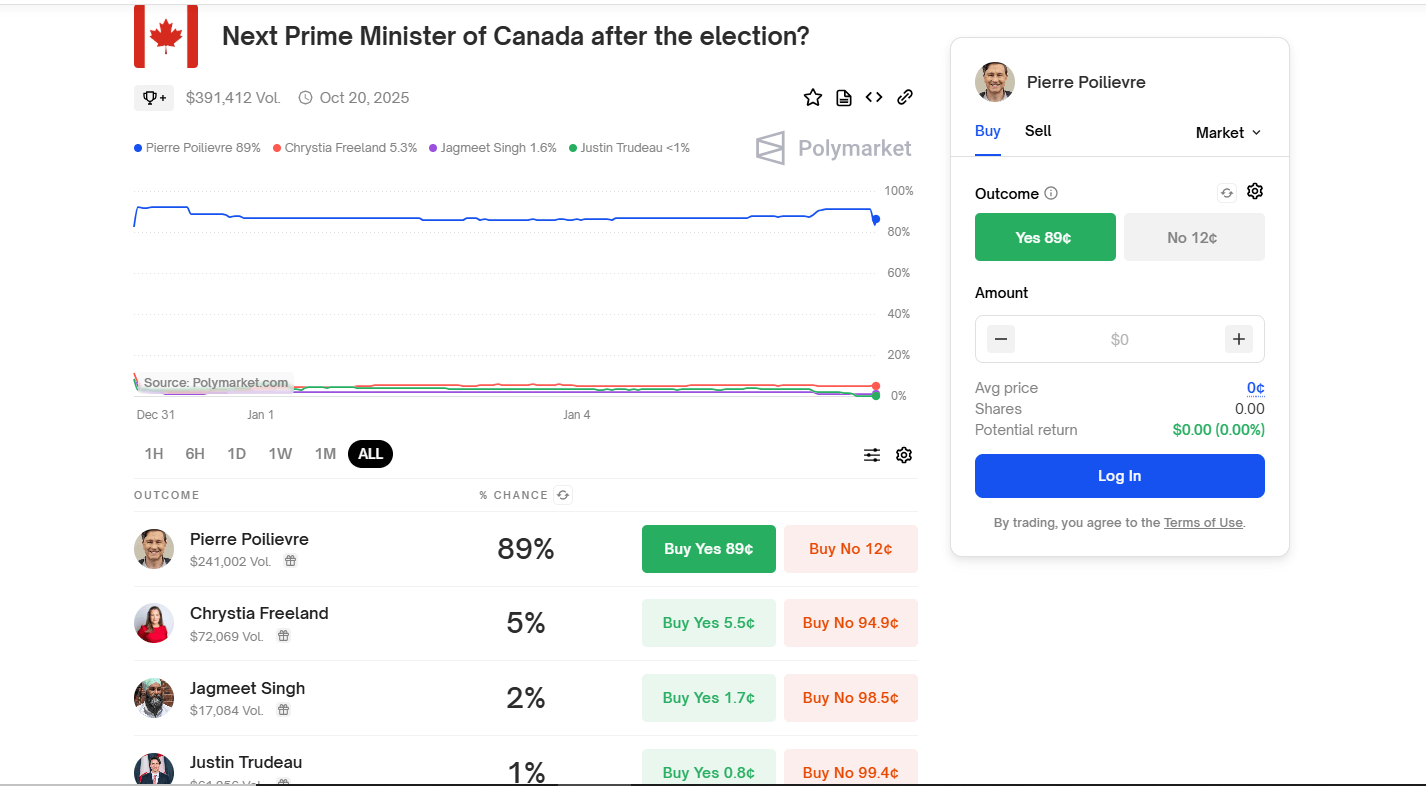

In a dramatic shift in Canadian politics, the odds of Pierre Poilievre becoming the country’s next prime minister soared to 93% on the Polymarket prediction platform, before slightly dropping to 87% at press time.

This surge follows the announcement by Justin Trudeau, Canada’s prime minister for nearly a decade, that he will step down as leader of the Liberal Party and resign as prime minister, leaving office once a new party leader is chosen.

Justin Trudeau announced his resignation on January 6, 2025, outside Rideau Cottage in Ottawa, citing internal party struggles and a desire for Canadians to have a clear choice in the upcoming election. While he will remain in a caretaker role until a new Liberal leader is selected, Trudeau acknowledged the challenges his government faced, including criticism of his cabinet and prolonged parliamentary gridlock.

The House of Commons will be prorogued until March 24, allowing time for the Liberal Party to elect a new leader.

Reflecting on his time in office, Trudeau highlighted key achievements such as supporting Ukraine, managing the COVID-19 pandemic, addressing climate change, and preparing the economy for future challenges. However, he expressed regret over his failure to reform Canada’s electoral system, which he believes would have allowed voters to rank multiple preferences on a single ballot.

The top three contenders for the Canada PM post are Pierre Poilievre, Chrystia Freeland, and Jagmeet Singh.

However, Pierre Poilievre, The Conservative Party leader, is emerging as the most probable choice. His policies emphasize preserving Canadians’ financial privacy and freedom by opposing the creation of a government-controlled digital currency.

Poilievre, known for his staunch opposition to central bank digital currencies (CBDCs) and advocacy for cash and cryptocurrency freedoms, has gained significant traction among voters.

Poilievre’s advocacy for cryptocurrency and blockchain innovation has garnered attention, with the Conservative leader expected to position Canada as a potential global hub for digital assets.

The Polymarket prediction, based on a contract titled “Next Prime Minister of Canada,” also reflects growing confidence in Poilievre’s chances.

The Polymarket contract has seen a trading volume exceeding $391,400, underscoring widespread interest in Canada’s political future.

As Canada braces for a political transition, Polymarket’s data highlights the electorate’s shifting priorities. Poilievre’s rising popularity underscores a growing appetite for change, as voters consider his vision for the nation’s economic and technological future.

With the next federal election required to occur before October 2025, the political landscape is poised for significant transformation.

The post Poilievre’s PM odds on Polymarket surge to 93% after Justin Trudeau’s resignation appeared first on CoinJournal.

Calamos Investments is set to launch a groundbreaking Bitcoin exchange-traded fund (ETF) offering 100% downside protection.

Scheduled to debut on the Chicago Board Options Exchange (CBOE) on January 22, the new ETF, named CBOJ, is designed to address Bitcoin’s volatility while providing growth opportunities, according to a company announcement.

CBOJ builds upon the success of Calamos’ Structured Protection ETF series, introduced in 2024. This series provided similar downside protection mechanisms for stock indices like the S&P 500 and Nasdaq-100.

By extending these principles to Bitcoin, Calamos seeks to meet the demands of advisors, institutions, and investors looking for a way to capture Bitcoin’s growth potential while mitigating its historically high volatility.

Bitcoin has historically been a highly volatile asset, often deterring risk-averse investors. The CBOJ ETF aims to overcome this challenge by ensuring that investors do not lose money, even if Bitcoin’s value declines.

This innovative fund achieves downside protection by integrating US Treasury bonds with options tied to the CBOE Bitcoin US ETF Index. The combination provides a regulated and transparent avenue for gaining Bitcoin exposure while minimizing associated risks.

One of the unique features of the CBOJ ETF is its annual reset of downside protection. Each year, investors benefit from a new cap on potential gains while maintaining full protection against losses for the next 12 months.

This structure ensures ongoing risk mitigation and aligns with the dynamic nature of the Bitcoin market.

“Many investors have been hesitant to invest in Bitcoin due to its epic volatility,” said Matt Kaufman, Head of ETFs at Calamos. “Calamos seeks to meet advisor, institutional, and investor demands for solutions that capture Bitcoin’s growth potential while mitigating the historically high volatility and drawdowns of the asset.”

ETFs are investment funds that trade like stocks on exchanges, allowing investors to pool their money into a fund holding various assets. With CBOJ, investors gain exposure to Bitcoin without the need to own the cryptocurrency directly. This protective structure makes the ETF especially appealing to cautious investors looking to navigate the crypto market’s notorious price swings.

As derivatives-based Bitcoin ETFs gain traction, industry reports suggest that more firms may follow Calamos’ lead in introducing similar solutions for risk-averse investors.

The post Calamos Investments to introduce a Bitcoin ETF with 100% downside protection appeared first on CoinJournal.